Airline Stock Roundup: CPA Q1 Earnings & Revenues Beat, GOL, UAL & RYAAY in Focus

In the past week, Copa Holdings CPA reported better-than-expected earnings per share and revenues for first-quarter 2023, driven by the upbeat air-travel demand scenario. First-quarter earnings-related updates were discussed in the previous write-up as well.

Driven by the buoyant passenger-volume scenario, another Latin American carrier Gol Linhas GOL reported rosy traffic numbers for the month of February. European carrier, Ryanair Holdings’ RYAAY April traffic report was impressive as well. An update on fleet modernization was also available from Ryanair. Meanwhile, United Airlines UAL expanded its code-sharing agreement with Azul AZUL in a customer-friendly move.

Recap of the Latest Top Stories

1 Copa Holdings’ first-quarter 2023 earnings (excluding 92 cents from non-recurring items) of $3.99 per share surpassed the Zacks Consensus Estimate of $3.34 and rose more than 100% year over year. Revenues of $867.3 million beat the Zacks Consensus Estimate of $839.1 million and improved 51.7% year over year on the back of passenger revenues.

Passenger revenues (contributed 96.2% to the top line) increased 28.5% from first-quarter 2019 levels, owing to higher yields (up 20%). Cargo and mail revenues jumped 51.8% from first-quarter 2019 actuals to $23.25 million, owing to higher cargo volumes and yields. Other operating revenues improved 24% to $10 million, owing to revenues from non-air ConnectMiles partners.

For 2023, CPA, currently sporting a Zacks Rank #1 (Strong Buy), expects consolidated capacity to grow in the 12-13% band from 2022 actuals. CPA expects the current-year operating margin to be between 22% and 24%. Load factor (% of seats filled by passengers) is expected to be approximately 85%. Fuel price per gallon of $2.85 is expected for the current year.

You can see the complete list of today’s Zacks #1 Rank stocks here

2. United Airlines widened the scope of its code-sharing partnership with Azul. Under the expanded deal, passengers can fly to six new destinations after connecting from the designated Brazilian airports to Orlando or Fort Lauderdale on UAL flights. The six new destinations are Chicago, Cleveland, Denver, San Francisco, Washington DC, and Los Angeles. The customer-friendly move will allow them to travel using a single ticket for both UAL and Azul-operated flights. From May 10, passengers will be able to make easy one-stop connections to the above destinations with a single ticket. The expanded partnership between the two airline companies was built on their existing codeshare routes from Houston and Newark.

3. Ryanair placed a huge order for 150 new 737 MAX-10 planes from Boeing. These planes, expected to be delivered between 2027 and 2033, will reportedly replace the aging 737 jets in the airline’s fleet.

On a separate note, 16 million passengers were ferried on RYAAY flights in April. This compared favorably with the March figure of 12.6 million and the year-ago number of 14.2 million. Owing to the upbeat traffic, load factor was as high as 94% in April compared with 91% a year ago.

4. For April, consolidated traffic (measured in revenue passenger kilometers) at Gol Linhas increased 13.6% year over year. To match the upbeat demand situation, the company is simultaneously expanding its capacity (measured in available seat kilometers). During the same month, capacity grew 12.5% year over year. GOL carried 19% more passengers in April compared with the year-ago figure. Consolidated load factor improved to 78.9% in April from 78.2% a year ago.

Domestic departures, which accounted for more than 95% of total departures during the month, grew 17.8% on a year-over-year basis. On the domestic front, the number of seats increased 15.8%.

Performance

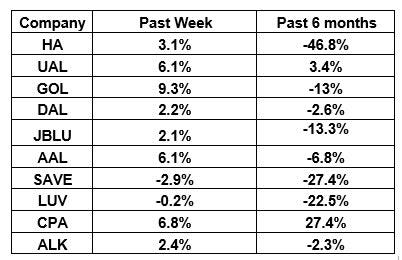

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks traded in the green over the last five trading days. The NYSE ARCA Airline Index increased 3.9% to $59.14. Over the course of the past six months, the NYSE ARCA Airline Index has declined 3%.

What's Next in the Airline Space?

Stay tuned for first-quarter 2023 earnings report of Azul on May 15.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

AZUL (AZUL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance