Allstate (ALL) Announces Quarterly Dividend: Worth a Look?

The Allstate Corporation ALL recently announced a quarterly dividend of 81 cents. The amount is in line with the previous quarter but up 50% from the year-ago period. It has hiked dividends annually for the past few years. The dividend will be paid out on Jan 3 next year to shareholders on record as of Nov 30.

The dividend amount translates to $3.24 per share on an annualized basis. Considering Nov 19’s closing price of $111.94 per share, Allstate’s dividend yield currently stands at 2.9%. Not only is the yield attractive for income investors but it also represents a steady income stream. Further, the yield is impressive compared with the industry average of 0.4%. Additionally, the company has an impressive share repurchase plan in place. This August, ALL approved a new $5-billion share repurchase authorization to be completed by Mar 31, 2023. This authorization leads to the continuation of Allstate's strong track record of providing cash returns to shareholders.

Despite its moves to boost shareholder value, prudent investors are cautiously watching the stock from the sidelines. There can be multiple reasons why many investors are cautious on Allstate.

Let’s delve deeper.

Debt Burden: At third quarter-end, Allstate had only $690 million in cash and long-term debt of $7,980 million. Its high debt level remains a concern, which results in increased interest expenses. The metric rose 3.4% during the first nine months of 2021 from the prior-year comparable period. Hence, the company must service its debt uninterruptedly, or else creditworthiness could be dented.

Profits Decline: Even though the company is witnessing a significant rise in revenues, profits are falling, primarily due to increased claim expenses. As COVID-19 restrictions are being eased off, more and more travelers are hitting the roads, leading to a higher number of incidents. This is resulting in higher claims and severity of claims.

Supply Chain Disruption: The pandemic has affected the supply chain, which in turn, has reduced the availability of car parts. This has boosted the cost of repairs and reduced the profits of car insurers like Allstate. ALL now has to rely on increasing premiums to boost profitability, which is not likely to make customers happy.

Exposure to Catastrophe Losses: Due to Allstate’s relatively large property insurance business, it is significantly exposed to catastrophic events. In the first nine months of 2021, the company incurred $2.8 billion of catastrophe losses, which increased 17.8% from the prior-year comparable period.

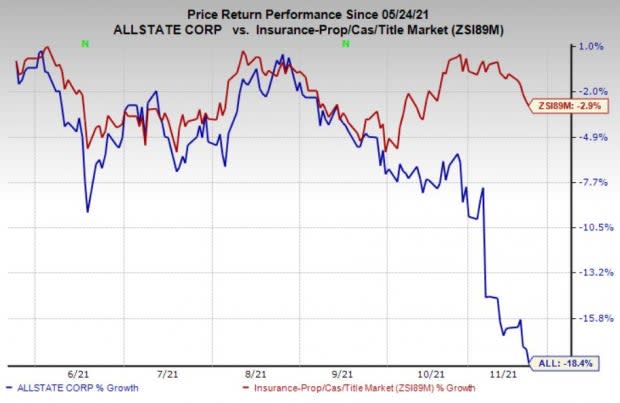

Price Performance

The stock has declined 18.4% in the past six months compared with the 2.9% fall of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently has a Zacks Rank #5 (Strong Sell). Some better-ranked players in the finance space include Alerus Financial Corporation ALRS, Blackstone Inc. BX and Houlihan Lokey, Inc. HLI, each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alerus Financial’s bottom line for 2021 is expected to jump 11.5% year over year to $2.81 per share. It has witnessed three upward estimates in the past 30 days and no movement in the opposite direction. Alerus Financial beat earnings estimates thrice in the past four quarters and missed once, with an average surprise of 23.6%.

Based in Grand Forks, ND, Alerus Financial provides numerous financial services to clients. Its financial strength is reflected by massive total assets of $3.2 billion at third quarter-end, which increased 5.4% for the first nine months of 2021. Rising investment securities will likely keep boosting the company’s asset position in the coming quarters.

Blackstone’s 2021 earnings are expected to rise 64.2% to $4.35 per share. It has witnessed five upward estimate revisions in the past 30 days compared with none in the opposite direction. The company beat earnings estimates in all the last four quarters, with an average of 23.7%.

Headquartered in New York, Blackstone is well poised to benefit from its fund-raising ability, revenue mix and inorganic expansion strategies. The company’s fee-earning assets under management (AUM) and total AUM consistently demonstrate strong growth, aided by increasing net inflows. Over the last four years (2017-2020), fee-earning AUM witnessed a CAGR of 11.9% and total AUM saw a CAGR of 12.5%.

Houlihan Lokey — headquartered in Los Angeles, CA — provides multiple financial services to clients all over the world. Its growing footprint in Europe and Asia’s investment banking services field will help the company boost strategic and shareholder value in the coming days. Rising average transaction fees will increase corporate finance revenues.

Full-year fiscal 2022 bottom line of Houlihan Lokey is expected to rise 36.8% year over year to $6.32 per share. In the past 30 days, it has witnessed four upward estimate revisions and no downward movement. The company beat earnings estimates in all the last four quarters, with an average of 39.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blackstone Inc. (BX) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

Alerus Financial (ALRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance