Adobe (ADBE) Q3 Earnings & Revenues Beat Estimates, Rise Y/Y

Adobe Inc. ADBE reported third-quarter fiscal 2022 non-GAAP earnings of $3.40 per share, beating the Zacks Consensus Estimate by 2.1%. The figure improved 9.3% on a year-over-year basis and 1.5% sequentially.

Total revenues were $4.433 billion, which beat the Zacks Consensus Estimate of $4.430 billion. The figure was up 13% from the year-ago quarter and 1.1% from the previous quarter.

Top-line growth was driven by the strong performance of Adobe Creative Cloud, Document Cloud and Experience Cloud. Accelerating subscription and services’ revenues contributed well.

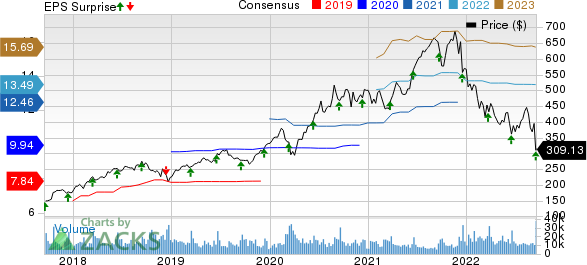

Adobe Inc. Price, Consensus and EPS Surprise

Adobe Inc. price-consensus-eps-surprise-chart | Adobe Inc. Quote

Top Line in Detail

Adobe reports revenues under three categories — subscription, product, and services & support.

Subscription revenues were $4.13 billion (accounting for 93% of the total revenues), up 12.9% on a year-over-year basis.

Product revenues totaled $126 million (3% of the total revenues), up 5.9% year over year.

Services & support revenues were $179 million (4% of the total revenues), increasing 12.6% from the prior-year quarter.

Segmental Details

Digital Media: The segment generated revenues of $3.23 billion, which improved 13% on a year-over-year basis. The segment comprises Creative Cloud and Document Cloud. Notably, Digital Media’s annualized recurring revenues (ARR) increased to $13.4 billion, in which the net new ARR was $449 million.

Creative Cloud generated $2.63 billion of revenues, up 11% year over year. Creative ARR was $11.15 billion. The rising demand for Premiere Pro and Frame.io, driven by the growing momentum in video production, contributed well. Solid traffic growth and expanding user base on the Adobe Express platform remained positives. Strength across Substance 3D and solid momentum in Adobe Stocks business were tailwinds.

Document Cloud’s revenues were $607 million, up 23% from the prior-year quarter. Document ARR was $2.25 billion. Solid momentum across the Acrobat ecosystem drove top-line growth. The strong adoption of PDF, along with the rising installation of Acrobat and Reader on mobile and desktop, contributed well.

The increasing volume of web searches for document actions drove growth in the monthly active user base of Acrobat Web. The strong adoption of Adobe Sign was a positive. Strength in integrated workflows between Acrobat Desktop, Acrobat Web and Adobe Express was another positive.

Digital Experience:The segment generated revenues of $1.12 billion, up 14% on a year-over-year basis. The segment comprises Adobe Experience Cloud. Experience Cloud subscription revenues were $981 million, which rose 14% from the year-ago quarter. Strong momentum across the Experience Cloud platform and Adobe Commerce drove top-line growth for the segment.

Operating Details

The gross margin was 87.7%, which contracted 40 basis points (bps) on a year-over-year basis.

Adobe incurred operating expenses of $2.4 billion, reflecting an 18.5% year-over-year increase. As a percentage of the total revenues, the figure expanded 2700 bps to 54.2%.

The adjusted operating margin was 44.1%, contracting 190 bps year over year.

Balance Sheet & Cash Flow

As of Sep 2, 2022, the cash and short-term investment balance was $5.8 billion, up from $5.3 billion as of Jun 3, 2022. Trade receivables were $1.7 billion, up from $1.6 billion recorded in the fiscal second quarter.

Long-term debt was $3.627 billion at the end of the fiscal third quarter, which remained flat with the previous quarter.

Cash generated from operations was $1.7 billion in the fiscal third quarter versus $2.04 billion in the fiscal second quarter. In the reported quarter, the company repurchased 5.1 million shares.

Guidance

For fourth-quarter fiscal 2022, Adobe projects total revenues of $4.52 billion. The Zacks Consensus Estimate for revenues is pegged at $4.53 billion.

Adobe expects year-over-year revenue growth of 10% from Digital Media. The Digital Experience segment’s revenues are expected to grow 13% on a year-over-year basis.

Net new ARR in the Digital Media segment is projected to be $550 million. Digital Experience subscription revenues are likely to increase 13% year over year.

Management expects non-GAAP earnings of $3.50 per share. The Zacks Consensus Estimate for the same is pegged at $3.44.

The above-mentioned outlook includes the impacts of foreign exchange headwinds and seasonal demand strength.

Zacks Rank & Stocks to Consider

Currently, Adobe carries a Zacks Rank #4 (Sell).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Arista Networks ANET, Teradata TDC and Monolithic Power Systems MPWR. While Arista Networks currently sports a Zacks Rank #1 (Strong Buy), Teradata and Monolithic Power Systems carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks has lost 18.7% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 18.6%.

Teradata has lost 27.4% in the year-to-date period. The long-term earnings growth rate for TDC is currently projected at 25%.

Monolithic Power Systems has lost 15.1% in the year-to-date period. The long-term earnings growth rate for MPWR is currently projected at 25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teradata Corporation (TDC) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Monolithic Power Systems, Inc. (MPWR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance