AdaptHealth Corp Reports Mixed Q1 2024 Results: Revenue Up, Net Loss Recorded

Revenue: Reported at $792.5 million, marking a 6.4% increase from the previous year, and surpassing the estimate of $769.87 million.

Net Loss: Recorded a net loss of $2.1 million, a significant shift from a net income of $15.7 million in the prior year, below the estimated net income of $6.32 million.

Earnings Per Share (EPS): Reported a loss of $0.02 per share, below the estimated earnings of $0.05 per share.

Adjusted EBITDA: Increased by 18.3% to $158.5 million from $134.0 million, with an Adjusted EBITDA Margin of 20.0%.

Free Cash Flow: Reported a negative $38.9 million, a decrease from a positive $51.1 million, primarily due to delayed payments from the Change Healthcare data breach.

Cash Flow from Operations: Decreased to $49.0 million from $140.2 million in the previous year, also affected by the aforementioned data breach.

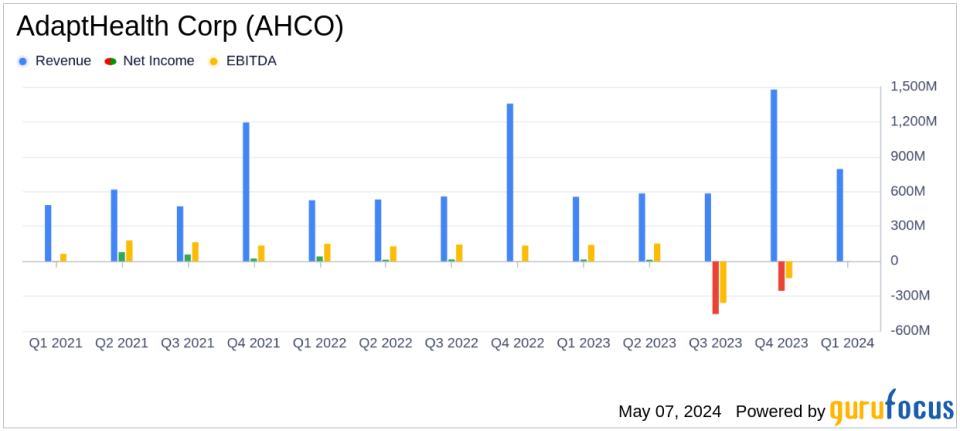

On May 7, 2024, AdaptHealth Corp (NASDAQ:AHCO) disclosed its first quarter financial results via an 8-K filing, revealing a complex quarter marked by revenue growth but also a net loss. The company, a national leader in providing patient-centered, healthcare-at-home solutions, reported a 6.4% increase in net revenue, reaching $792.5 million, up from $744.6 million in the same period last year. This surpasses the analyst's revenue estimate of $769.87 million.

However, the quarter was not without its challenges. AdaptHealth experienced a net loss of $2.1 million, a significant downturn from the net income of $15.7 million reported in Q1 2023. This was contrary to the estimated earnings per share of $0.05, reflecting a tougher operational landscape influenced by external factors such as the Change Healthcare data breach which impacted cash flows and payments.

Financial Highlights and Operational Challenges

The company's Adjusted EBITDA saw an 18.3% increase to $158.5 million from $134.0 million in the prior year, with an Adjusted EBITDA Margin of 20.0%. Despite this growth, AdaptHealth's Free Cash Flow was negative $38.9 million, a stark contrast to the positive $51.1 million in the previous year, primarily due to delayed payments stemming from the aforementioned data breach.

Richard Barasch, Chairman and Interim CEO, commented on the quarter's performance, emphasizing the strength in their Sleep and Respiratory product lines and improvements in the Diabetes segment. He noted, "Our expectations for Free Cash Flow for the first half and for the full year remain unchanged," highlighting management's outlook for recovery and operational normalization in upcoming quarters.

"I am pleased to report that AdaptHealth had an excellent first quarter... We delivered 6.2% non-acquired revenue growth and an 18.3% increase in Adjusted EBITDA driven by Adjusted EBITDA Margin of 20.0%," said Richard Barasch.

Analysis of Financial Statements

The balance sheet remains robust with total assets of $4.5 billion as of March 31, 2024, slightly down from $4.51 billion at the end of 2023. The company's efforts to reduce debt were evident, with long-term debt (excluding the current portion) reported at approximately $2.16 billion, down from $2.09 billion at the end of the previous year.

Operational income improved to $50.53 million from $26.18 million year-over-year, despite the net loss recorded due to higher interest expenses and changes in the fair value of warrant liability which impacted net income negatively.

Looking Ahead

As AdaptHealth continues to navigate through its operational challenges, including the impacts from the Change Healthcare data breach, the company remains focused on reducing debt and improving its cash flow position. The leadership transition with Suzanne Foster poised to take over as CEO also marks a significant shift that could influence the company's strategic directions and operational effectiveness.

For investors, the mixed results present a nuanced picture: while revenue growth and EBITDA improvements indicate underlying business strength, the net loss and cash flow issues highlight ongoing challenges that need careful monitoring.

Explore the complete 8-K earnings release (here) from AdaptHealth Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance