Alliant Energy's (LNT) Arm Prices $300M Green Bonds Due 2031

Alliant Energy Corporation’s LNT subsidiary Wisconsin Power and Light Company completes pricing 1.950% green debentures worth $300 million due Sep 16, 2031. The offering is likely to close on Sep 16, 2021, subject to certain customary closing conditions.

Net proceeds will be used for constructing and developing wind and solar facilities.

Debt Position

Long-term debt (excluding current portion) was $6,468 million as of Jun 30, 2021, lower than $6,769 million on Dec 31, 2020. Its total liquidity as of Jun 30, 2021 was $545 million (including cash and funds available under the credit facility), which is sufficient to meet its near-term debt obligations. There is no significant debt maturity for the company in 2021. Its current total debt to total capital is 54.85%, lower than the industry’s average of 56.97%.

The company’s times interest earned ratio at the end of second-quarter 2021 was 3, a tad lower than the 2020-end level. The times interest earned ratio of more than 1 indicates that it has enough financial strength to meet its debt obligations in the near future.

Clean Electricity Generation Plans

Alliant Energy is consistently investing in renewable and natural gas-based electricity generation, and gradually lowering its coal-based generation assets. Stringent emission standards are forcing utilities to lower their dependence on coal-fired production units. The company announced the voluntary goal of retiring all the existing coal-fired generation units by 2040 with an objective of lowering emissions from the 2005 levels by 50% and 100% within 2030 and 2050, respectively. In total, the company will replace 2 gigawatts of coal-fired generation with clean energy sources by 2040.

Alliant Energy is making strong progress with clean energy initiatives and already lowered carbon dioxide emissions by 42% in 2020 from its 2005 levels. Moreover, it plans to invest $2.2 billion in renewables during the 2021-2024 time period. The company has retired more than 1,100 megawatt (MW) of coal-fired units since 2005 and plans to retire 1,300 MW of coal by 2024 end. The unit is planning to add 1,089 MW of solar generation by 2023. Other utilities like Duke Energy DUK, DTE Energy DTE and Xcel Energy XEL are also making efforts to supply clean energy.

Price Performance

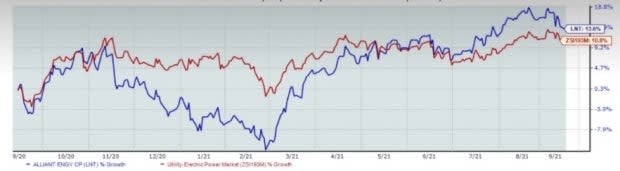

In the past year, shares of the company have gained 13.6%, outperforming the industry’s rise of 10.8%.

One-Year Price Performance

Image Source: Zacks Investment Research

Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance