Abercrombie and Fitch (NYSE:ANF) Reports Bullish Q1

Young adult apparel retailer Abercrombie & Fitch (NYSE:ANF) announced better-than-expected results in Q1 CY2024, with revenue up 22.1% year on year to $1.02 billion. It made a non-GAAP profit of $2.14 per share, improving from its profit of $0.39 per share in the same quarter last year.

Is now the time to buy Abercrombie and Fitch? Find out in our full research report.

Abercrombie and Fitch (ANF) Q1 CY2024 Highlights:

Revenue: $1.02 billion vs analyst estimates of $965 million (5.8% beat)

EPS (non-GAAP): $2.14 vs analyst estimates of $1.72 (24.5% beat)

The company lifted its full-year revenue guidance from 5% year-on-year growth at the midpoint to 10% growth

Gross Margin (GAAP): 66.4%, up from 61% in the same quarter last year

Free Cash Flow of $56.12 million is up from -$46.95 million in the same quarter last year

Same-Store Sales rose 21% year on year

Market Capitalization: $7.79 billion

Fran Horowitz, Chief Executive Officer, said, “Our outstanding first quarter results reflect the power of our brands and strong execution of our global playbook. We successfully navigated seasonal transitions with relevant assortments and compelling marketing, leveraging agile chase capabilities and inventory discipline, driving sales above our expectations. Growth was broad-based across regions and brands with Abercrombie brands registering 31% growth and Hollister brands delivering growth of 12%. Strong top-line growth, along with gross profit rate expansion, led to record first quarter operating income and an operating margin of 12.7%.

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE:ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Abercrombie and Fitch is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

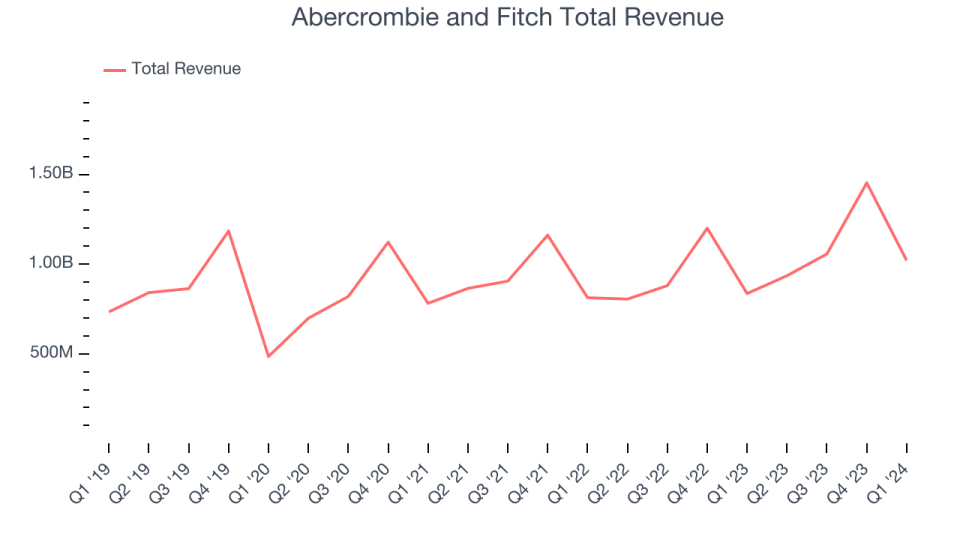

As you can see below, the company's annualized revenue growth rate of 4.4% over the last five years was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, Abercrombie and Fitch reported remarkable year-on-year revenue growth of 22.1%, and its $1.02 billion in revenue topped Wall Street's estimates by 5.8%. Looking ahead, Wall Street expects sales to grow 3.5% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

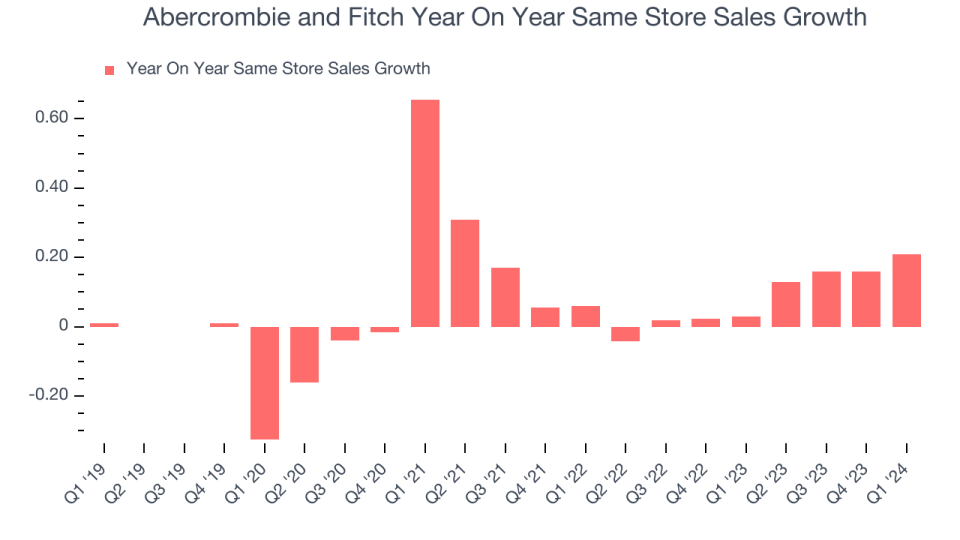

Abercrombie and Fitch's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 8.6% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Abercrombie and Fitch is reaching more customers and growing sales.

In the latest quarter, Abercrombie and Fitch's same-store sales rose 21% year on year. This growth was an acceleration from the 3% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Abercrombie and Fitch's Q1 Results

We were impressed by how significantly Abercrombie and Fitch blew past analysts' revenue and EPS expectations this quarter, driven by its insanely high 21% year-on-year same-store sales growth (vs analysts' estimates of 12%). On the back of the strong print, the company raised its full-year revenue guidance from 5% growth at the midpoint to 10%, a massive jump. Zooming out, we think this was a fantastic quarter that shareholders will appreciate. The stock is up 2.8% after reporting and currently trades at $156.44 per share.

Abercrombie and Fitch may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance