The AAC Technologies Holdings (HKG:2018) Share Price Is Down 67% So Some Shareholders Are Wishing They Sold

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of AAC Technologies Holdings Inc. (HKG:2018) have suffered share price declines over the last year. To wit the share price is down 67% in that time. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 21% in three years.

See our latest analysis for AAC Technologies Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

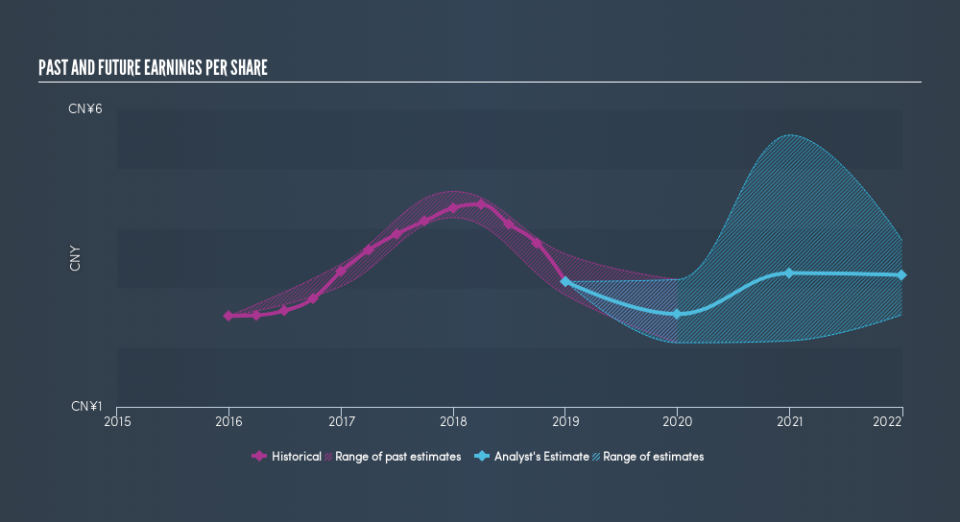

Unhappily, AAC Technologies Holdings had to report a 29% decline in EPS over the last year. The share price decline of 67% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on AAC Technologies Holdings's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between AAC Technologies Holdings's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for AAC Technologies Holdings shareholders, and that cash payout explains why its total shareholder loss of 67%, over the last year, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 4.8% in the twelve months, AAC Technologies Holdings shareholders did even worse, losing 67% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 4.2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Keeping this in mind, a solid next step might be to take a look at AAC Technologies Holdings's dividend track record. This free interactive graph is a great place to start.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance