Airline Stock Roundup: AAL, LUV, JBLU & HA Report Q3 Loss

In the past week, American Airlines AAL, Southwest Airlines LUV, Hawaiian Holdings HA and JetBlue Airways JBLU reported losses for third-quarter 2021. The same, however, narrowed year over year as the September-quarter results were better than the same reported for third-quarter 2020, which was severely hit by the COVID crisis. With COVID-19 cases declining in the United States as the Delta variant-induced threat recedes, passenger revenues increased significantly on a year-over-year basis in third-quarter 2021.

Alaska Air Group’s ALK third-quarter 2021 brought further joy as this Seattle, WA-based carrier reported earnings unlike the above-mentioned airlines. We remind investors that Delta Air Lines DAL too posted earnings report for the September quarter, which was included in the previous week’s write up.

Recap of the Latest Top Stories

1. Alaska Air’s third-quarter 2021 earnings (excluding 6 cents from non-recurring items) of $1.47 per share surpassed the Zacks Consensus Estimate of $1.29. In the year-ago period, the company incurred a loss of $3.23. Operating revenues of $1,953 million outperformed the Zacks Consensus Estimate of $1,932 million. The top line surged more than 100% year over year with passenger revenues, accounting for 90.8% of the top line, soaring above 200%, courtesy of improvement in air-travel demand from the pandemic-led lows. For the fourth quarter, Alaska Air expects capacity to decline approximately 13-16% from the comparable period’s level in 2019. The company estimates economic fuel cost per gallon in the band of $2.20-$2.30.

Alaska Air currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2. Southwest Airlines incurred a loss (excluding 96 cents from non-recurring items) of 23 cents per share in the third quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of 27 cents. This marks the company’s seventh consecutive quarterly loss. Operating revenues of $4,679 million outperformed the Zacks Consensus Estimate of $4,581.5 million and also jumped more than 100% year over year. Passenger revenues, which accounted for 90.3% of the top line, totaled $4,227 million, reflecting an improvement of more than 100% year over year. Management estimates lingering effects from the deceleration in bookings witnessed in the third quarter to impact the fourth-quarter operating revenues by approximately $100 million.

3. American Airlines’ third-quarter 2021 loss (excluding $1.24 from non-recurring items) of 99 cents per share compared favorably with the Zacks Consensus Estimate of a loss of $1.04. Quarterly loss per share was also narrower than the year-ago loss of $5.54. Operating revenues of $8,969 million skyrocketed 182.67% year over year and also surpassed the Zacks Consensus Estimate of $8,926.6 million. This massive year-over-year jump reflects improving air-travel demand. Revenues increased 20%, sequentially. American Airlines expects system capacity for the December quarter to decline in the 11-13% range from the figure reported in fourth-quarter 2019. Total revenues in the fourth quarter of 2021 are anticipated to decline 20% from the level recorded in fourth-quarter 2019. Fuel cost per gallon in fourth-quarter 2021 is expected in the $2.43-$2.48 band.

4. JetBlue Airways incurred a third-quarter 2021 loss (excluding 52 cents from non-recurring items) of 12 cents per share, comparing favorably with the Zacks Consensus Estimate of a loss of 19 cents. This was the seventh successive quarterly loss posted by the low-cost carrier. Quarterly loss per share was also narrower than the year-ago loss of $1.75. Revenues for the fourth quarter of 2021 are expected to decline in the 8-13% range from the fourth-quarter 2019 actuals. Capacity is anticipated to decline in the 4-7% range for the December quarter from the figure reported in the fourth quarter of 2019. Average fuel cost per gallon in the December quarter is estimated to be $2.49.

5. Hawaiian Holdings’ third-quarter 2021 loss (excluding $1.23 from non-recurring items) of 95 cents per share was narrower than the Zacks Consensus Estimate of a loss of $1.29 and the year-ago loss of $3.76. Quarterly revenues of $508.8 million skyrocketed 569.7% year over year and beat the Zacks Consensus Estimate of $490.6 million.

Passenger revenues (contributing 89.2% to the top line) surged to $454 million from $39.8 million a year ago as more people took to the skies following the ramp-up in vaccination. Airline traffic, measured in revenue passenger miles, surged in excess of 1625% year over year in the quarter under review. Capacity (measured in available seat miles) expanded 488.7% as the airline increases the same to meet the uptick in demand. Load factor (percentage of seats filled by passengers) expanded 50.3 percentage points to 75.9% for scheduled operations. Passenger revenue per ASM (PRASM) ascended 93.9% to 10.84 cents. Average fuel cost per gallon (economic) rose to $2.07 from $1.24 a year ago. Unit cost (excluding fuel and non-recurring items) declined 74.9% to 10.28 cents in the September quarter.

For the December quarter, capacity is anticipated to drop 18-21% from the fourth-quarter 2019 reading. Total revenues are anticipated to plunge 32-37% from the fourth-quarter 2019 actuals. Operating expenses (excluding non-recurring items) are expected to decline 7-11% from the levels recorded in fourth-quarter 2019. Adjusted EBITDA is expected between -$50 and -$110 million in the fourth quarter of 2021. Effective tax rate and fuel cost per gallon are anticipated to be 21% and $2.41, respectively, in the fourth quarter. Jet fuel consumption (in gallons) is expected to decline in the 21.5-24.5% band in fourth-quarter 2021 from the fourth-quarter 2019 actuals.

Performance

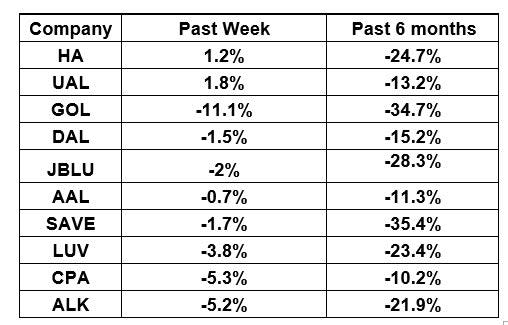

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks have traded in the red over the past week, causing the NYSE ARCA Airline Index to decline 2.4% to $87.86. Over the course of the past six months, the NYSE ARCA Airline Index has depreciated 17%.

What’s Next in the Airline Space?

Investors will await the third-quarter 2021 earnings report of SkyWest SKYW, scheduled to be released on Oct 28.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance