Allstate (ALL) Incurs Q4 Loss Due to Underwriting Losses

The Allstate Corporation ALL incurred a fourth-quarter 2022 adjusted loss of $1.36 per share, narrower than the Zacks Consensus Estimate of a loss of $1.37. Notably, earnings of $2.75 per share were reported in the prior-year quarter.

The quarterly results suffered a blow from significant auto insurance underwriting losses, reduced net investment income and an elevated expense level.

Operating revenues of Allstate amounted to $13,552 million, which rose 6.3% year over year. The top line beat the consensus mark by 8.5% and our estimate of $12,489.1 million. The improvement can be attributed to 9.5% year-over-year growth in earned premiums across its Property-Liability business.

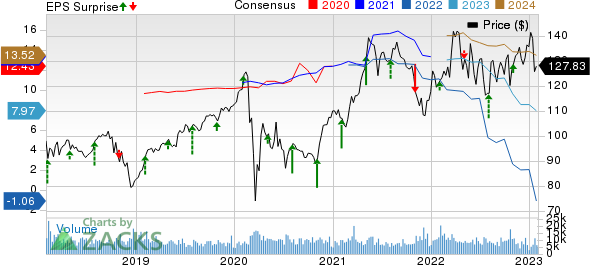

The Allstate Corporation Price, Consensus and EPS Surprise

The Allstate Corporation price-consensus-eps-surprise-chart | The Allstate Corporation Quote

Q4 Operations

Net investment income of Allstate dropped 34.2% year over year to $557 million due to a decline in performance-based investment income and fell shy of our estimate of $590.7 million. Yet, market-based investment income advanced 27.8% year over year in the fourth quarter.

Total costs and expenses escalated 21.1% year over year to $14,067 million. The increase was mainly due to increased property and casualty (P&C) insurance claims and claims expenses, and amortization of deferred policy acquisition costs.

A pretax loss of $420 million was reported in the quarter under review against the prior-year quarter’s pretax income of $1,393 million.

As of Dec 31, 2022, total policies in force dipped 1% year over year to 189.1 million.

Allstate incurred catastrophe losses of $779 million, which escalated 47.5% year over year.

Segmental Performances

Property-Liability’s premiums earned of $11,380 million grew 9.5% year over year in the fourth quarter. The reported figure outpaced the Zacks Consensus Estimate of $11,175 million.

The segment recorded an underwriting loss of $1,035 million against the prior-year quarter’s underwriting income of $113 million. The underwriting loss stemmed from current report year auto claim severities, elevated catastrophe losses and unfavorable prior year reserve reestimates. The underlying combined ratio deteriorated 790 basis points (bps) year over year to 99.2% in the quarter under review.

Protection Services' revenues improved 6.1% year over year to $643 million, thanks to strength in Allstate Protection Plans and Allstate Dealer Services. Adjusted net income of $38 million advanced 31% year over year in the fourth quarter.

Allstate Health and Benefits’ total premium and contract charges came in at $435 million, which slipped 5.2% year over year and lagged the consensus mark of $451 million. The decline was due to weakness in individual health. Adjusted net income grew 4.2% year over year to $50 million in the quarter under review but fell short of the Zacks Consensus Estimate of $64 million.

Financial Update (as of Dec 31, 2022)

Allstate exited the fourth quarter with a cash balance of $736 million, which slid 3.5% from the figure in 2021 end. Total assets of $98 billion decreased 1.5% from the 2021-end level.

Debt amounted to $7,964 million, which dipped 0.2% from the figure as of Dec 31, 2021. Total shareholders’ equity fell 30.6% from the 2021-end level to $17,475 million.

Book value per common share came in at $58.07 as of Dec 31, 2022, which tumbled 28.8% year over year.

The adjusted net income return on equity in the trailing 12-month period came in at a negative figure of 1.3%. The metric was recorded at 16.9% at the end of 2021.

Capital Deployment

Allstate rewarded its shareholders with $582 million via share buybacks of $354 million and dividends worth $228 million in the fourth quarter.

Full-Year Update

Allstate incurred an adjusted loss of 97 cents per share in 2022, while earnings of $13.48 per share were reported in 2021.

Consolidated revenues inched up 1.6% year over year to $51.4 billion. Net premiums earned of $43,909 million improved 8.5% year over year. Net investment income of ALL fell 27% year over year to $2,403 million

It reported an underwriting loss of $2,911 million, which compares unfavorably with the underwriting income of $1,665 million in 2021. The underlying combined ratio deteriorated 890 bps year over year to 95.1%.

Outlook

Management keeps an eye to implement additional rate hikes and underwriting actions within ALL’s auto insurance business in 2023.

Zacks Rank

Allstate currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other P&C Insurers

Of the P&C insurance industry players that have reported fourth-quarter results so far, RLI Corp. RLI, W. R. Berkley Corporation WRB and AXIS Capital Holdings Limited AXS beat the respective Zacks Consensus Estimate for earnings.

RLI reported fourth-quarter 2022 operating earnings of $1.53 per share, beating the Zacks Consensus Estimate by 41.7%. The bottom line improved 26.4% from the prior-year quarter. Operating revenues for the reported quarter of RLI were $329.5 million, up 19.4% year over year, driven by 16.7% higher net premiums earned and 59% higher net investment income. The top line beat the Zacks Consensus Estimate by 0.4%.

W.R. Berkley’s fourth-quarter 2022 operating income of $1.16 per share beat the Zacks Consensus Estimate of $1.07 by 8.4%. The bottom line improved 12.4% year over year. Net premiums written of WRB were a record $2.4 billion, up 6.7% year over year. Operating revenues came in at $2.9 billion, up 14.4% year over year. The top line beat the consensus estimate by 0.6% of $1.49.

AXIS Capital posted fourth-quarter 2022 operating income of $1.95 per share, which beat the Zacks Consensus Estimate by about 14.7%. The bottom line dropped 8.5% year over year. AXS’s operating revenues of $1.5 billion increased 8.6% year over year on higher net premiums earned and net investment income. The top line beat the consensus estimate as well as our estimate of $1.4 billion. Net investment income decreased 14.8% year over year to $147.1 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance