Adobe (NASDAQ:ADBE) Has A Rock Solid Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Adobe Inc. (NASDAQ:ADBE) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Adobe

What Is Adobe's Net Debt?

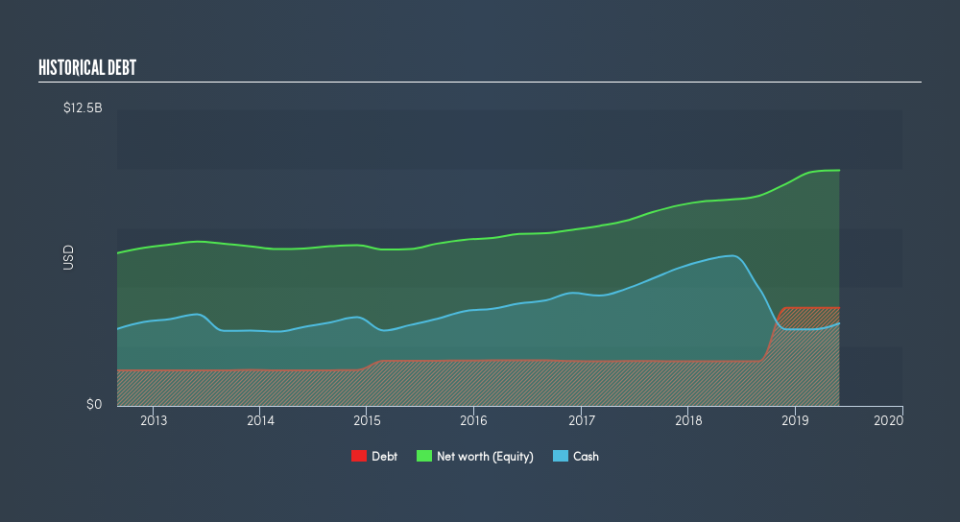

As you can see below, at the end of May 2019, Adobe had US$4.14b of debt, up from US$1.88b a year ago. Click the image for more detail. However, because it has a cash reserve of US$3.48b, its net debt is less, at about US$657.6m.

A Look At Adobe's Liabilities

Zooming in on the latest balance sheet data, we can see that Adobe had liabilities of US$7.69b due within 12 months and liabilities of US$2.05b due beyond that. On the other hand, it had cash of US$3.48b and US$1.27b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.98b.

Of course, Adobe has a titanic market capitalization of US$144.9b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, Adobe has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Adobe's net debt is only 0.20 times its EBITDA. And its EBIT covers its interest expense a whopping 53.7 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. And we also note warmly that Adobe grew its EBIT by 11% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Adobe can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Adobe actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Happily, Adobe's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Zooming out, Adobe seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. We'd be very excited to see if Adobe insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance