Adobe’s (NASDAQ:ADBE) Stock Price is Approaching Technical Support and a More Attractive Valuation

This article originally appeared on Simply Wall St News.

Adobe Inc’s ( NASDAQ:ADBE ) share price has fallen more than 13% from the all time high recorded at the beginning of the month. Technology shares have been under pressure, but Adobe has been noticeably weaker than the sector since reporting third quarter results last week. This is despite the fact that the company beat consensus estimates on the top and bottom line, and reported a record $3.94 billion in quarterly revenue.

There are several reasons to believe the stock has become fully valued following strong performance on the back of first and second quarter results earlier in the year. Heading into last week’s report, the stock price was up 45% since first quarter earnings were announced in March. Our estimate of Adobe’s fair value based on analyst forecasts is about $560. When the stock price was $670, that implied a premium of 20%. This premium has since fallen to just 4.4%.

Also worth noting is that Adobe’s Chairman and CEO Shantanu Narayen, sold 40,000 shares last week. This trade was worth over $24 million and represents about 10% of his holding in Adobe. This may indicate that insiders don’t see immediate upside for the share price.

Check out our latest analysis for Adobe

What kind of growth will Adobe generate?

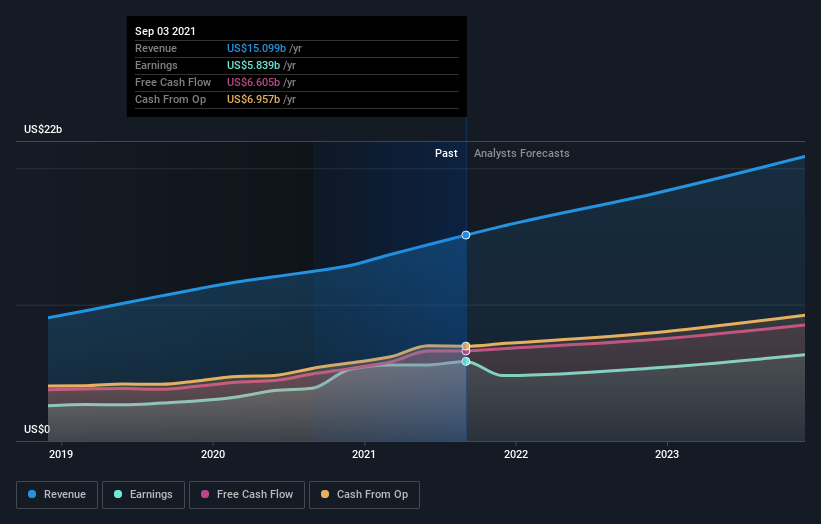

Looking to the future, analysts are looking for profits to grow by 22% over the next couple of years. However, over the next 12 months earnings growth is expected to slow to just 13%, which is lower than both the software industry and the broader market. The chart below illustrates how earnings are expected to dip in the near term, before rising again.

What this means for you:

Adobe is a high quality business with an enviable operating margin of 31% which has allowed the company to generate a return on equity of over 40%. The company has numerous competitive advantages and a growing target market of digital marketers, designers and content creators. Aside from the valuation, there is no reason to believe the company doesn’t have a very bright future.

Growth companies like Adobe very seldom trade at really attractive valuations, and investors typically have to pay for some future growth. But it is worth being patient and waiting for the stock to trade at a valuation that is reasonable compared to the company's own history.

Over the last five years, Adobe’s price-to-earnings ratio (P/E ratio) has ranged between 38 and 65, with a recent peak at 56. We don’t think P/E ratios are a very robust valuation tool, but they can be useful to compare a stock’s valuation to similar companies and to its own trading history. They can also give us an idea of how optimistic the market is about a company.

The stock price is currently headed toward our intrinsic value estimate of $560, but may well trade lower than that. The $535 level is a key support level where the 2020 high coincides with the 200-day moving average. This level would imply a small discount and a P/E ratio of 44, which is closer to the 5-year low for this metric. This would offer long term investors a more attractive entry point, with more support than current levels.

Bear in mind that it may take a few more earnings cycles for sentiment to improve unless the company upgrades its guidance. You can check out what analysts are forecasting by clicking here .

If you are no longer interested in Adobe, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance