Akamai (AKAM) to Report Q3 Earnings: What's in the Offing?

Akamai Technologies AKAM is scheduled to release third-quarter 2019 results on Oct 28.

Notably, the company has surpassed the Zacks Consensus Estimate in the trailing four quarters, the average beat being 8.5%.

Q3 Estimates

For third-quarter 2019, Akamai anticipates revenues between $692 million and $706 million. The corresponding Zacks Consensus Estimate is pegged at $701.7 million, indicating an improvement of 4.8% from the year-ago quarter.

Non-GAAP earnings are envisioned in the range of 98 cents to $1.02 per share. Meanwhile, the Zacks Consensus Estimate for second-quarter earnings is pegged at $1.01, suggesting growth of 7.5% from year-ago quarter.

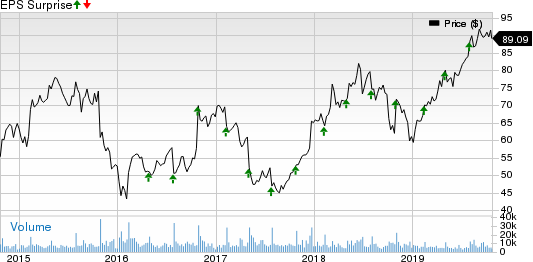

Akamai Technologies, Inc. Price and EPS Surprise

Akamai Technologies, Inc. price-eps-surprise | Akamai Technologies, Inc. Quote

Past-Quarter Performance

Akamai had delivered non-GAAP second-quarter 2019 earnings of $1.07 per share beating the Zacks Consensus Estimate by 6 cents. The figure also surged 29% from the year-ago quarter (up 32% adjusted for foreign exchange).

Revenues of $705.07 million outpaced the Zacks Consensus Estimate of $696 million and improved 6% from the year-ago quarter (up 8% adjusted for foreign exchange).

Let's see how things are shaping up prior to this announcement.

Factors to Consider

Solid demand for Kona Site Defender, Nominum services, Bot Manager and Prolexic Solutions are anticipated to get reflected in Cloud Security Solutions’ third-quarter revenues. The Zacks Consensus Estimate for Cloud Security Solutions revenues for the third quarter is currently pegged at $214 million, compared with prior-quarter figure of $205 million.

Strong traffic in OTT video vertical and media business, and operational efficiency is likely to have benefited the company’s performance in the third quarter. Synergies from the Nominum acquisition (completed in November 2017) have been enabling the company to enhance the Enterprise Threat Protector solution, and expand presence among carrier and enterprise customers. This is anticipated to have impacted the third-quarter performance.

Growing influence of the company’s security solutions among media customers is anticipated to get reflected in the third-quarter results. Akamai recently rolled out Enterprise Defender to enable customers in addressing malware prevention and secure app access across multiple cloud platforms.

Notably, the Zacks Consensus Estimate for Media and Carrier Division revenues for the third quarter are currently pegged at $320 million, compared with previous-quarter figure of $325 million.

Moreover, Akamai is likely to have benefited from robust adoption of its Intelligent Edge Platform.

Akamai rolled out product enhancements to Security and Personalization Services (SPS) Secure Business offering. The aim is to aid Internet service providers (ISPs) deliver robust cybersecurity solutions to small and mid-sized business (SMB) clients.

With the latest updates, ISPs can leverage Akamai SPS Secure Business to aid SMB clientele bolster business in a secure network infrastructure. This is anticipated to get reflected in the company’s third-quarter performance.

Strong growth in demand for High Definition video over the Internet is driving bandwidth requirements, thereby accelerating demand for the company’s solutions and aiding revenues. Markedly, Akamai recently integrated its content delivery network (CDN) with Microsoft MSFT Azure services to make it easier for media organizations to build video offerings in cloud and monetize the same. This is likely to have contributed to the company’s third-quarter performance.

However, the company’s profitability in the third quarter is likely to reflect stiff competition in the CDN market and associated pricing pressure.

Notably, the Zacks Consensus Estimate for CDN and other solutions revenues for the third quarter are currently pegged at $489 million, compared with prior-quarter figure of $500 million.

Moreover, increasing bandwidth costs are likely to have affected the third-quarter performance.

Key Developments

The company acquired KryptCo, a security startup that builds mobile-based authentication technology, in order to strengthen presence in the zero trust ecosystem.

With the joint Akamai-KryptCo solution, organizations can commence adoption of a zero trust security model. This buyout will aid Akamai to deliver on its commitment of safeguarding customer data while focusing on people-centric secure enterprise IT approach. This additional level of protection will aid the company in gaining the trust of users, consequently increasing adoption of its products and consequently boosting the top line.

During the quarter under review, Akamai announced that Hotstar, India's notable streaming platform, utilized Intelligent Edge Platform to enable viewers stream Vivo IPL and recorded notable viewership.

What Does the Zacks Model Say?

Our proven model doesn’t conclusively predict an earnings beat for Akamaithis time around. The combination of a positive Earnings ESP and Zacks Rank #3 (Hold) or higher increases the odds of an earnings beat. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Akamaiis 0.00%.

Zacks Rank: Akamai currently carries a Zacks Rank of #2 (Buy).

Stocks With Favorable Combination

Here are a few stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat.

Veoneer, Inc. VNE has an Earnings ESP of +7.17% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SAP SE SAP has an Earnings ESP of +4.35% and a Zacks Rank #2.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Veoneer, Inc. (VNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance