Allstate (ALL) Down 3.6% Since Earnings Report: Can It Rebound?

It has been about a month since the last earnings report for Allstate Corporation ALL. Shares have lost about 3.6% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is ALL due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Allstate's Q4 Earnings & Revenues Beat, Dividend Up

Allstate Corporation’s fourth-quarter 2017 operating earnings per share of $2.09, surpassed the Zacks Consensus Estimate by 39.3%. The bottom line, however, declined by 3.7% year over year due to high catastrophe loss.

The Tax Cuts and Jobs Act resulted in a $506 million increase in net income, which was up 50.4% year over year to $1.22 billion.

Allstate generated total revenues of $9.72 billion, outpacing the consensus mark by 15.3% and up 4.7% year over year. The upside was driven by premium growth and an increase in net investment income.

In the quarter, total expenses increased 8.3% year over year to $8.69 billion. The company incurred catastrophe loss of $599 million, which was up 98% year over year.

Top-Line Growth Across Segments

Property-Liability insurance premiums amounted to $7.97 billion, up 2.8% year over year. Net investment income of $45 million also increased 24.3% year over year. Underwriting income of $715 million declined 10.7% year over year due to high catastrophe loss.

Service Businesses, a new reportable segment, offers a broad range of products and services that expand and enhance customer value propositions. Total revenues from this division were $264 million up 45.9% year over year, led by Square Trade acquisition closed last year.

Allstate Life’s premium and contract charges of $324 million increased 1.9% year over year driven by higher traditional life insurance renewal premiums and lower levels of reinsurance premiums ceded. Net income of $57 million declined 13.6% year over year due to increased contract benefits and operating expenses, partially offset by higher premiums.

Allstate Benefits’ premium and contract charges of $273 million were up 8.3% backed by 7.4% growth in policies in force in 2017. Net income of $20 million was 13% lower than the prior-year quarter figure, primarily due to higher contract benefits and operating expenses, partially offset by higher premiums.

Allstate Annuities’ premium and contract charges of $4 million remained flat year over year. Adjusted net income of $55 million surged 34% owing to higher performance-based investment income.

Capital Position

As of Dec 31, 2017, total shareholders’ equity was $22.6 billion, up 9.6% year over year.

Total assets were $112.4 billion, up 3.5% from the level at 2016-end.

Long-term debt remained flat year over year at $6.35 billion.

For 2017, cash inflow from operating activities totaled $4.3 billion, up 8% year over year.

Stock Repurchase and Dividend Update

Allstate returned $713 million in the quarter under review via share buyback ($579 million) and dividend payments ($134 million).

Driven by its strong operating fundamentals and a reduction in the U.S. federal income tax rate, the company increased the quarterly dividend by 24% to 46 cents per share for the first quarter of 2018.

How Have Estimates Been Moving Since Then?

It turns out that fresh estimates flatlined during the past month. There have been two revisions higher for the current quarter compared to two lower.

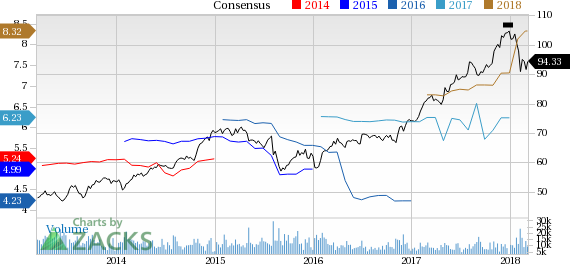

Allstate Corporation (The) Price and Consensus

Allstate Corporation (The) Price and Consensus | Allstate Corporation (The) Quote

VGM Scores

At this time, ALL has a nice Growth Score of B. Its Momentum is doing a bit better with an A. Charting a somewhat similar path, the stock was also allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for momentum investors than those looking for value and growth.

Outlook

ALL has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allstate Corporation (The) (ALL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance