Should You Be Adding Mohawk Industries (NYSE:MHK) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Mohawk Industries (NYSE:MHK). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Mohawk Industries

How Fast Is Mohawk Industries Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Mohawk Industries has grown EPS by 16% per year. That's a good rate of growth, if it can be sustained.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Mohawk Industries shareholders can take confidence from the fact that EBIT margins are up from 9.4% to 12%, and revenue is growing. That's great to see, on both counts.

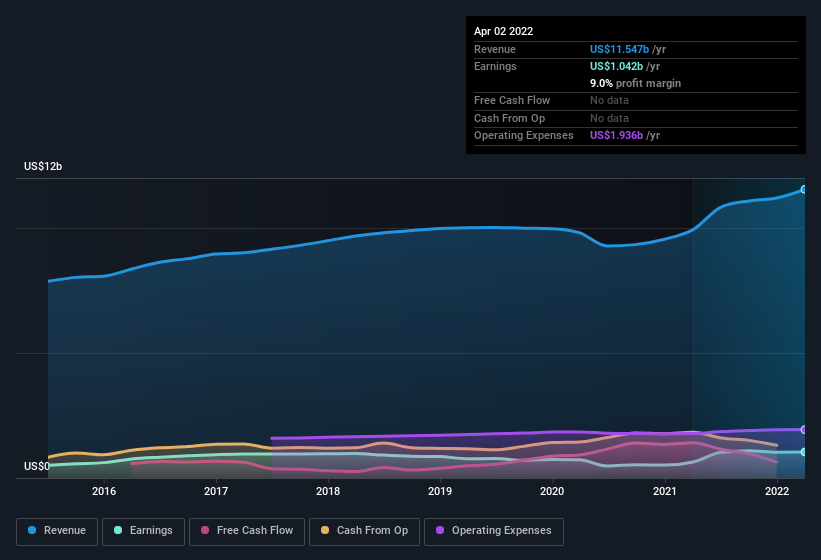

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Mohawk Industries's forecast profits?

Are Mohawk Industries Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping US$1.4m that the President, William Wellborn spent acquiring shares. The average price paid was about US$136. The quantum of that insider purchase is both rare and a sight to behold, not unlike an endangered Amur Leopard in the wild.

Along with the insider buying, another encouraging sign for Mohawk Industries is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth US$1.6b. That equates to 18% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Jeff Lorberbaum is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between US$4.0b and US$12b, like Mohawk Industries, the median CEO pay is around US$8.2m.

Mohawk Industries offered total compensation worth US$5.2m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Mohawk Industries Deserve A Spot On Your Watchlist?

One important encouraging feature of Mohawk Industries is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Now, you could try to make up your mind on Mohawk Industries by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Mohawk Industries, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance