Acorda (ACOR) to Post Q3 Earnings: What's in the Cards?

Acorda Therapeutics, Inc. ACOR is scheduled to report third-quarter 2019 results on Nov 4, after the market closes.

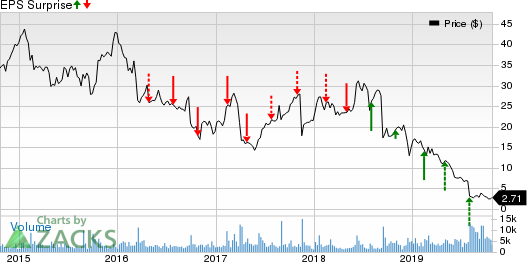

Acorda has an excellent earnings surprise history, surpassing expectations in each of the trailing four quarters, the average being 69.68%. In the last reported quarter, the company delivered a positive surprise of 48.11%.

Shares of Acorda have plummeted 84.4% so far this year underperforming the industry’s decrease of 2.8%.

Factors to Consider

Acorda’s lead multiple sclerosis (MS) drug Ampyra is facing generic competition in the United States. During the first half of 2019, sales of Ampyra tanked significantly year over year due to generic launches. This sales erosion induced by generic competition is likely to have hurt the company’s third-quarter top line. Though Ampyra sales recorded a surprising sequential increase in the second quarter, management had then guided that this will see a sharp decline in the upcoming quarters of 2019.

On Oct 23, the company provided Ampyra’s sales figure for the third quarter of 2019. The drug generated sales of $37.6 million in the third quarter, reflecting a 72.7% plunge year over year and a 14.9% decline on a sequential basis.

Notably, last September, Ampyra lost its exclusivity as generics entered the market including Mylan's MYL authorized generic version.

Acorda’s Parkinson’s disease drug Inbrija was launched in the United States in February and is off to a strong start on high demand both from doctors and patients. On Wednesday, management reported that the drug recorded sales worth of $4.9 million in the third quarter of 2019, reflecting a surge of 63.3% sequentially.

Inbrija is also under review in Europe with a decision expected by the end of 2019. Investor will be keen to get an update on the same during the earnings call as a potential approval in the EU will boost sales of the drug in the future quarters.

Key Recent Developments

Along with providing the sales numbers of Inbrija and Ampyra on Wednesday, Acorda also announced a corporate restructuring and updated its 2019 financial outlook as well as renewed 2020 financial guidance.

As part of its corporate strategy, management stated to trim workforce by almost 25%. The company expects to realize estimated annualized cost savings of approximately $21 million beginning next year due to headcount reduction.

Acorda lowered its previously issued research and development (R&D) expenses and selling, general and administrative (SG&A) expenses (excluding share-based compensation expenses) for the full year. The company now expects R&D expenses in the range of $55-$60 million compared with the previous expectation of $70-$80 million. SG&A expenses are expected in the $185-$190 million range compared with $200-$210 million expected earlier.

For 2020, R&D expenses are expected in the range of $20-$25 million while SG&A expenses are anticipated in the $160-$165 million band.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Acorda this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But this is not the case here. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Acorda has an Earnings ESP of -1.27%.

Zacks Rank: Acorda carries a Zacks Rank #2, which increases the predictive power of ESP. However, its negative ESP leaves surprise prediction inconclusive.

Acorda Therapeutics, Inc. Price and EPS Surprise

Acorda Therapeutics, Inc. price-eps-surprise | Acorda Therapeutics, Inc. Quote

Stocks That Warrant a Look

Here are a few healthcare stocks worth considering as our model shows that these have the right mix of elements to beat estimates this time around.

Incyte Corporation INCY has an Earnings ESP of +1.15% and a Zacks Rank of 1. The company is scheduled to release results on Oct 29. You can see the complete list of today’s Zacks #1 Rank stocks here.

Amgen, Inc. AMGN has an Earnings ESP of +0.50% and a Zacks Rank of 3. The company is scheduled to release results on Oct 29.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

Acorda Therapeutics, Inc. (ACOR) : Free Stock Analysis Report

Mylan N.V. (MYL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance