Should You Be Adding Goldplat (LON:GDP) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Goldplat (LON:GDP). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Goldplat

How Fast Is Goldplat Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. I, for one, am blown away by the fact that Goldplat has grown EPS by 55% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

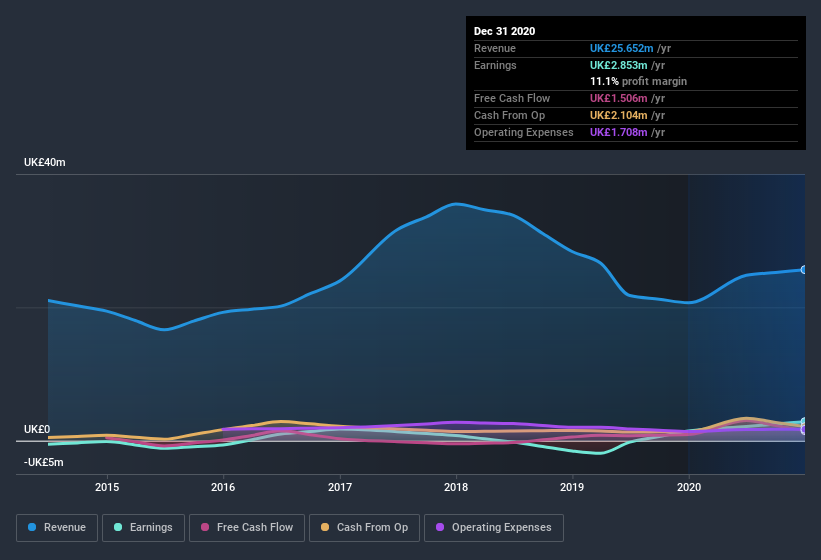

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Goldplat maintained stable EBIT margins over the last year, all while growing revenue 24% to UK£26m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Goldplat isn't a huge company, given its market capitalization of UK£12m. That makes it extra important to check on its balance sheet strength.

Are Goldplat Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Goldplat insiders spent UK£40k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Non-Executive Director Sango Ntsaluba for UK£15k worth of shares, at about UK£0.055 per share.

I do like that insiders have been buying shares in Goldplat, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like Goldplat with market caps under UK£146m is about UK£241k.

Goldplat offered total compensation worth UK£164k to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Goldplat To Your Watchlist?

Goldplat's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Goldplat may be at an inflection point. For those chasing fast growth, then, I'd suggest to stock merits monitoring. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Goldplat that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Goldplat, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance