AGCO Corp (AGCO) Gains on Farm Equipment Demand & Investment

AGCO Corporation AGCO is gaining from higher agricultural commodity prices, which is encouraging farmers to invest in farm equipment. Improved industry demand for farm equipment and investment in technology-focused agricultural products will continue to drive growth. However, inflated costs might dent the company’s margin.

Higher Prices to Fuel Farm Equipment Demand

According to the USDA’s (U.S Department of Agriculture) farm income forecast, net farm income is anticipated to increase 19.5% from 2020 to $113 billion in the current year — the highest level since 2013. Increased agriculture commodity prices will continue to drive farm income, encouraging farmers to upgrade and replace their aging fleets. This, in turn, will drive AGCO’s top line. These factors are anticipated to drive industry growth across all the major markets in the current year.

The company anticipates the North American industry sales to trend higher this year on escalating commodity prices and improved farmer sentiment. Higher milk prices and improved scenario for dairy producers are likely to support European Union (EU) farm economics. Healthy income levels for arable farmers as well as higher dairy and livestock prices are supporting increased equipment demand in Western Europe in the current year. Elevated commodity prices and favorable exchange rates fuel South America’s growth during 2021 as farmers continue to replace aged equipment.

Upbeat View on Improved Farm Fundamentals

AGCO expects 2021 sales and earnings to grow on robust end-market demand and strong farm prospects. Net sales for the ongoing year are projected at $10.9-$11.1 billion. In 2020, the company reported net sales of $9.15 billion. The upbeat guidance suggests improved sales volumes, positive pricing and favorable impacts of foreign-currency translation. Higher sales and production volumes and pricing benefits are expected to mitigate material cost inflation, driving AGCO’s gross and operating margins in the current year. Considering these factors, AGCO expects adjusted earnings per share (EPS) for the current year in the band of $8.75-$9.00. The company reported an adjusted EPS of $5.61 in 2020.

Focus on Investments to Drive Growth

Apart from favorable market demand, positive market response to the company’s technology-focused products is fueling sales growth and margin expansion across all regions. AGCO continues to invest in products, premium technology and smart farming solutions to improve distribution and enhance digital capabilities to drive margins and strengthen product offerings. These improvements will support the company’s investments in precision agriculture and digital initiatives. It also continues to make investments to upgrade system capabilities, expand product lines and improve factory productivity.

However, some factors might impede the company’s growth.

AGCO is encountering significant supply-chain challenges and escalating costs for steel, logistics, transportation and labor. Engineering expenses might shoot up by $50-$60 million in 2021 compared with 2020, as the company is investing in smart farming and precision farming products.

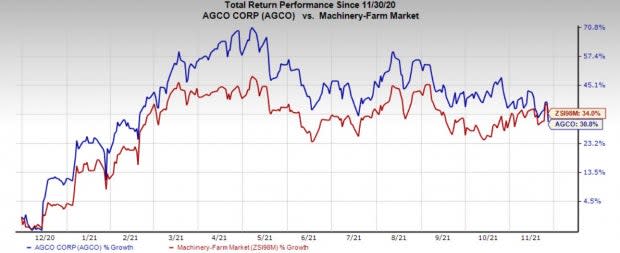

Price Performance

AGCO’s shares have gained 30.8% in the past year compared with the industry’s growth of 34%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

AGCO currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Encore Wire Corporation WIRE, SPX FLOW, Inc. FLOW and Casella Waste Systems, Inc. CWST. All these stocks flaunt a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Encore Wire has an expected earnings growth rate of around 491% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 37% upward in the past 60 days.

Encore Wire’s shares have surged 171% in the past year. The company has a trailing four-quarters earnings surprise of 271%, on average.

SPX FLOW has a projected earnings growth rate of around 101.3% for 2021. The Zacks Consensus Estimate for current-year earnings has been revised upward by 5.3% in the past 60 days.

The company’s shares have appreciated 56.9% in a year. SPX FLOW has a trailing four-quarter earnings surprise of 40.4%, on average. FLOW has a long-term earnings growth of 35.2%.

Casella Waste has an estimated earnings growth rate of around 6% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 11.4%.

The company’s shares have increased 44% in the past year. Casella Waste has a trailing four-quarter earnings surprise of 42.1%, on average. CWST has a long-term earnings growth of 14.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST) : Free Stock Analysis Report

SPX FLOW, Inc. (FLOW) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance