AdvanSix Inc. Q1 2024 Earnings: A Challenging Quarter Amid Operational Disruptions

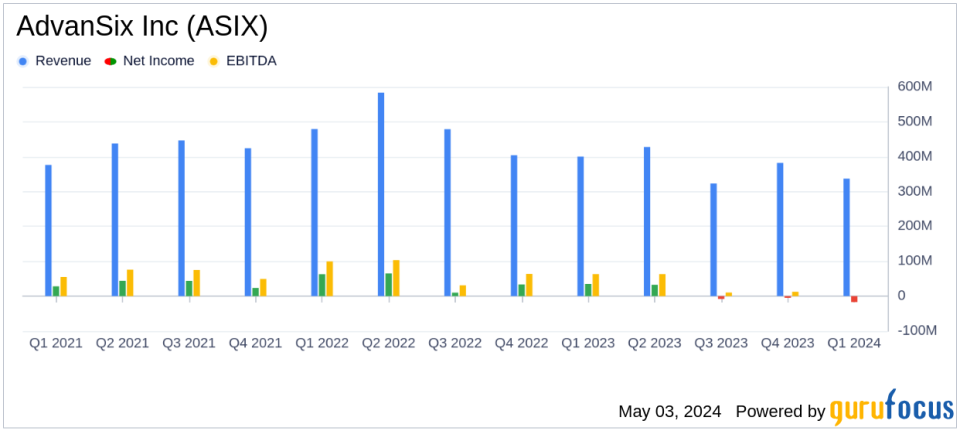

Revenue: Reported $337 million, a 16% decrease year-over-year, falling short of estimates of $344.63 million.

Net Loss: Recorded a net loss of $17.4 million, compared to a net income of $34.95 million in the previous year, slightly higher than the estimated net loss of $17.90 million.

Earnings Per Share (EPS): Reported EPS of -$0.65, below the estimated -$0.54.

Adjusted EBITDA: Plummeted to $0.6 million from $65.35 million a year earlier, indicating a significant operational impact.

Free Cash Flow: Deteriorated sharply to -$71.6 million from -$23.03 million in the prior year, reflecting increased capital expenditures and operational challenges.

Cash Flow from Operations: Declined to -$36.2 million from $1.58 million in the previous year, driven by lower net income and changes in working capital.

Capital Expenditures: Increased to $35.4 million, up $10.8 million from the previous year, focusing on enterprise programs and maintenance projects.

AdvanSix Inc (NYSE:ASIX) disclosed its first quarter financial results for 2024 on May 3, revealing a significant downturn influenced by operational challenges. The company reported a net loss of $17.4 million, a stark contrast to the net income of $34.95 million recorded in the same period last year. This performance fell short of analyst expectations, which had anticipated a slightly better scenario with an estimated net loss of $17.9 million. The earnings per share (EPS) stood at -$0.65, also missing the estimated EPS of -$0.54. The detailed financial outcomes are accessible through the company's recent 8-K filing.

About AdvanSix Inc.

AdvanSix Inc. is a diversified manufacturer pivotal in the chemistry sector, known for its production of Nylon 6, a polymer resin used across various industries including automotive, electronics, and packaging. The company also produces caprolactam, ammonium sulfate fertilizers, and other chemical intermediates, primarily serving the United States market while also expanding its international presence.

Operational Challenges and Market Conditions

The first quarter was particularly challenging for AdvanSix, marked by a $27 million unfavorable pre-tax income impact due to operational disruptions at its Frankford, PA manufacturing site. This disruption led to a 16% decline in sales, totaling $337 million compared to $400.54 million in the previous year. The decline was driven by a 9% drop in market-based pricing and a 7% decrease in volume. The company's adjusted EBITDA plummeted to $0.6 million from $65.35 million year-over-year, reflecting the severe impact of these operational challenges combined with unfavorable market conditions.

Financial Health and Investor Returns

Despite the operational setbacks, AdvanSix continued its commitment to returning value to shareholders. The company distributed $11 million through repurchases and dividends in the first quarter. However, the financial strain was evident in its free cash flow, which worsened to -$71.6 million from -$23.03 million in the prior year, and a significant decrease in cash flow from operations which turned negative at -$36.2 million.

Looking Ahead

Looking forward, CEO Erin Kane highlighted several positive outlooks for the second quarter of 2024, including expected improvements in ammonium sulfate pricing and nylon industry spreads, and a balanced to tight global acetone supply and demand environment. The company also anticipates capital expenditures between $140 million to $150 million for the year, focusing on critical enterprise risk mitigation and growth projects.

Conclusion

AdvanSix faces a challenging road ahead as it navigates through the repercussions of the Q1 disruptions and strives towards recovery. The company's ability to stabilize operations and capitalize on favorable market conditions in the coming quarters will be crucial for its financial recuperation and sustained growth.

Investors and stakeholders will likely keep a close watch on the company's strategic decisions and operational efficiency improvements in upcoming quarters to gauge the potential for a financial turnaround.

Explore the complete 8-K earnings release (here) from AdvanSix Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance