Alcon (ALC) Q1 Earnings Surpass Estimates, Margins Expand

Alcon, Inc. ALC delivered core earnings per share (EPS) of 78 cents in the first quarter of 2024, up 11% from the year-ago quarter’s figure (up 21% at the constant exchange rate or CER). The figure topped the Zacks Consensus Estimate by 8.3%. Alcon’s ‘core’ results are based on non-IFRS (International Financial Reporting Standards) measures.

In the first quarter, the company’s diluted EPS was 50 cents, up 43% year over year.

Revenues in Detail

Alcon’s net sales to third parties in the first quarter were $2.44 billion, missing the Zacks Consensus Estimate by 0.6%. However, the top line increased 5% from the year-ago quarter’s levels (up 7% at CER).

Quarter in Detail

Alcon reports operations through two reportable segments — Surgical (comprising Implantables, Consumables and Equipment/Other) and Vision Care (comprising Contact Lenses and Ocular Health).

Surgical

In the first quarter of 2024, Surgical sales amounted to $1.34 billion, up 3% year over year and 6% at CER.

Within this, net sales in Implantables increased 1%, led by the demand for advanced technology intraocular lenses in the international market.

Consumables increased 5%, while Equipment/Other was down 1% from the prior-year quarter’s levels.

Vision Care

The segment reported total sales of $1.11 billion, up 7% year over year on a reported basis and 10% at CER.

Net sales of Contact Lenses increased 9% year over year, driven by product innovation, including toric multifocal modalities and price increases.

Ocular Health sales increased 5% year over year, primarily driven by the portfolio of eye drops, including continued strength from the Systane family of artificial tears.

Margins

The cost of net sales in the first quarter was $1.08 billion, up 2.9% year over year. The core gross profit rose 5.9% to $1.38 billion in the reported quarter. The core gross margin expanded 72 basis points (bps) to 56.2% in the first quarter of 2024.

SG&A expenses increased 2.2% year over year, while R&D expenses fell 1.5% year over year. The core operating margin expanded 197 bps in the first quarter to 15.4%.

Financial Position

Alcon exited first-quarter 2024 with cash and cash equivalents of $1.14 billion compared with $1.09 billion at the end of fourth-quarter 2023.

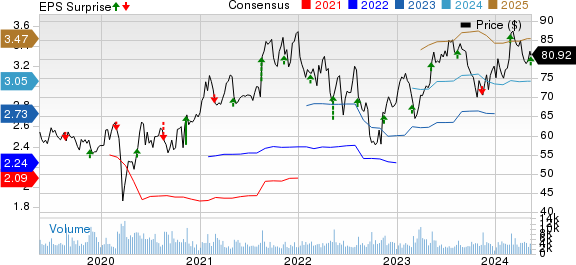

Alcon Price, Consensus and EPS Surprise

Alcon price-consensus-eps-surprise-chart | Alcon Quote

The cumulative net cash flow from operating activities at the end of the first quarter was $341 million compared with $85 million in the year-ago period. Free cash flow totaled $229 million at the end of first-quarter 2024 compared with ($19) million in fourth-quarter 2023.

2024 Outlook

Alcon updated its financial outlook for 2024.

The company anticipates 2024 net sales in the range of $9.90-$10.10 billion, indicating growth of 7%-9% at CER from 2023. The Zacks Consensus Estimate for ALC’s revenues is pegged at $9.97 billion.

Core EPS for the full year is expected in the range of $3.00-$3.10. This suggests growth of 15%-18%% at CER from the 2023 levels. The Zacks Consensus Estimate for Alcon’s 2024 earnings is currently pegged at $3.05 per share.

Our Take

Alcon’s earnings beat estimates and revenues missed the same in the first quarter of 2024. The company delivered substantial growth in both of its franchises on the back of healthy markets. The expansion of margins in the quarter buoys optimism.

International markets drive surgical growth, while Vision Care growth reflects strength driven by product innovation, including toric multifocal modalities and price increases. The company is presently working on several innovative products to support its customers and their patients, which are expected to outpace market growth, deliver operating leverage and create long-term shareholder value. This bodes well for the stock.

However, increasing costs in the quarter is a concern.

Zacks Rank and Other Key Picks

Alcon currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader medical space are Medpace MEDP, ResMed RMD and Encompass Health Corporation EHC.

Medpace, sporting a Zacks Rank #1 (Strong Buy), reported a first-quarter 2024 EPS of $3.20, which beat the Zacks Consensus Estimate by 30.6%. Revenues of $511 million improved 17.7% from last year’s comparable figure. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace has an estimated 2024 earnings growth rate of 26.5% compared with the industry’s 12.3%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 12.8%.

ResMed, sporting a Zacks Rank #2, reported a first-quarter 2024 EPS of $2.13, which topped the Zacks Consensus Estimate by 10.9%. Revenues of $1.20 billion surpassed the Zacks Consensus Estimate by 1.9%.

RMD has an estimated fiscal 2024 earnings growth rate of 17.9% compared to the industry’s 15.7%. In each of the trailing four quarters, the company delivered an average earnings surprise of 2.8%.

Encompass Health, carrying a Zacks Rank #2, reported a first-quarter 2024 adjusted EPS of $1.12, which surpassed the Zacks Consensus Estimate by 20.4%. Net operating revenues of $1.3 billion topped the Zacks Consensus Estimate by 3.6%.

EHC has an estimated long-term earnings growth rate of 15.6% compared with the industry’s 11.7% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 18.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance