Alamo Group Inc. (ALG) Q1 2024 Earnings: Surpasses Revenue Estimates, EPS Aligns with Projections

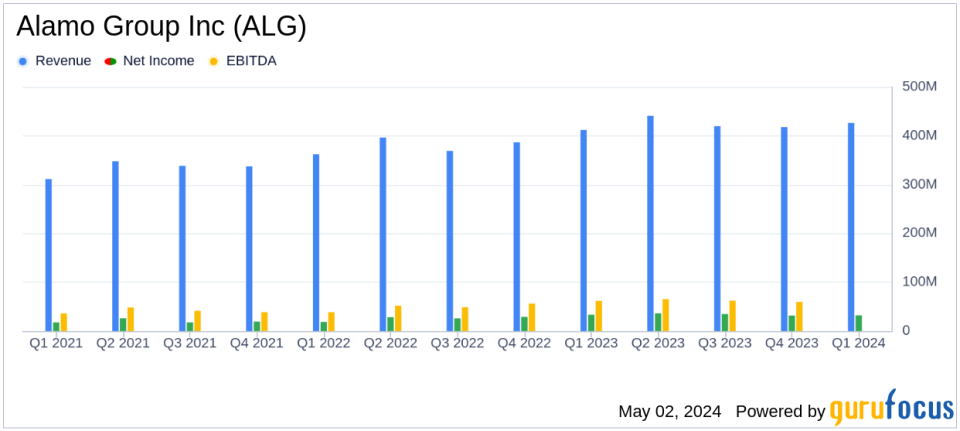

Revenue: Reported $425.6 million, up 3.4% year-over-year, surpassing estimates of $410.67 million.

Net Income: Achieved $32.1 million, exceeding estimates of $29.83 million but down from $33.3 million in the same quarter last year.

Earnings Per Share (EPS): Recorded at $2.67, surpassing the estimated $2.53.

Industrial Equipment Sales: Increased by 29.9% to $201.8 million, demonstrating significant growth in this segment.

Vegetation Management Sales: Decreased by 12.7% to $223.7 million, reflecting challenges in non-governmental markets.

Backlog: Remained elevated at $831.3 million, indicating strong future revenue potential despite a slight decrease from the end of 2023.

Debt Improvement: Total debt net of cash improved by $62.2 million or 23.8% compared to the first quarter of 2023, enhancing financial stability.

On May 2, 2024, Alamo Group Inc. (NYSE:ALG) released its 8-K filing, announcing its financial results for the first quarter ended March 31, 2024. The company reported a record net sales of $425.6 million, surpassing the analyst's revenue estimate of $410.67 million by approximately 3.6%. However, the earnings per share (EPS) of $2.67 aligned closely with the estimated $2.53, showcasing a robust performance amidst varying market dynamics.

Alamo Group Inc., a leader in the design and manufacturing of agricultural and infrastructure maintenance equipment, operates primarily through its Vegetation Management and Industrial Equipment segments. The company has a significant market presence predominantly in the United States, contributing the majority of its revenue.

Quarterly Financial Highlights and Segment Performance

The first quarter of 2024 saw Alamo Group achieving a slight increase in net sales, up 3.4% year-over-year. This growth was primarily driven by a remarkable 29.9% increase in sales in the Industrial Equipment segment, which offset a 12.7% decline in the Vegetation Management segment. Despite the overall sales growth, the company experienced a slight dip in gross margin to 26.2% from 27.3% in the previous year, attributed to a less favorable product mix and lower efficiencies in Vegetation Management.

Net income for the quarter was reported at $32.1 million, a slight decrease from $33.3 million in the first quarter of 2023. The company's backlog remained robust at $831.3 million, although it showed a minor decline from the end of 2023. This strong backlog, particularly in the Industrial Equipment segment, which saw a 17% increase to nearly $560 million, suggests sustained future revenues.

Management's Commentary and Future Outlook

Jeff Leonard, President and CEO of Alamo Group, commented on the results, highlighting the strength in governmental and industrial markets which bolstered the Industrial Equipment segment. However, he also noted ongoing challenges in the Vegetation Management segment, particularly in non-governmental markets, due to persistent high interest rates impacting dealer retail sales.

"Our first quarter results were broadly in line with expectations... We were very pleased that our Industrial Equipment Division had another outstanding quarter... The outlook for this Division looks quite positive for the balance of this year at least," stated Leonard.

Despite the optimistic performance of the Industrial Equipment segment, Leonard expressed a cautious outlook for the remainder of 2024, particularly due to the uncertain interest rate environment which could continue to impact the Vegetation Management segment.

Strategic Adjustments and Market Adaptations

In response to the challenging market conditions, Alamo Group has initiated strategic actions to optimize operations and maintain margins, including capacity reductions and the planned discontinuation of operations at certain facilities. These measures are aimed at aligning the company's production capacity with current market demands and improving overall efficiency.

In conclusion, Alamo Group's first quarter of 2024 illustrates a company navigating through mixed market conditions with strategic agility. While facing headwinds in some segments, the company's strong performance in Industrial Equipment and proactive management actions provide a solid foundation for navigating future challenges. Investors and stakeholders may look forward to updates in the upcoming quarters to gauge the effectiveness of the company's strategies in an evolving economic landscape.

Explore the complete 8-K earnings release (here) from Alamo Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance