‘Absurd’ video of bitcoin mine hooked to an oil well sparks outrage - but it’s complicated

The co-founder of a bitcoin mining company that runs on “waste” by-product from Texas oil wells says that the oil and gas industry is eyeing cryptocurrency operations as a way to burnish green credentials with the public and investors.

Bitcoin ‘mining’ requires high-powered supercomputers which compete against other machines to solve complex mathematical puzzles. Several major studies have found that the process devours enormous amounts of energy.

Matt Lohstroh’s video of his company’s digital currency operation at an oil well in east Texas went viral last month. The clip shows a gas pipe running from the well site to a generator hooked up to a shipping container with large exterior cooling fans. Inside the container are multiple racks of ‘mining’ rigs connected with hundreds of red wires.

Giga Energy Solutions, which he started with a college friend Brent Whitehead in 2019, is not itself extracting fossil fuels to power bitcoin mining but instead using flare natural gas, a by-product from oil extraction which is usually burned off. The process leaves a lower carbon footprint than coal, which largely powers Bitcoin mining that is concentrated in China, distantly followed by the US, Russia, Kazakhstan, Malaysia and Iran.

The price of natural gas, one of the fossil fuels driving the climate crisis, has plummeted in recent years. “Economically it’s a waste product,” Mr Lohstroh told The Independent. “Our company goes to an [oil] producer that’s already flaring - and they’ll continue to do this whether we’re there or not - and we say, we’ll take that gas off your hands. It’s zero effort on their part and we’re able to reduce carbon emissions by getting 90 per cent combustion rate in our engines.”

The East Texas mining rig, which began operating in January, has yet to gather data on emission reductions. Mr Lohstroh says that generally his company is “having a net benefit on emissions”.

“My energy is non-renewable but would otherwise be wasted,” he said.

Bitcoin: Initiated pic.twitter.com/baB58FKw6T

— Matt Lohstroh (@lohstroh) February 8, 2021

Giga Energy pays almost nothing for the natural gas. The company has more rigs in multiple locations across East Texas, the second-largest oil field in the US outside Alaska.

In states like Texas, where energy regulations are laxer, natural gas by-product can be vented, intentionally releasing gases, predominately potent methane, into the atmosphere. The other option is to set gas on fire in flare stacks to convert methane to carbon dioxide, slightly less dangerous when it comes to heating the planet in the short-term.

But even that strategy is not going to last as a growing number of oil companies commit to the World Bank’s Zero Routine Flaring by 2030 initiative. As the fossil fuel industry looks to improve its green credentials, having natural gas siphoned off at source, at practically no cost to them, appears to be a lucky break.

Mr Lohstroh said the oil company, which he declined to name to The Independent, have no outlay for the cryptocurrency operation. Equipment, installation, and maintenance costs are paid for by the bitcoin miners.

“They’re getting zero for this gas anyway so it makes almost no difference whether we’re on that well-site or not,” he said. “What it does is helps these oil and gas companies achieve an Environmental, Social, and Corporate Governance (ESG) mandate, reducing carbon emissions.” Increasingly ESGs, which refers to the sustainability and societal impact of an investment in a company, have become a major factor for global investors.

He added: “We’ve had publicly-traded companies reach out to us and say, ‘We don’t even care if we lose money on this. We want to improve our public opinion and then help reduce carbon emissions from our flaring.’”

But there remains a glaring issue. In the past decade bitcoin has risen from a fringe technology popular with cryptographers to the world’s ninth most valuable asset by market cap.

The cryptocurrency‘s dramatic ascent has created millionaires, reimagined money, and launched a multi-billion dollar industry inspired by its revolutionary decentralised technology. But it has damaging side effects.

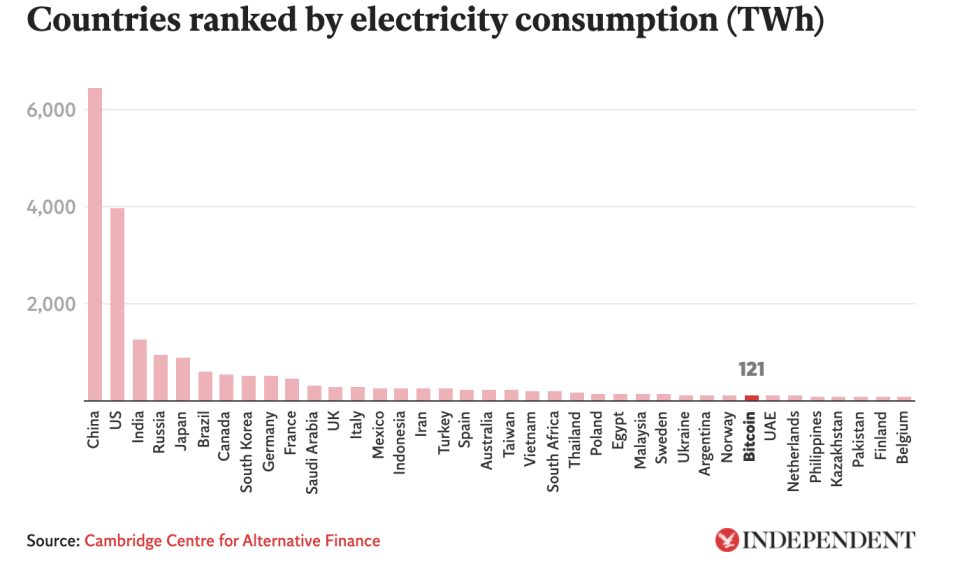

Analysis by the University of Cambridge suggests the network uses more than 121 terawatt-hours (TWh) annually, which would rank it in the top 30 electricity consumers worldwide if it were a country.

At current rates bitcoin, currently valued at $57,340, needs the same amount of energy annually as the Netherlands did in 2019, according to Cambridge and the International Energy Agency’s latest data.

Alex de Vries, founder of Digiconomist which examines consequences of new technologies, and a data scientist focusing on financial economic crime for De Nederlandsche Bank, called the oil well-bitcoin mining rig set-up “absurd”.

“It’s mind-blowing the suggestion that it is somehow helping the environment to use a by-product of fossil fuel extraction for bitcoin mining,” he told The Independent.

“We don’t have a climate change problem because fossil fuel companies are not efficient enough. And if you make the operation more efficient, you are not helping the environment anyway. Intuitively it just doesn’t make sense.

“Firstly, it’s adding to the bottom line of fossil fuel extraction and secondly, it’s still burning fossil fuels. We want to accelerate away from fossil fuels. We don’t want to make fossil fuels more profitable. I can’t wrap my head around it.”

He’s not the only one pointing out cryptocurrency’s climate problems.

“Bitcoin uses more electricity per transaction than any other method known to mankind, and so it’s not a great climate thing,” Bill Gates, a longtime bitcoin skeptic, recently told The New York Times.

MrLohstroh denied that companies like his are propping up the fossil fuel industry at a time when climate scientists tell us we must rapidly transition to clean energy to prevent climate catastrophe. Independent analysis this week found that the US needs to cut emissions by almost two-thirds in the next nine years to remain on track for net zero emissions by mid-century. The Biden administration has promised aggressive action including transforming the power sector to clean energy by 2035.

The bitcoin mine founder says he did not believe 100 per cent renewables was possible in 15 years’ time considering how dependent society remains on oil and gas, highlighting the lack of major breakthroughs in battery storage technologies for clean power.

“We believe that the [clean] energy transition is a lot further out than what most people think,” he said. “Our world operates on oil and gas. If we continue to produce oil for goods and services, natural gas is a byproduct of that and our business model will still be around.”

Bitcoin’s carbon footprint only looks set to get larger. The market is currently worth around $1trillion with 1.3 per cent of the global population owning cryptocurrency, according to one estimate. But with some of the world’s richest and most powerful investors jumping onboard, it could turbocharge global use of the digital currency. Among these investors are the established financial firm, Guggenheim Partners, Twitter founder Jack Dorsey and even Elon Musk, the low-carbon tech mastermind behind zero-emissions vehicle company Tesla.

Bitcoin enthusiasts say having big players in the market makes incentives like a “green bitcoin” more likely, and that companies could buy carbon credits to compensate power usage. Governments adopting more aggressive policies to tackle the climate crisis might also help.

Estimates on bitcoin’s reliance on fossil fuels versus renewables vary, with detailed data on bitcoin mining’s energy breakdown hard to come by. Chinese miners account for about 70 per cent of bitcoin production, data from Cambridge’s Centre for Alternative Finance shows. They tend to use renewables, mostly hydropower, during the rainy summer months, but fossil fuels - primarily coal - the rest of the year.

“Every miner’s objective is making a profit, so they don’t care about what kind of energy they use, if it is generated by hydro, wind, solar or burning coal,” Jack Liao, CEO of Chinese mining firm LightningAsic, told Reuters.

A 2019 white paper produced by CoinShares, a digital asset investment firm, estimated “the renewables penetration in the energy mix powering the Bitcoin mining network at 73 per cent” and claimed it is “more renewables-driven than almost every other large-scale industry in the world”.

Bitcoin enthusiasts argue that as the power grid switches to renewable energy so too will bitcoin.“It’s not so much bitcoin that is the problem.” Yves Bennaim, the founder of 2B4CH, a cryptocurrency think-tank, told Reuters. “People are saying it’s energy intensive therefore it’s polluting, but that is just the nature of the energy we are using today. As bitcoin goes up there will be more incentive to make investments in renewable sources of energy.”

Mr Lohstroh, and other cryptocurrency proponents point to the vast energy consumption of the existing financial system, and counter climate arguments by saying bitcoin is a tool for protecting human rights as it creates an electronic financial system without borders, where assets cannot be seized. Advocates also say the average bitcoin transaction is in the tens of thousands of dollars, compared to the small dollar amounts of average traditional electronic transactions.

This doesn’t mean that its without ethical and compliance issues. US Treasury Secretary Janet Yellen said last month that while she saw the promise of cryptocurrencies, it’s use for illicit purposes is a “growing problem”.

“I see the promise of these new technologies, but I also see the reality: Cryptocurrencies have been used to launder the profits of online drug traffickers; they’ve been a tool to finance terrorism,” she said.

Mr De Vries, who created a bitcoin energy consumption index, also took issue with a simplistic view that bitcoin would be part of a clean energy transition. He noted that bitcoin winners would be those working with the most powerful and fastest machines, and would keep resorting to the current cheapest and most stable source of power, fossil fuels.

Additionally, he pointed out that the computers worked best in the first six months, and because the specialized hardware cannot be repurposed, a mountain of e-waste was growing. Crypto networks were also piling pressure on a global chip shortage - incidentally, the same ones Tesla needs for its vehicles.

“If bitcoin were to scale up, it would seem like that’s going to go a lot faster than we’re capable of cleaning up our grid,” he said. “Then it’s going to have such a big impact on the world and might delay our ability to reach climate targets.”

Read More

‘Inequalities will become even more entrenched’: Why climate change is a feminist issue

Government intervenes in plan for Cumbria coal mine after climate backlash

What is an NFT and how do you buy it? The new ‘bitcoin for art’ trend explained

Yahoo Finance

Yahoo Finance