Accenture (ACN) Q3 Earnings & Revenues Surpass Estimates

Accenture plc ACN reported solid third-quarter fiscal 2020 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate.

Earnings of $1.90 per share surpassed the consensus estimate by 3.3% but came below the year-ago figure by 1.6%. The decline was due to lower revenues and operating results, higher non-operating expenses, which were partially offset by lower share count.

Net revenues of $10.99 billion outpaced the consensus mark by 0.7% but decreased 1% year over year on a reported basis and 1.3% in terms of local currency. Net revenues came in toward the higher end of the guided range of $10.75-$11.15 billion.

So far this year, shares of Accenture have gained 10.1%, outperforming 6.9% increase of the industry it belongs to and 7.7% increase of the Zacks S&P 500 composite.

Revenues in Detail

On the basis of the type of work, Consulting revenues of $6 billion decreased 4% year over year on a reported basis and 2% in terms of local currency. Outsourcing revenues of $5 billion increased 3% year over year on a reported basis and 5% in terms of local currency.

Segment-wise, Communications, Media & Technology revenues of $2.20 billion decreased 2% year over year on a reported basis and were flat in terms of local currency. Financial Services revenues of $2.14 billion decreased 3% year over year on a reported basis and were flat in terms of local currency. Health & Public Service revenues of $2.02 billion increased 11% year over year on a reported basis and 12% in terms of local currency. Products revenues of $3 billion decreased 3% year over year on a reported basis and 1% in local currency. Resources revenues of $1.64 billion decreased 6% year over year on a reported basis and 3% in terms of local currency.

Geographically, revenues of $5.24 billion from North Americas increased 2% year over year on a reported basis as well as in terms of local currency. Revenues from Europe of $3.57 billion decreased 5% on a reported basis and 2% in terms of local currency. Revenues from Growth Markets of $2.18 billion was flat year over year on a reported basis and increased 5% in terms of local currency.

Booking Trends

Accenture reported new bookings worth $11 billion. Consulting bookings and Outsourcing bookings totaled 6.2 billion and $4.8 billion, respectively.

Operating Results

Gross margin (gross profit as a percentage of net revenues) for the third quarter of fiscal 2020 increased 30 basis points (bps) to 32.1%. Operating income was $1.71 billion, down 0.6% year over year. Operating margin in the reported quarter expanded 10 bps to 15.6%.

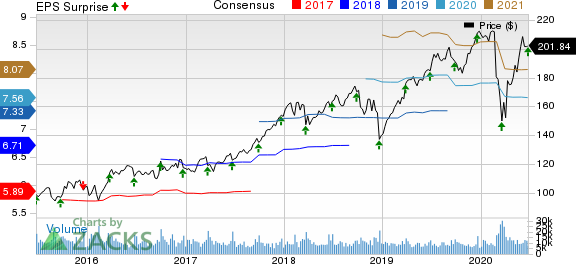

Accenture PLC Price, Consensus and EPS Surprise

Accenture PLC price-consensus-eps-surprise-chart | Accenture PLC Quote

Balance Sheet & Cash Flow

Accenture exited third-quarter fiscal 2020 with total cash and cash equivalents balance of $6.44 billion compared with $5.44 billion at the end of the prior quarter. Long-term debt was $60.3 million compared with $13.2 million at the end of the prior quarter.

Cash provided by operating activities crossed $2.74 billion in the reported quarter. Free cash flow came in at $2.59 billion.

Dividend Payout

Accenture has shifted its dividend payout policy from semi-annual to quarterly basis. On May 15, 2020, the company paid out a quarterly cash dividend of 80 cents per share to shareholders of record at the close of business on Apr 16, 2020. These cash dividend payouts totaled $509 million.

The company declared a quarterly cash dividend of 80 cents per share for shareholders of record at the close of business on Jul 16, 2020. This dividend will be paid out on Aug 14, 2020.

In fiscal 2019, the company paid out semi-annual cash dividends of $1.46 per share.

Share Repurchases

In line with the policy of returning cash to its shareholders, Accenture repurchased 3.7 million shares for $627 million in the fiscal third quarter. The company had approximately 637 million total shares outstanding as of May 31, 2020.

Guidance

Fourth-Quarter Fiscal 2020

For fourth-quarter fiscal 2020, Accenture expects revenues of $10.6-$11.0 billion. The assumption is inclusive of a negative foreign-exchange impact of 1%. Notably, the Zacks Consensus Estimate of $10.95 billion lies within the current guided range.

Fiscal 2020

Accenture updated its guidance for fiscal 2020. Management now expects EPS in the range of $7.57-$7.70 compared with the prior guided range of $7.48-$7.70. The current Zacks Consensus Estimate of $7.56 lies below the updated guidance. Revenues are expected to register 3.5-4.5% growth in terms of local currency compared with the prior guided growth rate of 3-6%.

Operating margin for the fiscal year is expected to be around 14.7%, indicating an expansion of 10 bps from fiscal 2019. Earlier, the company had expected expansion of 10-20 bps in fiscal 2020.

The company continues to expect negative foreign exchange impact of 1.5% on its results in U.S. dollars compared with 1% negative impact expected earlier.

Operating cash flow is now anticipated in the range of $6.45-$6.95 billion compared with $6.15-$6.65 billion guided earlier. Free cash flow is now expected between $5.8 billion and $6.3 billion compared with the prior guidance of $5.5-$6.0 billion. Annual effective tax rate is now anticipated in the range of 23.5%-24.5%, compared with the prior guided range of 23.5%-25.5%.

Currently, Accenture carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

S&P Global Inc.’sSPGI first-quarter 2020 adjusted earnings per share of $2.73 beat the consensus mark by 15.7% and improved 29.4% year over year on the back of revenue growth, benefits of productivity initiatives and reduced business travel. The stock currently carries a Zacks Rank #3.

IQVIA Holdings Inc.’s IQV first-quarter 2020 adjusted earnings per share of $1.50 beat the consensus mark by 1.4% but decreased 1.9% on a year-over-year basis. The reported figure lies within the guided range of $1.46-$1.51. The stock currently carries a Zacks Rank #3.

Insperity, Inc.’s NSP first-quarter 2020 adjusted earnings of $1.70 per share beat the consensus mark by 5.6% but decreased 14.1% year over year. The reported figure matched the higher end of the guided range of $1.61-$1.70. The stock currently carries a Zacks Rank #3.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Insperity, Inc. (NSP) : Free Stock Analysis Report

SP Global Inc. (SPGI) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance