Affirm (AFRM) Rises 4.1% Despite Q1 Earnings Miss on High Costs

Affirm Holdings, Inc.’s AFRM shares rose 4.1% since it reported first-quarter fiscal 2023 results on Nov 8, 2022. Increased operating costs affected the company’s bottom line in the quarter, partially offset by higher transactions, servicing income and merchant growth. Investors might have been impressed by its strong guidance.

Affirm reported a first-quarter fiscal 2023 adjusted loss of 86 cents per share, which missed the Zacks Consensus Estimate by 4.9%. The bottom line also deteriorated from a loss of 40 cents per share a year ago.

Net revenues improved 34% year over year to $361.6 million. The top line beat the consensus mark by 0.3%.

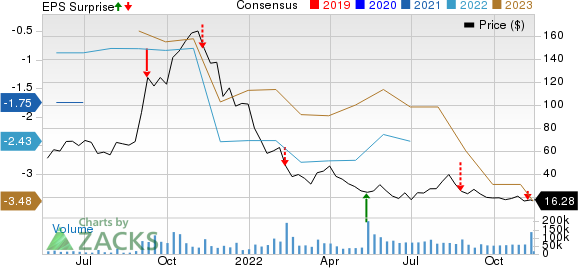

Affirm Holdings, Inc. Price, Consensus and EPS Surprise

Affirm Holdings, Inc. price-consensus-eps-surprise-chart | Affirm Holdings, Inc. Quote

Q1 Performance

Active merchants increased to 244,900 from 102,200 while GMV increased 62% to $4.4 billion. Total transactions were recorded at 13.3 million, up 97% from the year-ago quarter.

Servicing income of $21.4 million was up from $9.5 million a year ago but missed the Zacks Consensus Estimate of $23.7 million. Interest income of $136.8 million was up from $117.3 million but missed the Zacks Consensus Estimate of $151.4 million.

Merchant network revenues of $113.1 million were higher than $92.2 million in the prior-year quarter but missed the Zacks Consensus Estimate of $150 million. Virtual card network revenues of $26.7 million were up from $19.4 million but missed the consensus mark of $38.2 million.

Total operating expenses of $649.1 million escalated from $435.5 million a year ago, primarily due to higher technology and data analytics, sales and marketing, and processing and servicing costs. Meanwhile, loss on loan purchase commitment declined to $35.6 million in the quarter under review from $51.7 million a year ago.

Net loss of $251.3 million narrowed from $306.6 million in the year-ago quarter.

The adjusted operating margin was at negative 5.1%. In the prior-year period, the adjusted operating margin was at negative 16.7%.

Financial Position (as of Sep 30, 2022)

AFRM exited first-quarter fiscal 2023 with cash and cash equivalents of $1,530.1 million, which increased from $1,255.5 million at fiscal 2022-end. Total assets of $7,165.1 million rose from $6,973.8 million at fiscal 2022-end.

At the fiscal first-quarter end, the company had $4,312 million in long-term debt, up from $4,078.2 million at fiscal 2022-end. Total stockholders’ equity was at $2,563.4 million at the September-quarter end.

Net cash from operating activities was $51.2 million, down from $365.2 million a year ago.

FY Q2 2023 Guidance

Affirm estimates second-quarter fiscal 2023 GMV to be within $5.73-$5.83 billion. Transaction costs will likely be in the range of $244-$254 million. Revenues are expected to be in the range of $400-$420 million. Further, the weighted average shares outstanding are expected to be 294 million.

FY 2023 Guidance

Affirm expects fiscal 2023 GMV in the range of $20.5-$21.5 billion. Revenues are expected within the range of $1,600-$1,675 million. Transaction costs are likely to be in the range of $885-$910 million. The adjusted operating margin is likely to be within negative 7-5.5%. AFRM, which currently has a Zacks Rank #3 (Hold), expects weighted average shares outstanding to be at 298 million.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

How Other Stocks Performed

Here are some companies from the Business Services space that have reported earnings for the September quarter: Mastercard Incorporated MA, Visa Inc. V and The Western Union Company WU.

Mastercard reported third-quarter 2022 adjusted earnings of $2.68 per share, which beat the Zacks Consensus Estimate by 4.3%. The quarterly results were driven by improved consumer spending, recovery in cross-border travel, robust cross-border volume growth, higher GDV and increased switched transactions.

Visa reported fourth-quarter fiscal 2022 earnings of $1.93 per share, which outpaced the Zacks Consensus Estimate of $1.86. The quarterly results were aided by continued growth in payments volume, cross-border volume and processed transactions.

Western Union reported third-quarter 2022 earnings per share of 42 cents, which met the Zacks Consensus Estimate. WU’s quarterly results were hurt by lower revenues and transactions in the Consumer-to-Consumer segment, which usually contributes a massive chunk to WU’s overall revenues. Nevertheless, the downside was partly offset by a lower expense level and double-digit growth in U.S. outbound new digital customer acquisition.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

The Western Union Company (WU) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance