AES Corp (AES) Beats on Q1 Earnings, Cost of Sales Up Y/Y

The AES Corporation’s AES first-quarter 2018 adjusted earnings per share of28 cents surpassed the Zacks Consensus Estimate of 25 cents by 12%. Moreover, the bottom line improved 64.7% from the year-ago period’s figure of 17 cents.

Barring one-time adjustments, the company reported earnings of $1.03 in the first quarter as against the year-ago period’s loss of 4 cents.

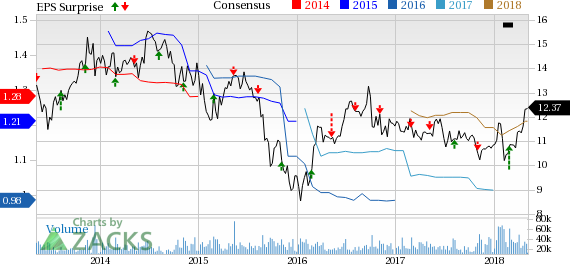

The AES Corporation Price, Consensus and EPS Surprise

The AES Corporation Price, Consensus and EPS Surprise | The AES Corporation Quote

Highlights of the Release

AES Corp generated total revenues of $2,740 million in the first quarter, up 6.2% year over year. The top line however missed the Zacks Consensus Estimate of $3,446 million by 0.5%.

Total cost of sales was $2,084 million in the first quarter, up 3% year over year. General and administrative expenses were $56 million, 3.7% higher than the year-ago quarter’s level of $54 million.

Operating income was up 17.8% year-over-year to $656 million.

Interest expenses in the quarter were $281 million, down from $287 million in the year-ago quarter.

Financial Condition

AES Corp reported cash and cash equivalents of $1,212 million as of Mar 31, 2018 compared with $949 million as of Dec 31, 2017. Non-recourse debt totaled $13,601 million as of Mar 31, 2018,up from $13,176 million as of Dec 31, 2017.

In the first quarter, cash from operating activities was $515 million compared with the year-ago quarter’s figure of $708 million.

Total capital expenditure in first quarter was $495 million, higher than $474 million a year ago.

Guidance

For 2018, AES Corp reaffirmed its adjusted earnings per share guidance in the range of $1.15-$1.25.

Zacks Rank

AES Corp has a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

CenterPoint Energy, Inc. CNP reported first-quarter 2018 adjusted earnings of 55 cents per share, which beat the Zacks Consensus Estimate of 44 cents by 25%.

Consolidated Edison Inc. ED reported first-quarter 2018 earnings of $1.37 per share, which surpassed the Zacks Consensus Estimate of $1.33 by 3%.

PG&E Corporation PCG reported adjusted operating earnings per share of 91 cents in first-quarter 2018, which missed the Zacks Consensus Estimate of $1.03 by 11.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

The AES Corporation (AES) : Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance