Aerie (AERI) Q3 Earnings Miss, Rhopressa Gains Traction

Shares of Aerie Pharmaceuticals, Inc. AERI lost 6.4%, following the company’s third-quarter results.

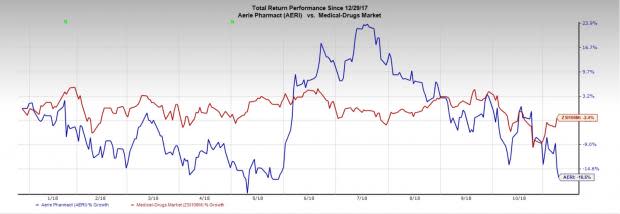

Aerie’s shares have lost 16.5% in the year so far compared with the industry’s ’s decline of 2.4%.

Aerie reported third-quarter 2018 loss of $1.73 per share, wider than both the Zacks Consensus Estimate of a loss of $1.33 and the year-ago loss of 71 cents. The wider-than-expected loss was on account of higher operating costs related to the launch of lead drug, Rhopressa.

Quarter in Detail

In December 2017, Rhopressa was approved by the FDA for the reduction of elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension. This approval came two months ahead of the scheduled Prescription Drug User Fee Act date of Feb 28, 2018. The drug was launched by the end of April.

Rhopressa’s revenues came in at $7.3 million, beating the Zacks Consensus Estimate by 29.8%.

In the reported quarter, research and development expenses more than doubled to $28.5 million. Selling, general and administrative expenses surged to $39.9 million from $19.8 million in the year-ago quarter.

Also, operating expenses were higher in the reported quarter, primarily due to increased activities associated with the expansion of the employee base to support growth of operations and activities associated with Rhopressa commercialization efforts.

Aerie is securing formulary contracts to enable commercial coverage in 2018 and Medicare Part D coverage in 2019. As of Oct 1, 2018, Rhopressa’s market access increased to approximately 85% (up from 80% as last reported) of commercial lives, including 45% in Tier 3 and 40% in preferred brand Tier 2. Medicare Part D coverage is now 40% in Tier 2.

Pipeline Updates

Aerie’s New Drug Application (NDA) for its second product candidate, Rocklatan (netarsudil/latanoprost ophthalmic solution) 0.02%/0.005%, which is a fixed-dose combination of Rhopressa and Pfizer’s (PFE) Xalatan, was submitted to the FDA in May 2018. The agency has completed its initial 60-day review of the NDA and determined that the application is sufficiently complete to permit a substantive review. The PDUFA (Prescription Drug User Fee Act) goal date for the completion of the FDA’s review of the Rocklatan NDA is set for Mar 14, 2019.

In early October 2018, the European Medicines Agency (EMA) accepted for review the Marketing Authorisation Application (MAA) for Rhokiinsa (marketed as Rhopressa in the United States). An opinion on approval is expected in the second half of 2019.

Earlier, the company initiated a phase III trial, Mercury 3, in the third quarter of 2017 to prepare for a regulatory submission in Europe. The trial is a non-inferiority trial comparing Roclatan with prescribed fixed-dose combination of Ganfort.

Pre-IND activities are well underway for further development of Aerie’s retina program candidates, including AR-13503 (Rho kinase and Protein kinase C inhibitor implant) and AR-1105 (dexamethasone steroid implant). Both are expected to enter clinic in 2019.

Outlook Reiterated

Aerie expects Rhopressa’s revenues to be $20-$30 million in 2018.

Our Take

The wider Q3 loss was primarily due to higher expenses as the company strives to commercialize Rhopressa. Nevertheless, Rhopressa sales comfortably beat estimates. The solid uptake in prescription volumes should propel sales further as glaucoma is one of the largest segments in the global ophthalmic market, even though competition is stiff from the likes of Bausch Health's (BHC) Vyzulta, among others.

Finally, a tentative approval of Rocklatan (early next year) will further boost prospects of the company.

Zacks Rank & Other Key Pick

Aerie carries a Zacks Rank #2 (Buy).

Another attractive stock in the healthcare sector is Gilead Sciences, Inc. GILD, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gilead’s earnings per share estimates increased from $6.10 to $6.57 for 2018 over the past 60 days. Estimates for 2019 are also up by 14 cents.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Aerie Pharmaceuticals, Inc. (AERI) : Free Stock Analysis Report

Bausch Health Cos Inc. (BHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance