Admiral Group's (LON:ADM) Dividend Will Be Increased To UK£1.61

Admiral Group plc (LON:ADM) will increase its dividend on the 1st of October to UK£1.61. This makes the dividend yield 6.8%, which is above the industry average.

Check out our latest analysis for Admiral Group

Admiral Group Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. The last payment was quite easily covered by earnings, but it made up 251% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

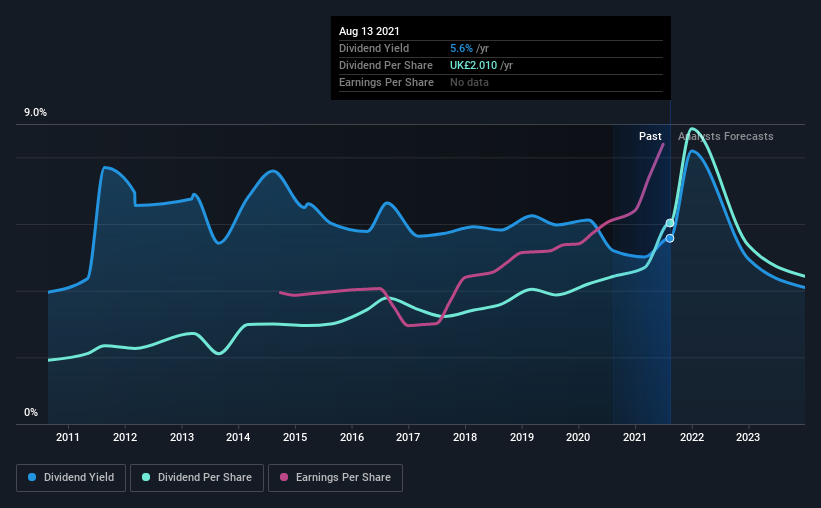

Over the next year, EPS is forecast to expand by 12.4%. Assuming the dividend continues along recent trends, we think the payout ratio could reach 115%, which probably can't continue putting some pressure on the balance sheet.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from UK£0.64 in 2011 to the most recent annual payment of UK£2.01. This means that it has been growing its distributions at 12% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Admiral Group has impressed us by growing EPS at 16% per year over the past five years. While on an earnings basis, this company looks appealing as an income stock, the cash payout ratio still makes us cautious.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Admiral Group's payments are rock solid. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Admiral Group (of which 2 are concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance