Accuray Inc (ARAY) Faces Challenges in Fiscal Q3 2024, Misses Revenue Expectations

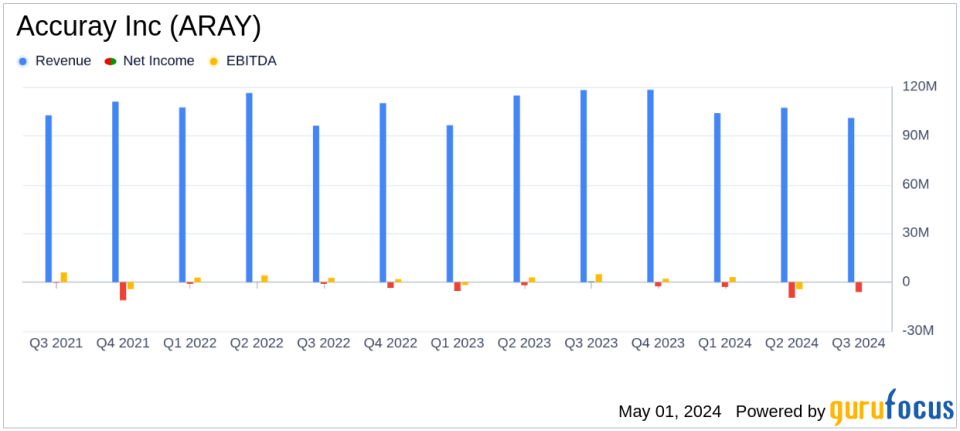

Revenue: Reported Q3 fiscal 2024 revenue of $101.1 million, falling short Short the estimated $113.65 million.

Net Loss: Posted a net loss of $6.3 million in Q3, significantly worse than the estimated net income of -$1.18 million.

Earnings Per Share (EPS): Recorded EPS of -$0.06, underperforming against the estimated EPS of -$0.01.

Gross Orders: Achieved $89.1 million in gross orders for Q3, marking a 21% increase year-over-year.

Adjusted EBITDA: Adjusted EBITDA for Q3 was $1.1 million, a substantial decrease from $8.3 million in the same quarter last year.

Book to Bill Ratio: Improved to 1.8 in Q3 fiscal 2024 from 1.2 in the prior year, indicating strong order intake relative to revenue.

Guidance: Adjusted FY 2024 revenue guidance to a range of $432 million to $437 million, with adjusted EBITDA expected between $19 million and $22 million.

On May 1, 2024, Accuray Inc (NASDAQ:ARAY) disclosed its financial outcomes for the third quarter of fiscal year 2024, revealing a decline in revenue and an increase in net losses compared to the previous year. The detailed report, available in their 8-K filing, highlights several operational and financial challenges despite a growth in gross orders.

Financial Performance Overview

For the third quarter ended March 31, 2024, Accuray reported net revenue of $101.1 million, a 14% decrease from $118.1 million in the same quarter the previous year. This fall in revenue was below the analyst expectations of $113.65 million. The company also reported a GAAP net loss of $6.3 million, compared to a net income of $0.6 million in the prior year's corresponding quarter. The earnings per share (EPS) stood at -$0.06, deviating from the estimated EPS of -$0.01.

Despite the downturn in revenue and profitability, Accuray observed a 21% year-over-year increase in gross orders, amounting to $89.1 million. This suggests a potentially stronger future revenue pipeline, underscored by a book-to-bill ratio of 1.8, indicating more orders were received than billed during the quarter.

Operational Highlights and Strategic Initiatives

Accuray's quarter was marked by significant operational developments including the opening of a new training center in Switzerland and the introduction of CyberComm at ESTRO, aimed at reducing commissioning time for its CyberKnifeS7 System. These initiatives are part of Accuray's strategy to enhance global service capabilities and expedite treatment setups, potentially boosting future service revenues.

The company also entered a collaboration with Oncopole Claudius Regaud and Airbus SAS to develop AI-driven solutions for predicting radiotherapy system performance, highlighting its commitment to technological advancement and market competitiveness.

Challenges and Management Commentary

CEO Suzanne Winter acknowledged the quarter's challenges, including delays in product shipments and slower U.S. installations. However, she remains optimistic about the company's strategic direction, emphasizing long-term growth and profitability drivers discussed during their investor day. Winter's statement reflects a focus on overcoming current hurdles while steering towards future opportunities.

"While I am disappointed in our quarterly results where we faced challenges as a result of multiple factors, including a delay in product shipments and slower than expected U.S. installations, we remain confident in our growth strategy and our ability to offer value to our customers globally," said Suzanne Winter, Chief Executive Officer.

Financial Health and Future Outlook

Accuray's financial health saw some pressure with cash and cash equivalents decreasing to $61.1 million from $89.4 million a year earlier. The company has adjusted its full-year 2024 revenue guidance to a range of $432 million to $437 million and expects adjusted EBITDA to be between $19 million and $22 million.

The revised guidance and the strategies underway to enhance operational efficiency and market reach suggest a cautious yet proactive approach by Accuray to navigate current challenges and leverage growth opportunities in the evolving medical technology landscape.

Conclusion

Accuray's fiscal Q3 2024 results reflect a challenging quarter, with revenue declines and increased losses. However, the growth in order bookings and strategic initiatives to enhance service offerings and technological capabilities indicate potential for recovery and growth. Investors and stakeholders will likely watch closely how the company's strategies unfold in the coming quarters.

Explore the complete 8-K earnings release (here) from Accuray Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance