AfriTin Mining's (LON:ATM) investors will be pleased with their strong 136% return over the last year

While AfriTin Mining Limited (LON:ATM) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. But that doesn't change the fact that the returns over the last year have been very strong. During that period, the share price soared a full 136%. So it is important to view the recent reduction in price through that lense. More important, going forward, is how the business itself is going.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Check out our latest analysis for AfriTin Mining

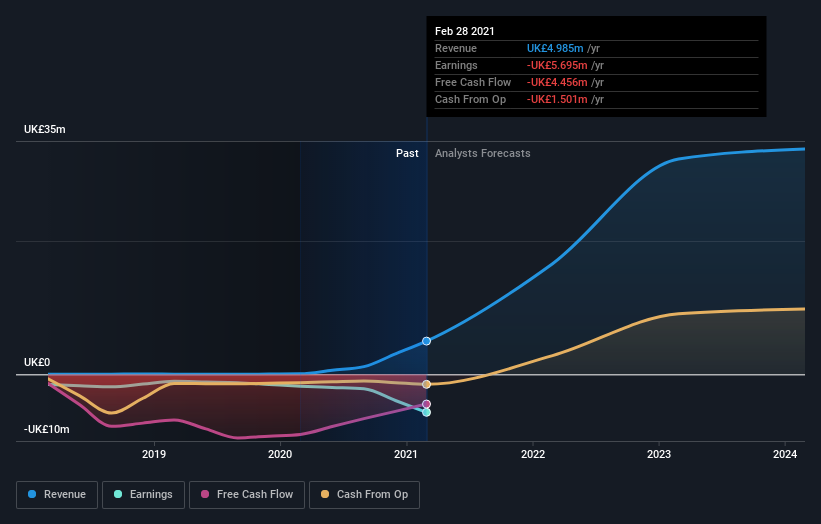

AfriTin Mining isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, AfriTin Mining's revenue grew by 7,121%. That's well above most other pre-profit companies. And the share price has responded, gaining 136% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at AfriTin Mining's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that AfriTin Mining rewarded shareholders with a total shareholder return of 136% over the last year. That gain actually surpasses the 15% TSR it generated (per year) over three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand AfriTin Mining better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for AfriTin Mining you should be aware of, and 2 of them shouldn't be ignored.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance