Allergan (AGN) Beats on Q1 Earnings & Sales, Raises '19 View

Allergan plc’s AGN first-quarter adjusted earnings came in at $3.79 per share, which beat the Zacks Consensus Estimate of $3.55 and came ahead of the guidance of $3.40 and $3.60. Earnings rose 1.3% year over year.

Revenues came in at $3.60 billion, which exceeded the Zacks Consensus Estimate of $3.53 billion as well as the guidance of $3.4 billion to $3.55 billion. Revenues fell 2% from the year-ago period primarily due to loss of exclusivity on some brands and divestitures of some others in 2018.

Moreover, sales of Allergan’s blockbuster eye drug, Restasis also declined in the quarter ahead of anticipated generic competition. Also, declines in textured breast implants in certain international markets hurt sales. However, key products like Botox (cosmetic and therapeutics), Juvéderm collection of fillers, Vraylar, and Lo Loestrin pulled up the top line in the quarter.

Allergan said that its core business (Medical Aesthetics, CNS, Eye Care and GI), comprising more than 80% of total revenues, grew 4.4% year on year in the quarter.

Segment Discussion

Allergan reports revenues under three segments – U.S. General Medicine, U.S. Specialized Therapeutics and International.

U.S. Specialized net revenues declined 2.3% to $1.54 billion. Strong sales growth of its facial aesthetics products, Botox and Juvéderm and Botox Therapeutic was offset by decline in sales of Restasis and divestiture of Medical Dermatology business in September 2018.

In Facial Aesthetics, Botox (cosmetic) raked in sales of $229.5 million, up 16.7% year over year. Juvéderm collection of fillers rose 5.6% to $129.7 million

Alloderm sales, however, fell 4.5% to $95.0 million while CoolSculpting sales of $62.9 million declined 27.8% year over year.

In Eye Care, while Ozurdex sales rose 18.8% to $30.3 million, Restasis sales fell 9.4% to $231.7 million. Restasis sales decreased due to lower selling price.

Botox Therapeutic revenues were $397.6 million, up 5.8% year over year.

There have been concerns regarding possible new competitors to Botox. The entry of CGRP antibodies may have a negative impact on sales of Botox Therapeutics, mainly for the chronic migraine indication. Amgen AMGN, Eli Lilly LLY and Teva Pharma’s TEVA CGRP migraine treatments, Aimovig, Emgality and Ajovy, respectively were all launched in 2018.

Meanwhile, in February, Evolus’ Jeuveau injection indicated to improve the appearance of glabellar or frown lines was approved by the FDA, which can pose competition to Botox. Revance Therapeutics is developing RT002, a rival treatment to Botox for the frown lines indication, which has demonstrated longer duration of efficacy compared to Botox in late-stage studies.

U.S. General Medicine net revenues were up 2.1% year over year to $1.25 billion in the reported quarter as strong growth of Vraylar, Linzess and Lo Loestrin was offset by lower sales of drugs like Namenda XR and Estrace due to generic competition.

Linzess sales rose 1.3% to $161.3 million. Lo Loestrin sales grew 9.8% to $125.8 million while Bystolic sales fell 3.4% to $128.3 million. Vraylar sales were $143.7 million in the first quarter, 70.3% higher than the year-ago quarter, while Viibryd sales were $85 million, up 18.5% from the year-ago quarter.

The International segment recorded net revenues of $801.5 million, up 1.3% from the year-ago period, excluding the impact of foreign exchange as growth in Facial Aesthetics and Botox (therapeutic) was partially offset by regulatory changes for textured breast implants and lower glaucoma and eye drop revenues.

Profits Decline

Adjusted operating income decreased 7.6% to $1.63 billion in the first quarter due to the impact of divestitures, loss of exclusivity of some products and a decline in Restasis.

Selling, general and administrative (SG&A) expenses increased 4.5% to $1.10 billion in the first quarter owing to higher marketing spending in Medical Aesthetics.

Research and development (R&D) expenses rose 11.8% to $397.9 million due to pipeline progress.

2019 Guidance

Allergan slightly raised its earnings and sales guidance for 2019. Allergan expects sales to be in the range of $15.13-$15.43 billion, up from the previous guidance of $15.0-$15.3 billion.

The company estimates its adjusted earnings to be more than $16.55 per share versus equal to or greater than$16.36 per share expected previously.

Adjusted tax rate is expected to be approximately 13-13.5% in 2019. Adjusted R&D expenses are expected to be approximately $1.6 - $1.7 billion and SG&A spend is expected to be approximately $4.1 - $4.3 billion. Adjusted gross margin is expected to be approximately 85%-85.5%.

For the second quarter, the company expects revenues to be in the range of $3.88 billion to $4.03 billion and earnings per share between $4.20 and $4.40.

Our Take

Allergan’s stock was down slightly in pre-market trading despite beating estimates for both earnings and sales in the first quarter and marginally boosting its guidance. So far this year, Allergan’s share price has risen 10.5% compared with the industry’s increase of 7.1%.

Allergan’s key products like Botox and new products such as Viberzi and Vraylar are supporting sales. Allergan also continues to deliver on its R&D pipeline with some important data readouts scheduled in 2019 and some major product launches expected over the next couple of years. Allergan anticipates five regulatory approvals over the next eighteen months. Biosimilars also represent significant opportunity. Allergan is also consistently paying down debt and cutting costs.

However, in 2019, sales are expected to be hurt by loss of exclusivity of key drugs including Restasis.

Allergan currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

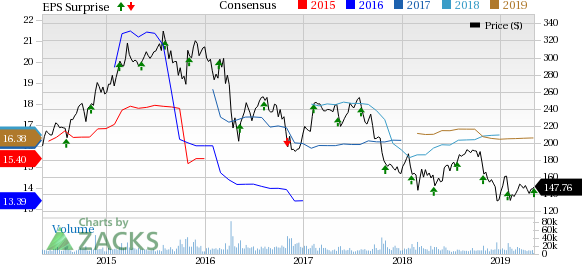

Allergan plc Price, Consensus and EPS Surprise

Allergan plc Price, Consensus and EPS Surprise | Allergan plc Quote

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allergan plc (AGN) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance