Is Go-ahead a worthy addition to your portfolio?

Screening for companies with strong balance sheets and solid dividend yields can be a quick and simple way of identifying potentially high-quality investments that might be attractively priced. One way of doing might be to include stocks that have a Piotroski F-Score of 8 or 9 and a dividend yield of at least, say, 3%.

Take Go-ahead (LON:GOG), for example, which is a mid cap adventurous super stock company in the Industrials sector. Go-ahead pays out a rolling 5.08% of its share price in dividend payments.

GET MORE DATA-DRIVEN INSIGHTS INTO LON:GOG »

Does Go-ahead pass our F-Score test?

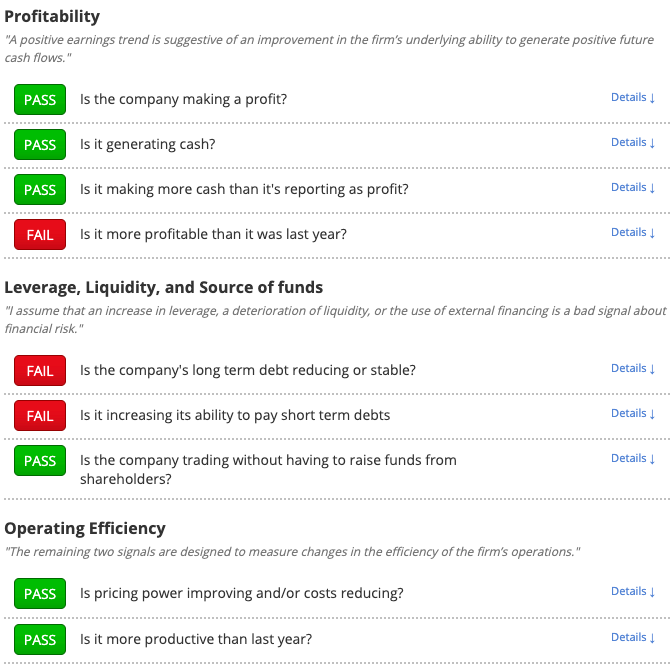

Stockopedia applies algorithms to its stream of financial data to automatically calculate the Piotroski F-Score for every stock on the market. It shows that Go-ahead scores 8 out of a possible 9.

By investing in companies scoring 8 or 9 by these measures, Piotroski showed that, over a 20-year test period through to 1996, the return earned by a value-focused investor could be increased by an astounding 7.5% each year. Even better, it suggests that the company is well-placed to continue to pay out attractive dividends.

Find more high-quality stocks

This F-Score suggests Go-ahead is a promising investment candidate and is worthy of further research - but it is only a first step. Higher F-Score stocks often trade at a premium compared to other stocks. Investors like to pay up for quality but it's important not to pay too much. We suggest checking the various value factor measures for Go-ahead on the group's StockReport.

For years, the Stockopedia team have been poring over studies to see what works in investing. That's how we found the F-Score, but that's not all we've found... So take a two-week free trial today to see how Stockopedia can help you to build a better portfolio.

Yahoo Finance

Yahoo Finance