Aaron's (AAN) Agrees to be Acquired by IQVentures, Shares Rise

The Aaron's Company, Inc. AAN has signed a deal with IQVentures Holdings, LLC, a well-known fintech organization, to be acquired by the latter. The companies expect to close the transaction by the end of 2024, after receiving unanimous consent from Aaron’s board and satisfying other closing conditions.

After the completion of the sale transaction, AAN will continue to operate under its current brand name and retain its headquarters in Atlanta, GA. Post the sale, Aaron’s will be a privately-held company and cease to trade on the NYSE.

Per the deal, AAN will sell all its shares to IQVentures for $10.10 per share in cash, summing up to a total enterprise value of $504 million. This represents a premium of 34% to Aaron’s closing price on Jun 14, 2024, and a premium of 35.6% to its 90-day volume-weighted average share price.

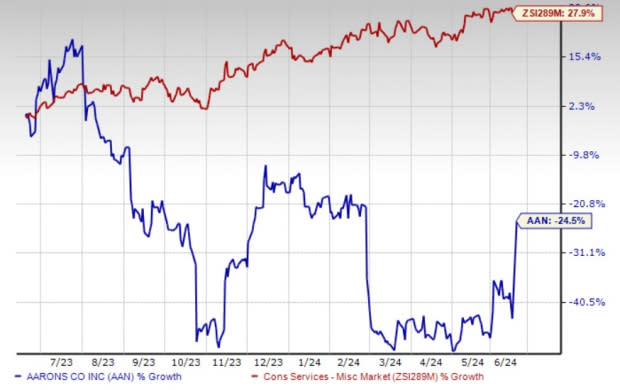

Shares of Aaron’s rallied 33.4% following the announcement of its acquisition by IQVentures on Jun 17, 2024. Moreover, the Zacks Rank #3 (Hold) company has declined 24.5% in the year against the industry’s growth of 27.9%.

Image Source: Zacks Investment Research

Aaron’s management indicated that the sale decision was the result of a strategic review conducted to evaluate the company’s stand-alone plan versus strategic opportunities. The management stated that the sale was in the best interest of the shareholders and maximizes the shareholder value.

For AAN, the acquisition by IQVentures should further enhance its standing, which will help accelerate its omni-channel strategy and operational efficiency initiatives. Additionally, it will facilitate the company to better serve its customers by providing high-quality products through affordable lease and retail purchase options.

As for IQVentures, the acquisition of Aaron’s provides an opportunity to build up on the latter’s transformation efforts and work collectively to evolve and grow the business. IQVentures, as a fintech leader, provides intelligent, market-driven solutions based on the latest developing technologies and beneficial shared services for the entities it acquires. IQVentures has a record of value creation and expertise in customer management.

Aaron’s Progress on Transformation

AAN has been on track to expand its e-commerce business, driven by its omni-channel lease decisioning and customer acquisition program.

The company has been witnessing strength in its e-commerce platform, driven by flexible payment options, low prices and a wider variety of products. Some other notable efforts include increased investments in digital marketing, improved shopping experience, same-day and next-day delivery services, the personalization of products, and a broader assortment, including the latest product categories. Its express delivery program also bodes well.

Within the BrandsMart business, the company continues to invest in its e-commerce shopping experience and digital marketing strategies to attract customers. The company expects its investments in e-commerce to result in growth in this channel as customer demand is likely to rebound late in 2024. Additionally, the company witnessed significant growth in business-to-business sales in the first quarter, which it expects to continue.

AAN is also gaining from its market optimization strategy, including the GenNext stores and hub, as well as the showroom program. This strategy has been delivering a significant financial performance by improving in-store customer experience and enhancing the operating model. The GenNext stores contributed more than 33% of its lease revenues and retail sales at the end of first-quarter 2024.

Stocks to Consider

Some better-ranked companies in the Consumer Discretionary sector are Skechers SKX, Crocs CROX and Caleres CAL.

Skechers designs, develops, markets and distributes footwear for men, women, and children in the United States and overseas under the SKECHERS name, as well as under several uniquely branded names. The company currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 34.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Skechers’ current financial-year sales and earnings suggests growth of 10.6% and 16.9%, respectively, from the numbers reported in the prior-year quarter. The consensus mark for SKX’s earnings per share has moved up by a penny in the past seven days.

Crocs, one of the leading footwear brands with its focus on comfort and style, currently carries a Zacks Rank #2 (Buy). CROX has a trailing four-quarter earnings surprise of 17.1%, on average.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and earnings suggests growth of 4.4% and 5.2%, respectively, from the year-ago reported numbers. The consensus mark for CROX’s earnings per share has been unchanged in the past 30 days.

Caleres, a footwear retailer and wholesaler, currently carries a Zacks Rank #2. CAL has a trailing four-quarter earnings surprise of 4.9%, on average.

The Zacks Consensus Estimate for CAL’s current financial-year sales and earnings suggests growth of 0.7% and 5.3%, respectively, from the year-ago period’s actuals. The consensus mark for CAL’s earnings per share has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Aaron's Company, Inc. (AAN) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Caleres, Inc. (CAL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance