ABB's Abundant Prospects a Boon, Persistent Risks a Bane

ABB Ltd ABB stands to gain from its presence in diverse end markets, which allows it to neutralize risks associated with a single market. In the quarters ahead, strength in ABB’s end markets, including oil and gas, marine & ports, mining & metals, automotive, food and beverage, renewables and power distribution utilities is likely to benefit ABB. Over time, ABB is also anticipated to benefit from growth across short-cycle businesses and improvement in service and process-related businesses.

In addition, ABB focuses on rewarding its shareholders through dividend payments and share repurchases. In first-quarter 2022, ABB used $889 million for paying out dividends and repurchased shares worth $1,561 million. ABB also launched a share buyback program in April 2022, which is expected to remain operational until its 2023 Annual General Meeting. Through this program, ABB intends to buy back shares worth up to $3 billion.

Also, ABB believes in strengthening its businesses through addition of assets. The acquisition of InCharge Energy in January 2022 boosted its E-mobility business in North America. Additionally, the buyout of Codian Robotics B.V. (October 2020) added value to its Robotics & Discrete Automation segment.

However, challenges related to supply chain, logistics and availability of labor pose a concern. ABB’s top line was affected by supply-chain constraints due to delays in customer delivery in the first quarter of 2022. These adversities are likely to continue in the near term.

Further, ABB’s global presence exposes it to various environmental laws and regulations in the countries where it operates. Also, the entity remains vulnerable to foreign currency woes. In the quarters ahead, ABB's overseas business might be depressed by a stronger U.S. dollar.

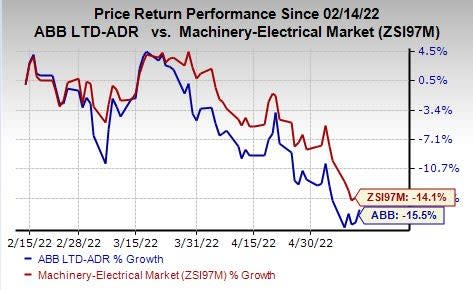

Image Source: Zacks Investment Research

In the past three months, this currently Zacks Rank #3 (Hold) stock has dipped 15.5% compared with the industry’s decline of 14.1%.

Zacks Rank & Stocks to Consider

Some better-ranked companies from the industrial products sector are discussed below.

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1. AIT delivered a trailing four-quarter earnings surprise of 25.4%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AIT’s earnings estimates have increased 5.4% for fiscal 2022 (ending June 2022) in the past 60 days. Its shares have rallied 9.8% in the past three months.

Roper Technologies, Inc. ROP presently has a Zacks Rank #2 (Buy). Its earnings surprise in the last four quarters was 2%, on average.

In the past 60 days, ROP’s earnings estimates have increased 1.1% for 2022. The stock has declined 1.7% in the past three months.

Ferguson plc FERG is presently Zacks #2 Ranked. FERG’s earnings surprise in the last four quarters was 14.2%, on average.

In the past 60 days, the stock’s earnings estimates have increased 6.5% for fiscal 2022 (ending July 2022). The same has declined 18.8% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

ABB Ltd (ABB) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Wolseley PLC (FERG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance