AbbVie's Uterine Fibroids Candidate Succeeds in Phase III

AbbVie ABBV and partner Neurocrine Biosciences announced that the second of the two pivotal phase III studies evaluating its pipeline candidate, elagolix uterine fibroids, met the primary endpoint. AbbVie is looking to get elagolix approved as an oral medicine for reducing heavy menstrual bleeding in premenopausal women with uterine fibroids.

Elagolix is already under review in the United States for management of endometriosis with associated pain.

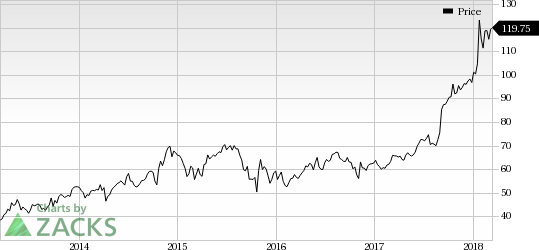

AbbVie’s shares have increased more than 1% on Mar 13, following the news release. Moreover, so far this year, AbbVie’s share price has increased 24.5%, comparing favorably with a gain of 0.5% recorded by the industry.

Coming back to the latest release, data from the phase III ELARIS UF-II (M12-817) study demonstrated that elagolix, in combination with low-dose add-back therapy, reduced heavy menstrual bleeding in 76.2% of women with uterine fibroids compared with 10.1% in placebo at month six. The safety profile of the candidate was also found to be consistent with the first phase III study (ELARIS UF-I) results. The study met its secondary endpoints as well. Data from the ELARIS UF-II study will support regulatory submissions for elagolix for the aforementioned indication.

Note that, positive top-line data from the first phase III ELARIS UF-I study were announced in February 2018. This study also met the primary endpoints.

Per the company’s press release, uterine fibroid affects around 20-80% of women by age 50. Out of them, 25% may experience symptoms such as heavy menstrual bleeding, painful periods, vaginal bleeding at times other than menstruation and anemia. At present, there are limited non-surgical treatment options for women suffering from the disease. Uterine fibroid is currently managed with oral contraceptives, progestins and GnRH agonists. Many of these medicines are not specifically indicated for the treatment of uterine fibroid. Hence, approval of the candidate will provide the company access to patients who are in need of an additional treatment option to apprehend the disease.

Meanwhile, pharma company Allergan AGN also has a pipeline candidate, ulipristal acetate, in its portfolio which is being evaluated for treatment of uterine fibroids. It might be the first oral treatment to hit the market, as it is under review in the United States with a response expected from the regulatory agency in August 2018.

AbbVie Inc. Price

AbbVie Inc. Price | AbbVie Inc. Quote

Zacks Rank & Key Picks

AbbVie carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the health care sector are Regeneron Pharmaceuticals, Inc. REGN and Ligand Pharmaceuticals Incorporated LGND. While Regeneron sports a Zacks Rank #1 (Strong Buy), Ligand holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.02 to $18.68 and from $20.29 to $21.60 for 2018 and 2019, respectively, in the last 60 days. The company pulled off a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Ligand’s earnings per share estimates have moved up from $3.78 to $4.20 for 2018 and from $4.75 to $5.32 for 2019 in the last 30 days. The company delivered a positive surprise in three of the trailing four quarters with an average beat of 24.88%. Share price of the company has surged 65.8% over a year.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allergan plc (AGN) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance