Activision (ATVI) Hits 52-Week High on Franchise Strength

Shares of Activision Blizzard, Inc. ATVI rallied to a new 52-week high of $81.64, eventually closing a bit lower at $81.50 on Jul 13. The company has a market cap of $62.03 billion and a long-term earnings growth of 15.41%.

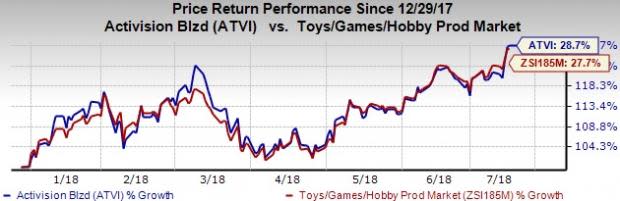

Notably, shares of Activision have been witnessing an upside, appreciating 28.7% in the year-to-date period compared with the industry’s rally of 27.7%.

Popular Franchises Drive Growth

Activision is riding on the growing popularity of its Overwatch e-sports league. Notably, Overwatch league had a scintillating start with more than 10 million viewers watching the event in the first week of the inaugural season. We note that the launch of Overwatch league is driving viewership, corporate sponsorships and media coverage for Activision.

The company’s recent announcement of signing a multi-year deal with Disney to broadcast the league live on ESPN, as well as on ABC, is expected to give it a further boost.

Moreover, Activision’s enviable popularity in the video game publishing sector which is driven by its well-known franchises continues to boost its top-line. Call of Duty is one of the biggest revenue generators for the company. King Digital’s highly popular Candy Crush also continues to rake in significant revenues for the company.

Activision Blizzard, Inc Revenue (TTM)

Activision Blizzard, Inc Revenue (TTM) | Activision Blizzard, Inc Quote

The Call of Duty: Black Ops 4 is set to launch this October and is expected to gain as much popularity as its immensely successful prequel, Call of Duty: WWII, which ruled the console video game market last year.

The company has also been continuously drawing strength from new and engaging content releases. The addition of content is helping the company increase engagement levels of players and thereby leading to higher in-game purchases.

We believe the inclusion of a battle royale (BR) game mode called Blackout in Call of Duty: Black Ops 4 will help it counter the growing craze for Epic Games’ Fortnite.

However, significant competition from the likes of Electronic Arts EA, Take Two Interactive TTWO and Glu Mobile GLUU remain concerning.

Zacks Rank

Activision currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Activision Blizzard, Inc (ATVI) : Free Stock Analysis Report

Take-Two Interactive Software, Inc. (TTWO) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

Glu Mobile Inc. (GLUU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance