Airline Stock Roundup: LUV Reinstates Dividend, GOL Reports Rosy November Traffic

In the past week, Southwest Airlines’ LUV management decided to start paying quarterly dividends after a pandemic-induced hiatus of more than two years. With air-travel demand buoyant in Brazil, Gol Linhas GOL reported a 28.5% year-over-year increase in November traffic. European carrier Ryanair Holdings RYAAY reported a 9.8% year-over-year increase in passenger volume for the month of November. JetBlue Airways JBLU was also in the news owing to its environmentally-friendly attitude.

Read the last Airline Roundup here.

Recap of the Latest Top Stories

1. In November, RYAAY flew 11.2 million passengers, higher than 10.2 million flown a year-ago. Load factor (% of seats filled by passengers) in November 2022 was 92%, compared with 87% a year-ago. Ryanair currently carries a Zacks Rank #3 (Hold).

Ryanair was also in the news when it inked an environmentally-friendly deal with oil company Shell SHEL for sustainable aviation fuel (SAF). The MoU will see Shell supply SAF to more than 200 Ryanair airports across Europe, with the primary focus on the airline’s major hubs in Dublin and London Stansted. Per the agreement, Ryanair will be able to access 360,000 tons (120 million gallons) of Shell’s SAF between 2025 and 2030. This will help the airline cut its carbon emissions by about 900,000 tons.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

2. At Gol Linhas, consolidated traffic for November increased 28.5% year over year. To match the increased demand situation, the company is expanding its capacity. During the same month, capacity grew 29.7% year over year. GOL carried 26% more passengers in November from the year-ago levels. Upbeat traffic in its domestic markets is leading to a rosy scenario on a consolidated basis. In November, domestic traffic and capacity improved 18.7% and 19.6%, respectively. On the domestic front, 21.7% more passengers boarded GOL’s flights in November 2022.

3. Following the lifting of restrictions under the CARES Act, which prohibited airlines from paying dividends till Sep 30, 2022, Southwest Airlines’ management reinstated its quarterly dividend of 18 cents per share. With the carrier returning to profitability in March 2022 and expecting to be profitable for full-year 2022 as well, the decision was hugely-expected. The dividend will be paid on Jan 31, 2023 to its shareholders of record at the close of business on Jan 10.

On its investor day, LUV also gave projections for some items for first-quarter and full-year 2023. Capacity (measured in available seat miles) is expected to increase 10% and 15% year over year, in first-quarter and full-year 2023, respectively. Fuel cost per gallon is expected in the $3-$3.10 range in the March quarter. The same is expected in the $2.85-$2.95 range for full-year 2023. Non-fuel unit costs are expected to be either flat or increase up to 2% year over year in first-quarter 2023. The metric is expected to be down in the 1-3% range for the full year. Interest expense is expected to be roughly $65 million and $250 million in first-quarter and full-year 2023, respectively. Capital spending for full-year 2023 is anticipated in the $4- $4.5 billion range. LUV expects to end the next year with 841 planes in its fleet.

4. JetBlue’s management stated that it aims to reduce emissions pertaining to jet fuel by 50% per revenue tonne kilometer by 2035 from 2019 levels. In accordance with the goals of the Paris climate agreement, JBLU aims to boost investments in lower-carbon solutions within its operation and evaluate future sustainability investments. JBLU aims to reach net zero carbon emissions by 2040,10 years ahead of broader airline industry targets.

Performance

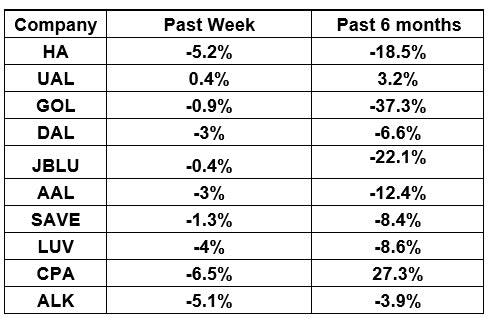

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks traded in the red over the past week. The NYSE ARCA Airline Index has decreased 4.4% to $58.18 over the past week. Over the past six months, the NYSE ARCA Airline Index has declined 17.8%.

What's Next in the Airline Space?

Delta Air Lines’ DAL management is scheduled to provide a financial outlook and provide a strategic update at an event in New York on Dec 14. With air-travel demand soaring, we believe that this Atlanta-based carrier’s management will present a rosy picture with respect to the top line.

With oil price still high the bottom-line growth is being restricted. As a result, market watchers will keenly await the steps outlined to reduce costs and dive growth. Stay tuned for other usual updates in the space.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance