Allstate (ALL) Q2 Earnings Beat on Higher Premiums, Costs Ail

The Allstate Corporation ALL reported a second-quarter 2022 adjusted loss of 76 cents per share, which outpaced the Zacks Consensus Estimate of a loss of $1.26. The company reported earnings of $3.79 per share in the year-ago quarter.

Operating revenues of $12,953 million advanced 4.8% year over year and beat the Zacks Consensus Estimate of $12,158 million and our estimate of $12,557.8 million.

The better-than-expected results were supported by factors including higher premiums and increased policies in force in the Property-Liability business. However, these were partially offset by the underwriting loss, higher catastrophe losses, decrease in equity valuation and fixed income sales losses. Increased costs and expenses also played spoilsport.

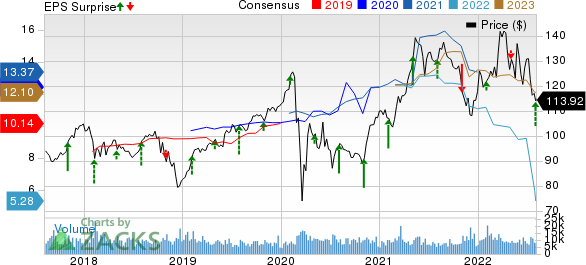

The Allstate Corporation Price, Consensus and EPS Surprise

The Allstate Corporation price-consensus-eps-surprise-chart | The Allstate Corporation Quote

Operations

Total costs and expenses increased to $13,535 million from $10,849 million a year ago and were higher than our estimate of $12,046 million, primarily due to higher property and casualty insurance claims and claims expenses, accident and health insurance policy benefits, amortization of deferred policy acquisition costs, and operating costs and expenses. Pre-tax loss of $1,315 million deteriorated from the pre-tax income of $1,797 million in the prior-year quarter, primarily due to higher expenses.

As of Jun 30, 2022, total policies in force amounted to 187.7 million, down 0.9% from the prior-year comparable period’s figure. Net investment income dipped to $562 million for the second quarter from $974 million a year ago. While market-based investment income increased 3.7% year over year, performance-based investment income fell 63.6% from the year-ago level. Allstate incurred $1,108 million of catastrophe losses in the quarter under review, increasing from $952 million a year ago.

In the June quarter, book value per common share declined 23.4% year over year to $66.15. The underlying combined ratio deteriorated to 93.4% from 85.7% a year ago. Adjusted net income return on equity in the trailing 12-month period came in at 6.9%, which declined from 23.8% a year ago.

Segmental Performances

Property-Liability insurance premiums earned totaled $10,874 million, which advanced 8.6% year over year, aided by contributions from increased average premiums and policies in force. Even though the reported figure beat our estimate of $10,228 million, it missed the Zacks Consensus Estimate of $10,886.1 million.

The segment generated an underwriting loss of $864 million, which compares unfavorably with the year-ago quarter’s underwriting income of $429 million. Higher claim severities and catastrophe losses led to the result, partially offset by a rise in premiums earned. The combined ratio increased 770 basis points (bps) year over year to 93.4%.

Protection Services' revenues climbed 8.3% year over year to $629 million for the second quarter, courtesy of a strong performance of Allstate Protection Plans, partially offset by declines in Arity. Adjusted net income decreased 13% from the prior-year quarter’s level to $43 million, but beat the consensus mark of $30.2 million.

Allstate Health and Benefits’ total premium and contract charges increased 4.3% year over year to $466 million, thanks to growth in individual and group health. It beat our estimate of $447.6 million and the Zacks Consensus Estimate of $452.2 million. Adjusted net income increased 4.8% year over year to $65 million for the second quarter and beat our estimate of $37.1 million.

Financial Update (as of Jun 30, 2022)

Allstate exited the second quarter with a cash balance of $766 million compared with the 2021-end level of $763 million. Total assets of $96,350 million decreased from $99,440 million on Dec 31, 2021.

Long-term debt at the quarter-end amounted to $7,970 million, marginally down from $7,976 million at 2021-end. Total shareholders’ equity declined from the 2021-end figure of $25,179 million to $20,115 million.

Capital Deployment

Throughout the second quarter, Allstate rewarded its shareholders with $919 million via share buybacks ($683 million) and dividends ($236 million). ALL has $1.8 billion left under its $5-billion buyback authorization. Management is expected to conclude the repurchase program by early 2023.

Outlook

Allstate had plans to fight inflation by changing its investment allocations, lowering costs and raising prices. The advancement made by the personal property-liability business model is expected to help ALL generate higher growth on the back of lower expenses and extending customer access. The utilization of technology will likely enable ALL to provide affordable, simple and connected protection to clients. Its strategic initiatives are likely to equip itself better to withstand the effects of inflation on auto insurance prices and returns. Management targets reducing the Property-Liability adjusted expense ratio to 23 by 2024-end from the current level of 26.

The company plans to raise insurance prices further, implement underwriting restrictions in selected regions and decrease advertisement costs. While these can boost profitability, they might hamper policy growth.

The Zacks Consensus Estimate for full-year earnings per share currently stands at $5.28, indicating a 60.8% year-over-year decline. The consensus mark for revenues is pegged at $49.2 billion for this year, signaling a 0.6% decrease from a year ago.

Zacks Rank & Key Picks

Allstate currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader finance space are EverQuote, Inc. EVER, SmartFinancial, Inc. SMBK and Paramount Group, Inc. PGRE, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headquartered in Cambridge, MA, EverQuote provides online insurance shopping opportunities. EVER beat earnings estimates thrice in the past four quarters and missed once, with the average surprise being 24.6%.

Based in Knoxville, TN, SmartFinancial is a leading financial services provider for individuals and corporate clients. The Zacks Consensus Estimate for SMBK’s 2022 earnings indicates 18% year-over-year growth.

New York-based Paramount Group works as a fully-integrated real estate investment trust. The Zacks Consensus Estimate for PGRE’s 2022 bottom line indicates 4.4% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Allstate Corporation (ALL) : Free Stock Analysis Report

EverQuote, Inc. (EVER) : Free Stock Analysis Report

Paramount Group, Inc. (PGRE) : Free Stock Analysis Report

SmartFinancial, Inc. (SMBK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance