Aerospace customers open door for Melrose takeover of GKN

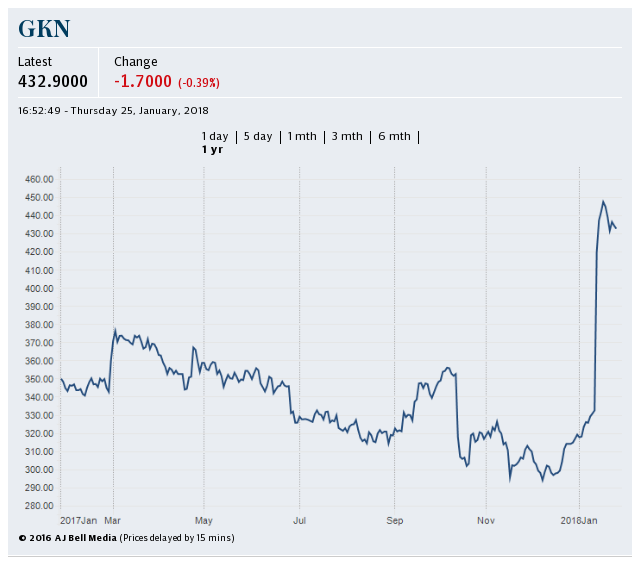

GKN’s chances of fending off a hostile takeover bid have been dealt a blow amid concern among major customers about the company’s track record of delivering on large contracts.

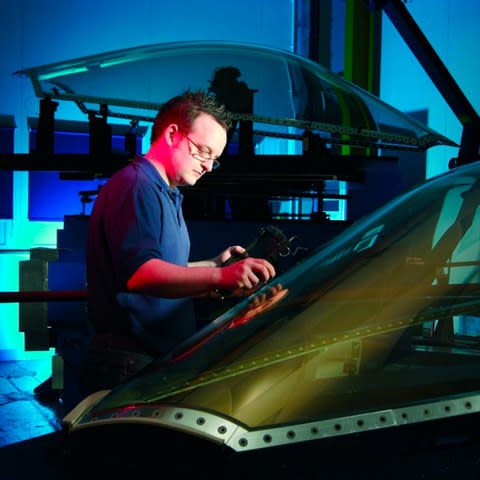

It is understood that the engineer has struggled to deliver promised improvements on contracts with some of its big aerospace clients.

“There’s a view that GKN’s management lack the strength to keep things on track,” said one UK aerospace insider. In a further setback, big clients have indicated support for Melrose, the turnaround firm that has launched a £7.4bn hostile offer for GKN.

“On the other side, Melrose have a bloody good track record for tight management,” the source said.

Melrose has pledged to “bring discipline” and better management to GKN, which has failed to hit profit targets.

Close to half of GKN’s £9bn annual sales are from its aerospace arm, supplying complex products for military customers as well as commercial groups including Airbus, Boeing and Rolls-Royce.

GKN insiders claim Melrose would be unable to manage these complicated customer relationships. This argument is expected to form a key part of its attempts to fight the bid.

However, Melrose may still have to raise its bid to emerge victorious after one major shareholder said the current offer was too low.

“Melrose’s current offer does not recognise the full value of GKN’s assets and Melrose has room to increase their bid. If they do not, we feel confident in Anne Stevens and her team’s ability to execute,” a top five investor told The Sunday Telegraph.

Unions are leading calls for Greg Clark, the Business Secretary, to launch an investigation under the Enterprise Act, citing concerns about national security and the potential impact on the Government’s Industrial Strategy.

Steve Turner, Unite assistant general secretary, said: “Melrose aims to sell in five years – that is not the long-term support needed for the industrial strategy.”

Yahoo Finance

Yahoo Finance