AECOM (ACM) JV Wins GCSMAC Contract From NAVFAC Pacific

AECOM ACM announced that its joint venture (JV) with Akima Support Operations received a contract from the Naval Facilities Engineering Systems Command (NAVFAC) Pacific.

Per this multiple-award, indefinite-delivery, indefinite-quantity (IDIQ) contract, the JV will provide facility support services under the Global Contingency Services Multiple Award Contract (GCSMAC). It will provide various services in response to natural disasters, humanitarian efforts, Navy operations and projects worldwide.

The scope of work also includes supporting the Navy’s facility maintenance and modernization operations, as well as providing incidental environmental and engineering services.

This IDIQ contract marks AECOM’s third consecutive GCSMAC award, spanning 13 years of engineering and operations support for NAVFAC facilities across the world.

Solid Backlog Growth Raises Hope for the Future

AECOM has been witnessing robust prospects in each of its segments. Currently, it has a good visibility of a strong backlog and pipelines for the upcoming quarters. Impressively, state and local budgets are robust and private sector clients are also investing to restore capacity and adapt to water and energy transition impacts. This apart, growth in the U.K. water market is poised to accelerate in the next five years due to the expected near doubling of AMP8 funding, where ACM has existing experience with nearly every large water utility involved.

Owing to the improving global scenario, which is fostering infrastructural demand around the globe, there has been an increase in demand for ACM’s services. This improving trend is reflected in the company’s backlog levels.

As of the fiscal second-quarter end, the total backlog was $23.74 billion compared with $22.98 billion reported in the prior-year period. The current backlog level includes 54.8% contracted backlog growth. The design business backlog grew 6.3% to $22.29 billion. The metric was driven by a near-record win rate and continued strong end-market trends.

The company’s net service revenues or NSR — defined as revenues excluding subcontractor and other direct costs — have been benefiting from strength across core transportation, water and environment markets. NSR for the fiscal second quarter rose 8% year over year, marking the 13th consecutive quarter of accelerating organic growth.

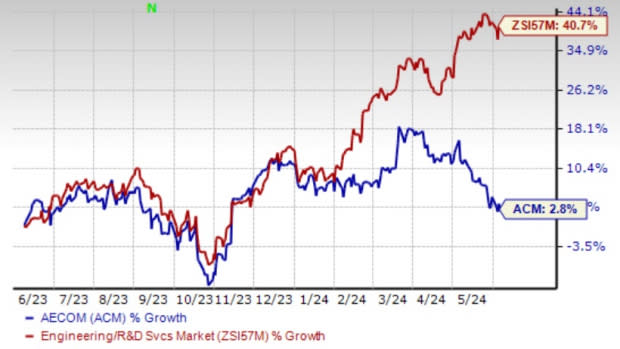

Image Source: Zacks Investment Research

Shares of AECOM have gained 2.8% in the past year compared with the Zacks Engineering - R and D Services industry’s growth of 40.7%. Although shares of the company have underperformed the industry in the past year, the ongoing contract wins are likely to boost its prospects in the forthcoming quarters. Also, increasing infrastructural spending trends across the world are encouraging for ACM.

Zacks Rank & Key Picks

ACM currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are:

Howmet Aerospace Inc. HWM presently carries a Zacks Rank #2 (Buy). HWM has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for HWM’s 2024 sales and earnings per share (EPS) indicates a rise of 10.6% and 29.9%, respectively, from the prior-year levels.

Sterling Infrastructure, Inc. STRL presently carries a Zacks Rank #2. Sterling Infrastructure has a trailing four-quarter earnings surprise of 22.3%, on average.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 11.7% and 14.8%, respectively, from the prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2. GTES has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance