Adidas Leads Trio Of Value Stocks On German Exchange Estimated Below Intrinsic Worth

As European markets show signs of resilience, with Germany's DAX index recently climbing by 1.48%, investors are keenly observing opportunities for value in this environment of moderated inflation and economic recalibration. In this context, identifying stocks that appear undervalued relative to their intrinsic worth could be particularly compelling, as they may offer potential for appreciation in a stabilizing economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Stabilus (XTRA:STM) | €43.80 | €79.60 | 45% |

technotrans (XTRA:TTR1) | €17.90 | €29.40 | 39.1% |

PSI Software (XTRA:PSAN) | €22.30 | €43.32 | 48.5% |

Stratec (XTRA:SBS) | €44.00 | €82.06 | 46.4% |

SBF (DB:CY1K) | €2.94 | €5.72 | 48.6% |

CHAPTERS Group (XTRA:CHG) | €24.40 | €46.51 | 47.5% |

MTU Aero Engines (XTRA:MTX) | €250.80 | €418.92 | 40.1% |

R. STAHL (XTRA:RSL2) | €18.40 | €29.10 | 36.8% |

Rubean (DB:R1B) | €5.85 | €10.81 | 45.9% |

Your Family Entertainment (DB:RTV) | €2.56 | €4.54 | 43.6% |

Let's uncover some gems from our specialized screener.

adidas

Overview: Adidas AG is a global company that designs, develops, produces, and markets athletic and sports lifestyle products across various regions, with a market capitalization of approximately €40.83 billion.

Operations: Adidas generates revenue primarily from three regional segments: €5.16 billion from North America, €3.20 billion from Greater China, and €2.31 billion from Latin America.

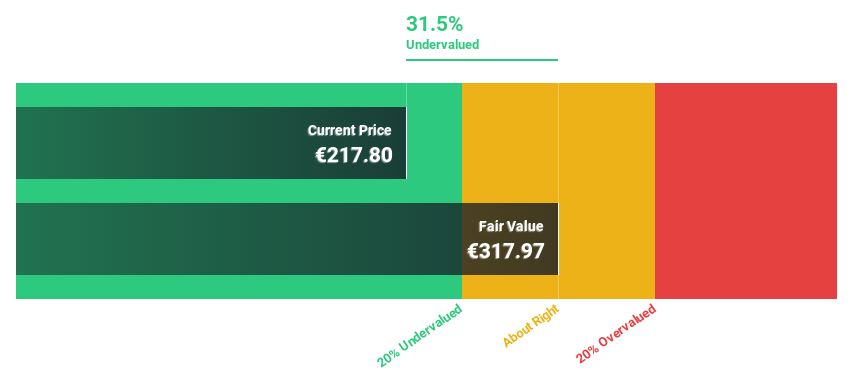

Estimated Discount To Fair Value: 32.9%

Adidas AG, with a recent rebound to profitability in Q1 2024, reported a significant turnaround with sales rising to €5.46 billion and net income of €170 million. Despite revenue growth projections being modest at 7.9% annually, earnings are expected to surge by 41.3% per year. Currently trading at €228.7, significantly below the estimated fair value of €340.61, Adidas presents a compelling case as an undervalued stock based on cash flows and future earnings potential in Germany's market landscape.

Our growth report here indicates adidas may be poised for an improving outlook.

Dive into the specifics of adidas here with our thorough financial health report.

PSI Software

Overview: PSI Software SE specializes in developing and integrating software solutions to optimize the flow of energy and materials for utilities and industry globally, with a market capitalization of approximately €345.38 million.

Operations: The company generates revenue primarily through two segments: Energy Management (€141.78 million) and Production Management (€148.79 million).

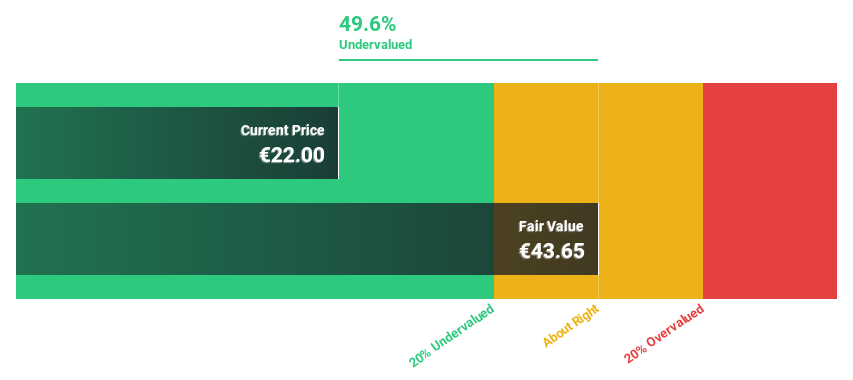

Estimated Discount To Fair Value: 48.5%

PSI Software SE, currently priced at €22.3, is recognized as undervalued based on discounted cash flow analysis, with a calculated fair value of €43.32. While its return on equity is expected to remain modest at 16.4%, the company's revenue growth rate of 7.6% annually outpaces the German market forecast of 5.4%. Recent strategic developments include the appointment of Erol Bozak as CTO to spearhead cloud transformation initiatives, enhancing PSI's technological capabilities and potentially bolstering future profitability and market position.

SAP

Overview: SAP SE operates globally, offering a broad range of applications, technology, and services through its subsidiaries, with a market capitalization of approximately €216.95 billion.

Operations: The company generates €31.81 billion from its Applications, Technology & Services segment.

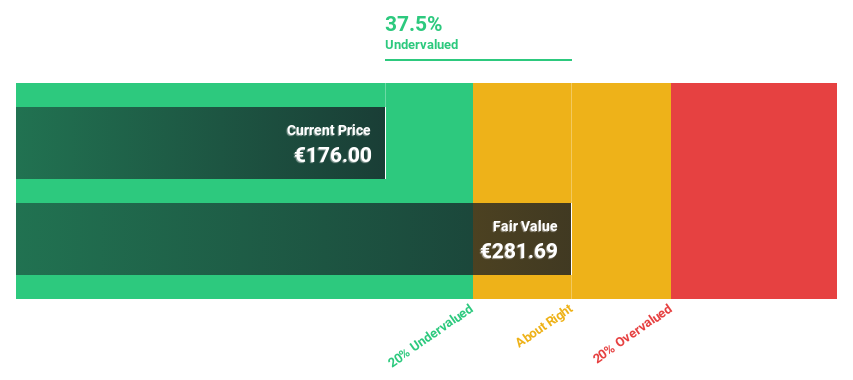

Estimated Discount To Fair Value: 33.8%

SAP, valued at €187.22, appears undervalued by discounted cash flow metrics, suggesting a fair value of €282.61. Despite a modest forecasted return on equity of 16.1% in three years, SAP's revenue and earnings growth projections outstrip the German market averages, with earnings expected to grow significantly at 34% annually. Recent strategic alliances and client implementations of SAP S/4HANA Cloud indicate ongoing operational enhancements and potential for sustained growth despite some financial fluctuations due to large one-off items impacting results.

The growth report we've compiled suggests that SAP's future prospects could be on the up.

Click to explore a detailed breakdown of our findings in SAP's balance sheet health report.

Where To Now?

Explore the 28 names from our Undervalued German Stocks Based On Cash Flows screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ADSXTRA:PSAN and XTRA:SAP

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com