AGR or CNP: Which is a Better Electric Power Utility Stock?

Electricity sales to customers in the U.S. commercial and industrial sectors are growing faster than sales to the residential sector. With increased medical knowledge and usage of vaccines, the impact of COVID-19 has reduced substantially, resulting in the reopening of economic activities across the United States. As a consequence, the U.S. Energy Information Administration (EIA) predicts U.S. sales of electricity to customers to rise 2.6% year over year in 2022.

The EIA also forecasts that the U.S. residential price of electricity will average 14.8 cents per kilowatt-hour in 2022, up 7.5% from 2021. Higher retail electricity prices largely reflect an increase in wholesale power prices, driven by rising natural gas prices.

Both the abovementioned factors are positives for utility operators in the United States amid the negative impact of rising interest expenses. No doubt, the ongoing increase in interest expenses will increase the projected infrastructure upgrade and expansion costs of capital-intensive utilities, which require loans from the market to fund the long-term projects.

A clear transition is evident in the U.S. utility space, with operators in the electric power sector gradually moving toward cleaner sources of energy to produce electricity. Per EIA, the annual share of U.S. electricity generation from renewable energy sources will rise from 20% in 2021 to 22% in 2022 and 24% in 2023 as a result of the continued addition of solar and wind-generating capacity.

Amid this backdrop, we ran a comparative analysis on two utilities belonging to the Zacks Utility Electric Power industry — AVANGRID Inc. AGR and CenterPoint Energy Inc. CNP — to ascertain which one is a better investment option right now. The market capitalization of AVANGRID is $16.88 billion and the same for CenterPoint Energy is around $18.81 billion.

Both the stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates Movement

In the past 60 days, the Zacks Consensus Estimate for AVANGRID ’s 2022 earnings has been upwardly revised by 0.4% to $2.27 per share.

The Zacks Consensus Estimate for CenterPoint Energy’s 2022 earnings has moved up by 0.7% over the past 60 days to $1.39 per share.

Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE for CenterPoint Energy and AVANGRID is 10.92% and 4.65%, respectively, compared with the industry average of 10.38%.

Debt-to-Capital

The debt-to-capital ratio is a good indicator of the financial position of a company and shows how much debt is utilized to conduct the business. AVANGRID has a debt-to-capital of 27.9% compared with CenterPoint Energy’s 56.9%. AVANGRID’s debt-to-capital ratio is lower than the industry’s 54.06%.

Earnings Surprise & Long-term Earnings Growth

AVANGRID delivered an average earnings surprise of 17.58% in the last four reported quarters.

CenterPoint Energy delivered an average earnings surprise of 9.64% in the last four reported quarters.

The long-term (three to five year) earnings growth rate of AVANGRID and CenterPoint Energy is currently pegged at 5.9% and 3.9%, respectively.

Dividend Yield

Currently, the dividend yield of AVANGRID is pegged at 3.97% compared with CenterPoint Energy’s 2.36%. The industry’s dividend yield is 3.27%.

Price Movement

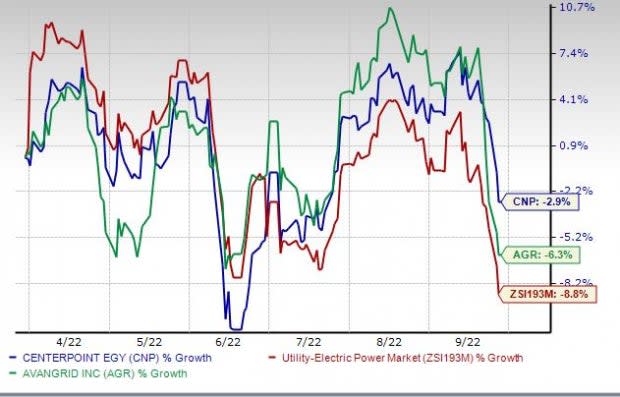

Shares of CenterPoint Energy and AVANGRID have lost 2.9% and 6.3%, respectively, in the past six months, compared with the industry’s decline of 8.8% in the same time frame.

Six-Months Price Performance

Image Source: Zacks Investment Research

Our Verdict

Both electric utilities will continue to serve the needs of their customers and have the potential to improve further from their current positions. Both utilities have some metrics going in their favor, but given the low debt to capital and strong long-term earnings growth prediction of AVANGRID, it is better placed compared with CenterPoint Energy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Avangrid, Inc. (AGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance