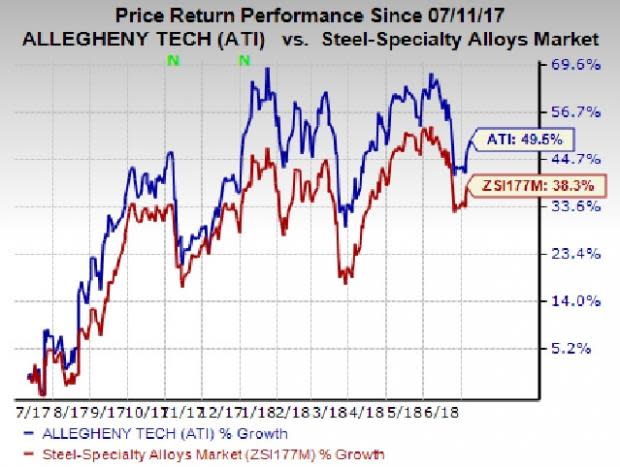

Allegheny (ATI) Up 50% in a Year: What's Behind the Rally?

Shares of Allegheny Technologies Incorporated ATI have surged around 50% over a year, outperforming the industry’s gain of roughly 38%.

Allegheny has a market cap of roughly $3.3 billion and average volume of shares traded in the last three months was around 1,700.8K.

Let’s take a look into the factors that are driving this Zacks Rank #1 (Strong Buy) stock.

Driving Factors

Better-than-expected first-quarter earnings performance, upbeat outlook and the company’s actions to improve its operations and cost structure have contributed to the rally in Allegheny’s shares. Allegheny racked up a positive earnings surprise of 33.3% in the first quarter. Notably, the company has topped the Zacks Consensus Estimate for earnings in three of the trailing four quarters with an average positive surprise of 38.7%.

The Zacks Consensus Estimate for earnings for 2018 for Allegheny is currently pegged at $1.38, reflecting an expected year-over-year growth of 187.5%. Moreover, earnings are expected to register a 48.3% growth in 2019.

Allegheny expects operating margin improvement and revenue growth in its High Performance Materials & Components (HPMC) unit in 2018 from improved asset utilization and aerospace market demand growth. It also expects its Flat-Rolled Products (FRP) segment to capitalize on the operational improvements and the A&T Stainless joint venture as well as growth in differentiated products.

Allegheny also continues to improve its cost structure with its gross cost reduction initiative. In 2018, Allegheny expects to generate free cash flow of at least $150 million from ongoing operational improvements and disciplined spending.

Moreover, the company’s joint venture (JV) with Tsingshan Group Company will offer cost competitive stainless sheet products made for the North American market through a unique combination of Allegheny’s innovative, low-cost Hot-Rolling and Processing Facility (HRPF) and Tsingshan’s unparalleled Indonesian refining, mining and castings assets, and the JV’s unique Direct Roll Anneal and Pickle facility in Midland, PA.

The JV supports Allegheny’s considerable investment in the U.S. manufacturing operations, especially its HRPF facility, which will provide value addition to the processing services for the JV’s finished products.

Allegheny Technologies Incorporated Price and Consensus

Allegheny Technologies Incorporated Price and Consensus | Allegheny Technologies Incorporated Quote

Other Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include FMC Corporation FMC, LyondellBasell Industries N.V. LYB and Methanex Corporation MEOH, each carrying a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

FMC has an expected long-term earnings growth rate of 14.3%. Its shares have gained roughly 22% over a year.

LyondellBasell has an expected long-term earnings growth rate of 9%. The company’s shares have rallied around 31% in a year.

Methanex has an expected long-term earnings growth rate of 15%. Its shares have shot up roughly 68% over a year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance