Advanced Micro Devices, Inc. (NASDAQ:AMD) Seems Overvalued and Large Players may Take Profits

This article was originally published on Simply Wall St News

Advanced Micro Devices, Inc. (NASDAQ:AMD) is clearly on a profit run, and the company is continuously surpassing expectations, which has led investors to pay more attention. In this article, we will examine if the stock price is too expensive in relation to the ability of AMD to produce future cash flows, and look at possible investment strategies that might occur.

Starting with the most recent earnings report. We see that for the third quarter, the company reported sales was USD 4,313 million compared to USD 2,801 million a year ago. Net income was USD 923 million compared to USD 390 million a year ago.

The net income is the most important aspect, as it is what translates into cash flows attributable to investors. For AMD, this result has been superb for shareholders, and the company even issued guidance expecting to grow revenues around 65% for the full 2021 year.

Investors have responded to the success of AMD, and the stock has risen by 60% over the last year. However, becoming bigger is harder than becoming big and the recent stock growth falls short of the 78% return per annum it has made for shareholders, each year, over five years.

Check out our latest analysis for Advanced Micro Devices

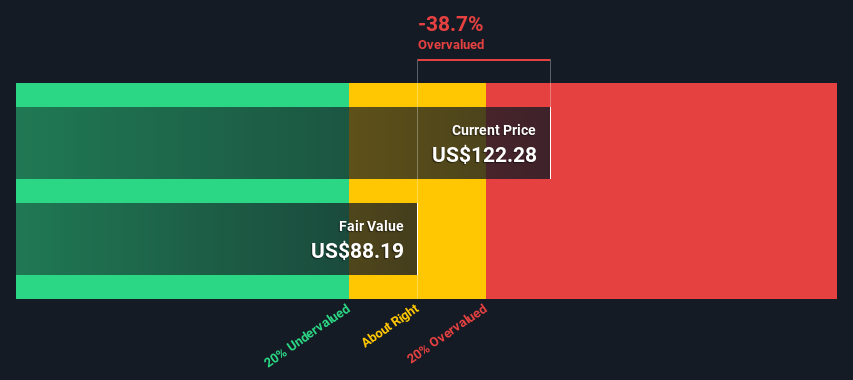

AMD Fair Value

Next, we will see if the future cash flows attributable to investors justify the current stock price. For this we will use our Discounted Cash Flow valuation model.

Remember though, that there are many ways to estimate a company's value, and a DCF is just one method. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

By using our model, we get two crucial results. The present value of the future cash flows and the present value of the terminal value - present value is only an attempt to estimate how much are future earnings worth today.

Present Value of 10-year Cash Flow (PVCF) = US$37b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$136b÷ ( 1 + 6.9%)10= US$70b

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$107b.

Finally, we divide the equity value by the number of shares outstanding. Relative to the current share price of US$122, the company appears reasonably expensive at the time of writing.

Our model has a built-in safety margin of 10% on either side that accounts for possible errors in value estimation. It seems that currently AMD stock has a fair value of US$88 per share, but is trading some 40% above that. The market may be overestimating the future growth potential of the company, and the current price is a reflection of optimistic sentiment more than the fundamentals.

Conclusion

For existing shareholders, this can be an opportunity to cycle funds elsewhere, as some holders might decide to take their gains and the stock can move back to equilibrium. The goal of investing is to sell high, and even when business is going great, experienced investors might decide to capitalize on their investments, instead of participating in riskier price movements.

If, however, the company finds new growth ventures and innovation, the price can be argued to be justified.

For people that are considering becoming shareholders, it will be good to take a deeper dive into the details, and look for places where the company might be able to unlock value over and above what is currently implied.

There is no question that AMD is a great and successful company, however when buying, we must also be mindful not to overpay for great things.

Next Steps:

For Advanced Micro Devices, we've put together three fundamental aspects you should further examine:

Risks: Every company has them, and we've spotted 1 warning sign for Advanced Micro Devices you should know about.

Future Earnings: How does AMD's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance