Abbey: End of the road?

How much longer can the bull run last for stocks in the housing sector? A statement from the property development company, Abbey, suggests that things may be about to slow down. Abbey’s preliminary statement warns that ‘the sweet spot of the UK cycle is probably behind us.’ This causes a conundrum as although the company’s management team sees danger ahead, Abbey’s StockRank has jumped from 81 to 98 over the last month. From a pure quantitative basis Abbey’s statistics have improved… should we trust the quant, or trust the management?

End of the cycle?

Abbey is a property development company which generates most of its revenue in the UK and Ireland. The firm also operates in the Czech Republic. In 2011, Abbey’s earnings fell by 22% while revenues dropped by more than 30%. In the UK and Ireland, this trend was driven by a fall in disposable incomes, coupled with the highly restrictive mortgage market, which placed significant constraints on house sales. Cyclical stocks tend to perform badly during recessions, but often bounce back when the economy recovers. Indeed, since 2011, the company's share price has risen by more than 130% while earnings have increased from €0.37 per share (2011) to €1.81 (2015). 2014 and 2015 both saw strong progress as the economic recovery gathered momentum in the UK, supported by the government’s ‘Help to Buy’ Scheme.

Worryingly, there are some phrases in the company’s recent statements which suggests that Abbey’s management team could see the end of the road for Britain’s housing bull market. In The Zulu Principle, Jim Slater highlights several red flags for cyclical stocks. He explains that as business cycles runs into bear territory, businesses ‘compete for both land and labour. Cost pressures begin to increase. Some of the builders borrow to stock-pile land. Very soon there is over-capacity in the business...’

Has this process already started for Abbey? The company’s annual report for 2014 noted that ‘It is a cause of concern that supply chain bottlenecks both in labour and materials have emerged so quickly.’ There is no evidence that this has created cost pressures just yet. The company’s recent statement explains that house ‘price rises have continued, for the time being, to outstrip rising costs’. However, the company seems to be unsure how much longer this trend can continue. The preliminary statement warns that ‘costs impacted by both labour and material supply bottlenecks may continue to rise quickly’. It adds that ‘margins may be eroded’ as the company goes forward.

Abbey fears also that ‘rising interest rates in the new year are likely’, while ‘recent reports of declining mortgage approvals are a warning that sufficient credit may not be available to support a more normal level of output.’

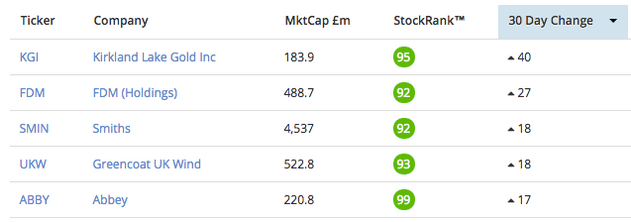

Abbey’s preliminary statement reported that although ‘the longer term outlook [is] uncertain...the short term outlook is good’ and ‘a satisfactory year is in prospect’. The market seems to have responded well to this outlook, despite potential hazards in the long-run. Abbey share price has risen by nearly 10% since this statement was released on 8 July, driving Abbey’s MomentumRank up from 78 (7 July) to 92 (4 August). This has helped the company’s overall StockRank to rise by 17 (see below).

Companies’ that are coming out of a recession and have improving fundamentals tend to have a high Piotroski F-Score. The F-Score seeks to identify companies that are profit-making, have improving margins, don’t employ any accounting tricks and have strengthening balance sheets. Abbey has a high F-Score (7 out of a possible 9). In turn, the Piotroski Score is a strong component of Stockopedia’s QualityRank, which aim to identify stable, growing, cashflow generative businesses. Abbey’s QualityRank is 93.

Academics like Robert Haugen have been researching the low volatility anomaly since the 1970s, and have argued that low risk (ie. low volatility) stocks generate higher expected returns. One measure that is often used to measure volatility is beta. This measures how sensitive a company’s share price is in relation to the market. If a stock’s price tends to rise more than the market on up-days and fall more than the market on down days, it will have a beta greater than 1. If a company is not as sensitive to market movements then it will have a beta of less than 1. Abbey has a beta of 0.35, suggesting that the company is less volatile than the market.

Liquidity risk

Academic research also suggests that companies which are less liquid have a greater probability chance of beating the market. Indeed, when Amihud and Mendelson used bid–ask spreads to explain stock returns they found that between 1961 and 1980 higher-spread equities yielded higher returns than lower-spread stocks. Abbey does have a very high spread (741bps).

This spread can of course be viewed as a double edged sword. Illiquid stocks may have beaten the market in the past, but they can be much, much more difficult to trade. Over the last three months the daily trading volume for Abbey has averaged a paltry 259 shares. This means that it has been difficult to trade much more than £2,500 worth of Abbey shares in a single day.

If Abbey does produce bad news shareholders may find it quite hard to exit. Perhaps this helps to explain why the company is relatively cheap with a P/E ratio of just 8. Many believe that value investors get paid a premium for investing in more risky stocks - and in this case it would certainly seem fair to expect one given the significant liquidity risk involved.

Where will Abbey go next?

Abbey is a low volatility, high QVM stock, but the prospect of rising interest rates, tighter credit conditions and a general slowdown in the UK housing market could be enough to scare many investors away from this company. Nevertheless, research by Joel Greenblatt suggests that when investors pick from a basket of stocks that pass stock screening criteria, it is often the most unpopular picks that end up performing the best. Greenblatt even showed that the unpopular picks could generate as much as 20% of the portfolio's return. We are not necessarily saying that Abbey will go on to be a stock market winner, but should investors shun a company that is highly exposed to factors like value, quality and momentum simply because the management team sees potential dangers in the long run? The other red flag is of course the high spread. Abbey is a cheap stock, but this company is cheap for a reason. Is the market discounting Abbey because it could be difficult to escape if the market turned bearish? Please feel free to leave your comments below...

Read More about Abbey on Stockopedia

Discuss Abbey on Stockopedia

Yahoo Finance

Yahoo Finance