AES Wins Regulatory Nod to Buy 195MW Solar Plant in Indiana

AES Corp. AES recently announced that its subsidiary, AES Indiana, has won the regulatory nod from the Indiana Utility Regulatory Commission (IURC), for purchasing Clinton County’s Hardy Hills solar project. The project, with an estimated capacity of 195 megawatt (MW), is expected to start its commercial operation in 2023.

Benefits of the Deal

The latest transaction is in line with AES Indiana's strategy to deliver greener, smarter energy solutions to its customers, thereby offering them long-term savings through lower fuel and maintenance cost. Moreover, courtesy of the Hardy Hills project, its customers will experience benefits like risk reduction from the diversification of energy sources, along with improved environmental and sustainability performance.

Solar Prospects in Indiana

As of June 2020, Indiana remained among the top one-fourth of the U.S. states in terms of total electricity consumption, as stated by the U.S. Energy Information Administration (EIA). So, no doubt, electricity demand in this state is strong enough to attract utility providers like AES Corp. .

Interestingly, nearly three-fourths of the electricity generation from solar resources in Indiana is provided by utility-scale facilities. As of first-quarter 2021, 939.1 MW of solar was installed in this state, with the solar industry investing almost $1.2 billion (as per Solar Energy Industries Association). Over the next five years, 4,548.7 MW of solar are projected to get installed in this state, indicating huge growth from the current levels.

With renewables being the future and considering the aforementioned solar growth prospects in Indiana, the Hardy Hills project’s acquisition seems to be a profitable transaction made by AES Corp.

Utilities’ Take on Renewables

Utilities like AES Corp. are rapidly expanding their renewable generation portfolio, to reap the benefits of the growing clean energy market.

Notably, AES Corp.’s backlog of 6,926 MW of renewables now includes 2,570 MW under construction, which is expected to come online through 2024. It also has 4,356 MW signed under long-term PPAs, including a 10-year agreement to supply Google's data centers in Virginia with 500 MW of 24/7 carbon-free energy.

Another utility, CMS Energy CMS aims to spend $2.4 billion in renewables, which includes investments in wind, solar, and hydroelectric generation resources during the 2021-2025 period. Similarly, DTE Energy DTE expects its wind and solar energy portfolio to generate enough clean energy to power 900,000 homes by 2022. Likewise, Duke Energy DUK is investing nearly $1 billion in solar projects in Florida, aimed at bringing 700 MW of solar online through 2022.

Price Performance & Zacks Rank

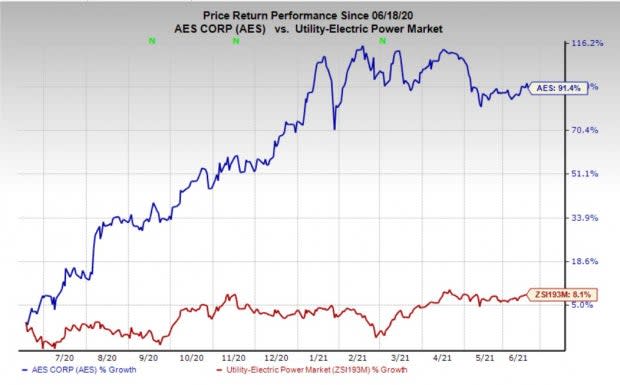

AES Corp has gained 91.4% in the past year compared with the industry’s 8.1% growth.

Image Source: Zacks Investment Research

The company currently holds a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

The AES Corporation (AES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance