Allegion (ALLE) Q4 Earnings Meet Estimates, Revenues Miss

Allegion plc’s ALLE fourth-quarter 2019 adjusted earnings came in line with estimates, while revenues missed the same.

Earnings/Revenues

Quarterly adjusted earnings came in at $1.28 per share, meeting the Zacks Consensus Estimate. Notably, the bottom line was 4.9% higher than the year-ago figure of $1.22. The upside can be primarily attributed to solid sales growth and improved operating income.

In full-year 2019, Allegion’s adjusted earnings came in at $4.89 per share, up 8.7% on a year-over-year basis.

Revenues totaled $719.5 million, up 2.4% year over year. However, the top line missed the consensus estimate of $740 million. Revenues jumped 3.5% on an organic basis. The rise was backed by strength in businesses in the Americas region and strong pricing benefits, partially offset by adverse impact of unfavorable foreign exchange movements.

In 2019, Allegion generated revenues of $2,854 million, up 4.5% on a year-over-year basis.

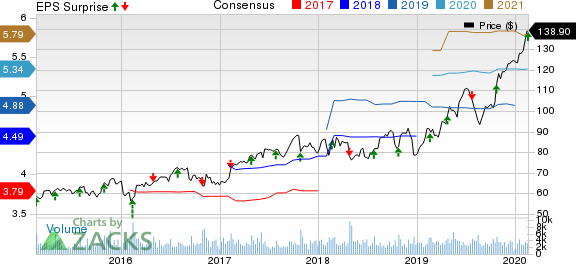

Allegion plc Price, Consensus and EPS Surprise

Allegion plc price-consensus-eps-surprise-chart | Allegion plc Quote

Segmental Breakup

Revenues in the Americas rose 6.8% year over year to $526.3 million, driven by strength in non-residential and residential businesses. EMEIA (Europe, Middle East, India and Africa) revenues declined 5% to $149.6 million, on account of adverse impacts of divestitures and unfavorable foreign exchange movements. Revenues in Asia-Pacific fell 16.6% to $43.6 million in the quarter, reflecting weak residential end markets in Australia and market softness in China.

Costs/Margins

In the fourth quarter, Allegion’s cost of sales decreased 0.4% year over year to $400.3 million. Gross profit grew 6.2% to $319.2 million while gross margin improved 160 basis points (bps) to 44.4%.

Selling and administrative expenses increased 10.6% year over year to $175.9 million.

Adjusted operating margin expanded 30 bps to 21%.

Balance Sheet/Cash Flow

As of Dec 31, 2019, Allegion had cash and cash equivalents of $355.3 million, up from $283.8 recorded on Dec 31, 2018. Long-term debt was $1,427.6 million, up from $1,409.5 million recorded at the end of 2018.

In 2019, the company generated net cash of $488.2 million from operating activities, up 6.6% on a year-over-year basis. Capital expenditures totaled $65.6 million compared with $49.1 million a year ago.

2020 Guidance

Adjusted earnings per share are expected in the range of $5.10 to $5.20, reflecting an increase of 5.3% on a year-over-year basis.

The company expects full-year 2020 revenue growth in the band of 3-4% on reported basis, and 3.5-4.5% on an organic basis.

Full-year adjusted effective tax rate is anticipated to be 16.5-17%.

Available cash flow is expected to be $450-$470 million.

Zacks Rank & Key Picks

Allegion currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are Intellicheck, Inc. IDN, Alarm.com Holdings, Inc. ALRM and Johnson Controls International plc JCI. While Intellicheck sports a Zacks Rank #1 (Strong Buy), Alarm.com Holdings and Johnson Controls carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Intellicheck delivered earnings surprise of 4.76%, on average, in the trailing four reported quarters.

Alarm.com Holdings pulled off positive earnings surprise of 16.93%, on average, in the previous four reported quarters.

Johnson Controls delivered earnings surprise of 4.43%, on average, in the trailing four reported quarters.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson Controls International plc (JCI) : Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance