AllianceBernstein Holding LP (AB) Reports First Quarter Earnings: Adjusted Earnings Surpass ...

Adjusted Diluted Earnings Per Share (EPS): Reported at $0.73, surpassing the estimated $0.71.

GAAP Diluted Net Income: Reported at $0.67 per unit, below the prior quarter's $0.71 but up from $0.59 year-over-year.

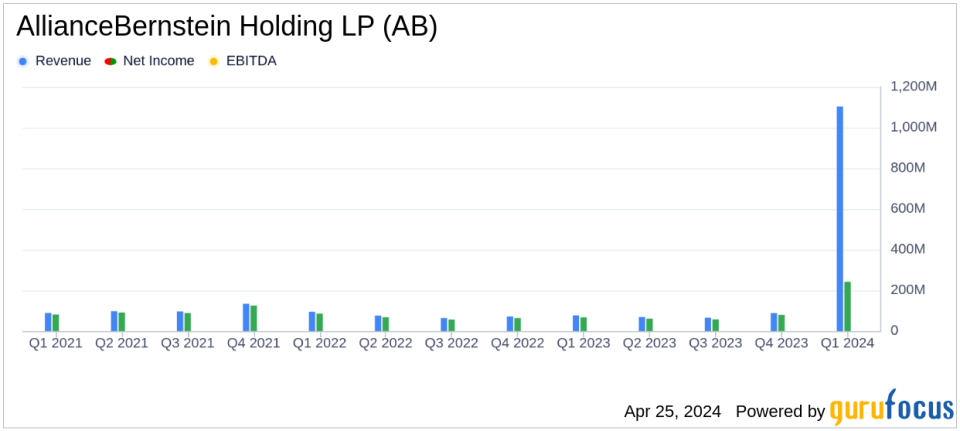

Net Revenues: Increased to $1.1 billion, up 7.8% from the previous year, exceeding the estimated $902.78 million.

Operating Income: Rose to $242 million, marking a 12.4% increase year-over-year and slightly above last quarter's $238.5 million.

Assets Under Management (AUM): Ended the quarter at $758.7 billion, a 12.2% increase from the previous year and a 4.6% rise from the last quarter.

Cash Distribution: Set at $0.73 per unit, payable on May 23, 2024, reflecting a 10.6% increase from the previous year.

Adjusted Operating Margin: Improved to 30.3%, up 160 basis points from the previous year, indicating enhanced operational efficiency.

On April 25, 2024, AllianceBernstein Holding LP (NYSE:AB) unveiled its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported adjusted diluted net income per unit of $0.73, surpassing the analyst estimate of $0.71 per unit, and showcased a robust financial and operational performance amidst varying market conditions.

Company Overview

AllianceBernstein, a global investment management firm, serves a diverse set of clients including institutional, retail, and private wealth sectors. As of the end of January 2024, AB managed assets totaling $726 billion, predominantly in fixed-income and equity strategies. The company also engages in sell-side research and brokerage services through its Sanford Bernstein subsidiary.

Financial Highlights

The first quarter of 2024 saw AB's adjusted net revenues climb to $884 million, a 6.2% increase year-over-year, driven by higher investment advisory base fees and investment gains. Adjusted operating income rose by 12.1% to $267 million, with an operating margin expansion to 30.3%, reflecting a 160 basis points improvement from the previous year.

AB's earnings were bolstered by robust retail sales, particularly in taxable fixed income and municipals, contributing to a 6% annualized organic growth in the retail channel. However, the institutional segment experienced net outflows of $4.2 billion, highlighting ongoing challenges in active and passive equities. Despite these outflows, AB's total assets under management (AUM) increased by 12.2% year-over-year to $758.7 billion, indicating strong market and operational performance.

Operational Efficiency and Market Adaptation

AB's strategic initiatives and market adaptability were evident in its operational efficiency and financial outcomes. The adjusted operating margin of 30.3% underscores the firm's effective cost management and ability to capitalize on favorable market conditions. Moreover, the firm's engagement in a joint venture with Societe Generale, which concluded with a $304 million equalization payment, exemplifies its proactive approach in optimizing its business model in response to market dynamics.

Challenges and Market Outlook

Despite the positive financial performance, AB faces challenges such as persistent equity net outflows and a subdued trading environment impacting its Bernstein Research revenues. The ongoing geopolitical conflicts and uncertain inflation landscape pose further risks, potentially affecting future performance. However, AB's diversified asset management strategy and robust pipeline of institutional mandates, valued at $11.5 billion, provide a cushion against market volatility.

Conclusion

AllianceBernstein's first quarter results reflect a resilient business model capable of navigating complex market environments while delivering value to its clients and shareholders. With a strategic focus on high-growth areas and efficient operations, AB is well-positioned to maintain its trajectory of growth and profitability in the evolving financial landscape.

For detailed insights and further information, readers are encouraged to refer to the full earnings report and additional disclosures provided by AllianceBernstein.

Explore the complete 8-K earnings release (here) from AllianceBernstein Holding LP for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance