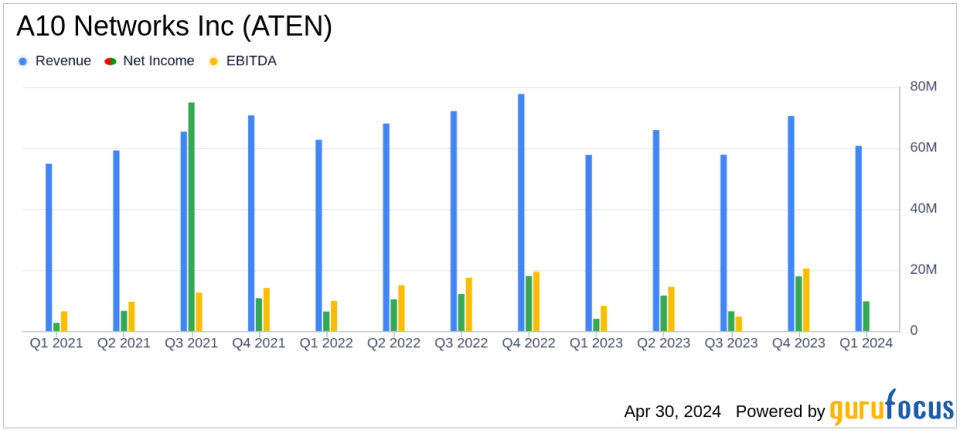

A10 Networks Inc (ATEN) Q1 2024 Earnings: Aligns with Analyst Projections

Revenue: Reported at $60.7 million, up 5.2% year-over-year, aligning with expectations and surpassing the estimate of $59.43 million.

Net Income: GAAP net income reached $9.7 million, significantly exceeding the previous year's $4.0 million and the estimated $11.24 million.

Earnings Per Share (EPS): GAAP EPS was $0.13, up from $0.05 year-over-year, falling short of the estimated $0.15. Non-GAAP EPS was $0.17, surpassing the estimated $0.15.

Gross Margin: GAAP gross margin was 81.1%; non-GAAP gross margin improved to 81.9%, reflecting strong operational execution despite market volatility.

Shareholder Returns: Returned $7.5 million to shareholders through share repurchases and dividends, including a quarterly cash dividend of $0.06 per share.

Operational Highlights: Security solutions constituted 61% of consolidated revenue, aligning with strategic goals. Continued investment in R&D, focusing on AI solutions to meet evolving customer needs.

Future Outlook: Positive enterprise revenue growth anticipated, driven by active pipeline and customer engagements, amidst a challenging economic environment.

A10 Networks Inc (NYSE:ATEN) disclosed its financial results for the first quarter ended March 31, 2024, meeting analyst expectations with steady revenue growth and expanded earnings per share. The details were released in their recent 8-K filing on April 30, 2024. The company reported a revenue of $60.7 million, a 5.2% increase year-over-year, aligning closely with the estimated $59.43 million. Non-GAAP net income rose to $12.7 million, or $0.17 per diluted share, surpassing the estimated earnings per share of $0.15.

A10 Networks Inc, a leader in cybersecurity and infrastructure solutions, continues to leverage its diverse portfolio, including the Thunder Application Delivery Controller and Thunder Threat Protection System, to meet the evolving needs of global enterprises and service providers. The company's strategic focus on operational execution and market diversification has enabled it to navigate the complexities of the current economic landscape effectively.

Financial Performance Overview

The company's financial health showed significant improvement, with a GAAP net income of $9.7 million, a substantial increase from $4.0 million in the same quarter the previous year. This improvement reflects a robust gross margin of 81.1% on a GAAP basis and 81.9% on a non-GAAP basis, underscoring efficient management and operational execution. A10 Networks also demonstrated its commitment to shareholder value through $7.5 million in dividends and share repurchases during the quarter.

Strategic Initiatives and Market Adaptation

President and CEO Dhrupad Trivedi commented on the company's adaptability amid market fluctuations, emphasizing the strategic integration of A10's solutions in long-term service provider projects. He noted, "Our service provider customers are committed to improving network throughput and security, and A10s solutions are designed into long-term initiatives that help them achieve their mission critical goals." This strategic positioning is expected to drive sustained growth and stability.

"Recent and ongoing investments to better position A10 to target the evolving needs of the enterprise market are beginning to show results," Trivedi added, highlighting the potential for increased enterprise revenue through active pipeline and customer engagements.

Looking Ahead

With a solid foundation in diversified markets and continuous investment in research and development, particularly in AI solutions, A10 Networks is well-positioned to maintain its growth trajectory and profitability. The company's proactive approach to innovation and customer engagement, coupled with its robust financial performance, provides a positive outlook for the upcoming quarters.

As A10 Networks continues to execute its strategic initiatives and navigate market conditions, investors and stakeholders can anticipate ongoing resilience and potential growth opportunities in the evolving cybersecurity landscape.

For detailed financial figures and future projections, interested parties can access the earnings call webcast and additional documents through the Investor Relations section of A10 Networks website.

Explore the complete 8-K earnings release (here) from A10 Networks Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance