Can AB InBev's (BUD) Strategies Aid Growth Amid Rising Costs?

Anheuser-Busch InBev SA/NV BUD, alias AB InBev, has been benefitting from its unique commercial strategy, strong brand portfolio and investments in operation excellence. This has been aiding market share growth across most key markets. The expansion of the Beyond Beer portfolio, and investments in B2B platforms, e-commerce and digital marketing also bode well. The premiumization of the beer industry has also been a key growth opportunity for AB InBev.

Continued business momentum due to relentless execution, brand investments and accelerated digital transformation aided the company’s second-quarter 2022 performance. Revenues improved year over year on robust volume and revenue per hectoliter (hl) growth, as well as strength in global brands. Organic revenue grew 11.3%. Revenues were also driven by the strong performance of its three global brands and growth in the Beyond Beer portfolio.

Despite strong revenues, investors’ sentiments continue to be hurt by high costs and supply-chain headwinds, which have been affecting margins. The company’s gross and EBIT margin declined in second-quarter 2022, driven by higher cost of sales and SG&A expenses. Higher SG&A expenses resulted from elevated supply-chain costs.

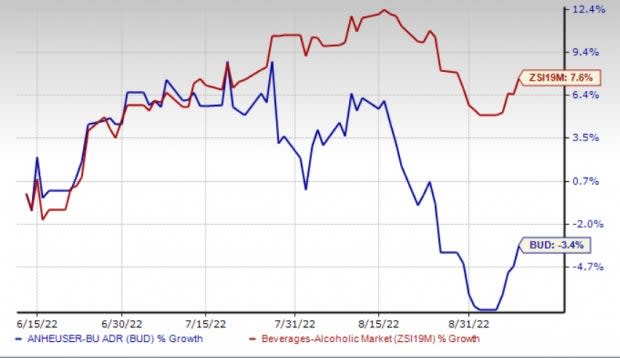

The Zacks Rank #3 (Hold) stock has declined 3.4% in the past three months against the industry’s growth of 7.6%.

Image Source: Zacks Investment Research

Factors Driving Growth

AB InBev is anticipated to retain the strong business momentum on continued premiumization efforts and favorable industry trends. The company has been investing in a diverse portfolio of global, international and crafts and specialty premium brands in its markets. Apart from the premium brands, BUD’s global brands lead the way in premiumization.

The company’s above core portfolio contributed 12% to revenue growth in second-quarter 2022, led by double-digit growth in Michelob ULTRA in the United States and Mexico, and the expansion of Spaten in Brazil. The company’s three global brands — Budweiser, Corona and Stella Artois — advanced 9.7% outside their home markets in the second quarter. Corona brand grew 18.2%, Stella Artois improved 7.7% and Budweiser rose 6.1%.

AB InBev is steadfastly growing its Beyond Beer portfolio, including products like Ready-to-Drink beverages like canned wine and canned cocktails, hard seltzers, cider and flavored malt beverages. The Beyond Beer trend has been recently gaining popularity due to the rise in demand for low-alcoholic or non-alcoholic drinks.

The company remains focused on expanding its Beyond Beer portfolio, which has also been aiding the top line. The Beyond Beer portfolio contributed more than $425 million to revenues in the second quarter. BUD witnessed double-digit growth in Brutal Fruit and Flying Fish in South Africa. In the United States, the company’s portfolio witnessed growth ahead of the industry in the spirits-based ready-to-drink segment, driven by its Cutwater and NUTRL vodka seltzer.

The rapid expansion of its digital platform and leveraging technology such as B2B sales and other e-commerce platforms have been other key drivers. AB InBev is witnessing an acceleration in the B2B platforms, e-commerce and digital marketing trends, aiding growth for the past few months. The company’s proprietary B2B platform, BEES, is live in 18 markets and has reached 2.9 million monthly active users.

Revenues for BUD’s owned direct-to-consumer (DTC) business were $385 million in the second quarter of 2022. The DTC e-commerce platform generated more than 16 million orders in the quarter, backed by growth in orders at Ze Delivery in Brazil and the expansion of its on-demand platform in 10 additional markets in Latin America.

Backed by the continued business momentum, AB InBev retained its upbeat view for 2022. It expects EBITDA growth in line with the medium-term outlook of 4-8%. BUD anticipates revenue growth to be higher than EBITDA growth, driven by strong volume and pricing.

Headwinds to Overcome

Commodity headwinds and higher supply-chain costs in some markets continue to be major headwinds for AB InBev. Higher commodity costs mainly relate to increased aluminum and barley prices. Like others in the industry, the company expects higher commodity costs to continue, exerting pressure on input costs. BUD’s presence across various countries exposes it to negative currency translations. The company anticipates foreign currency to remain volatile.

While AB InBev has been gaining from improving trends in key markets and continued premiumization in the majority of its markets, commodity cost inflation weighed on EBITDA in the second quarter. The company’s normalized EBITDA increased 5.2% year over year and 7.2% on an organic basis in the second quarter.

Stocks to Consider

We have highlighted some better-ranked stocks from the broader Consumer Staples space, namely Fomento Economico Mexicano FMX, Carlsberg CABGY and Chewy CHWY.

Fomento Economico Mexicano, alias FEMSA, has exposure in various industries, including beverage, beer and retail, which gives it an edge over its competitors. It currently has a Zacks Rank #2 (Buy). FMX has a trailing four-quarter earnings surprise of 18.9%, on average. Shares of FMX have lost 5.6% in the past three months.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for FEMSA’s current financial-year sales suggests growth of 11.3% from the year-ago period's reported figures. FMX has an expected EPS growth rate of 11.4% for three-five years.

Carlsberg produces and sells beer and other beverage products in Denmark. It currently has a Zacks Rank #2. Shares of CABGY have gained 5.1% in the past three months.

The Zacks Consensus Estimate for Carlsberg’s current financial-year sales suggests growth of 8.8%, while the same for earnings per share indicates a decline of 9.8% from the year-ago period’s reported figures. CABGY has an expected EPS growth rate of 9.1% for three-five years.

Chewy is a pure-play e-commerce business in the United States. It currently has a Zacks Rank #2. The company has an expected EPS growth rate of 20% for three-five years.

The Zacks Consensus Estimate for Chewy’s current financial-year sales suggests growth of 13.9% from the year-ago period’s reported figures. Shares of CHWY have rallied 32.9% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

AnheuserBusch InBev SANV (BUD) : Free Stock Analysis Report

Carlsberg AS (CABGY) : Free Stock Analysis Report

Chewy (CHWY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance