Alexandria (ARE) Beats Q1 AFFO Estimates, Narrows '24 Guidance

Shares of Alexandria Real Estate Equities, Inc. ARE are up more than 5% in the pre-market trading session today after the company reported first-quarter 2024 adjusted funds from operations (AFFO) per share of $2.35 yesterday, which beat the Zacks Consensus Estimate of $2.31. The reported figure also climbed 7.3% from the year-ago quarter.

Results reflected a rise in revenues, aided by decent leasing activity and rental rate growth. Alexandria also narrowed its 2024 outlook.

Total revenues of $769.1 million increased 9.7% on a year-over-year basis and also outpaced the consensus estimate of $765.9 million.

Behind the Headlines

Alexandria’s total leasing activity aggregated 1.1 million rentable square feet (RSF) of space in the first quarter, reflecting healthy demand for its high-quality office/laboratory space. Of this, lease renewals and re-leasing of space amounted to 994,770 RSF, while leasing of development and redevelopment space totaled 100,232 RSF.

The company registered rental rate growth of 33% during the quarter. On a cash basis, the rental rate increased 19%.

On a year-over-year basis, same-property net operating income (NOI) increased 1%. It improved 4.2% on a cash basis. The occupancy of operating properties in North America was 94.6% as of Mar 31, 2024, the same as in the prior quarter and up from 93.6% in the year-ago quarter. It is also ahead of our estimate of 94.4%.

In the reported quarter, investment-grade or publicly traded large-cap tenants accounted for 52% of the annual rental revenues in effect. The weighted average remaining lease term of all tenants is 7.5 years. For Alexandria’s top 20 tenants, it is 9.7 years.

As of Mar 31, 2024, the tenant receivable balance was $7.5 million.

During the first quarter, Alexandria completed acquisitions worth $194.8 million. Moreover, acquisitions made since the beginning of the year through April, as well as its pending acquisitions subject to signed letters of intent or purchase and sale agreements, in total reached $277.16 million.

During the quarter, ARE placed into service development and redevelopment projects aggregating 343,445 RSF, which are fully leased across multiple submarkets, delivering $26 million of incremental annual NOI.

Liquidity

The company exited the first quarter with cash and cash equivalents of $722.2 million, up from $618.2 million as of Dec 31, 2023. It had $6.0 billion of liquidity at the end of the reported quarter.

The net debt and preferred stock to adjusted EBITDA was 5.2X, and the fixed-charge coverage was 4.7X on an annualized basis. Its weighted average remaining term of debt was 13.4 years.

2024 Guidance

Alexandria narrowed its 2024 guidance, projecting the AFFO per share in the range of $9.41-$9.53, with the midpoint remaining unchanged at $9.47 from the prior guidance of $9.37-$9.57. The Zacks Consensus Estimate is currently pegged at $9.46.

Alexandria’s current-year expectations are backed by anticipations for occupancy in North America (as of Dec 31, 2024) in the band of 94.6-95.6%, rental rate increases for lease renewals, re-leasing of space of 11-19% (5-13% cash basis) and same-property NOI growth of 0.5-2.5% (3-5% cash basis).

Alexandria currently carries a Zacks Rank #3 (Hold).

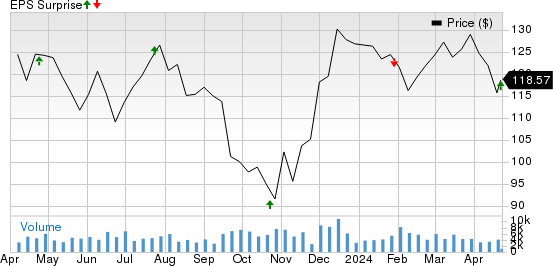

Alexandria Real Estate Equities, Inc. Price and EPS Surprise

Alexandria Real Estate Equities, Inc. price-eps-surprise | Alexandria Real Estate Equities, Inc. Quote

Upcoming Earnings Releases

We now look forward to the earnings releases of other REITs like Ventas VTR, Healthpeak Properties DOC and Boston Properties, Inc. BXP. While Healthpeak Properties and Boston Properties are slated to report on Apr 25 and Apr 30, Ventas is scheduled for May 1.

The Zacks Consensus Estimate for Healthpeak’s first-quarter 2024 FFO per share is pegged at 44 cents, which implies a 4.76% year-over-year increase. DOC currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Boston Properties’ first-quarter 2024 FFO per share is pegged at $1.73, which suggests no growth year over year. BXP currently carries a Zacks Rank #3.

The Zacks Consensus Estimate for Ventas’ first-quarter 2024 FFO per share stands at 75 cents, which indicates a 1.35% rise year over year. VTR currently has a Zacks Rank #4 (Sell).

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Healthpeak Properties, Inc. (DOC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance