Allstate's (ALL) Auto Rate Hiking Spree Continues in August

The Allstate Corporation ALL recently unveiled the auto rate increases that it had enforced in August 2022.

Last month, the Allstate brand executed rate hikes of 14.5% totaling $777 million across 8 locations. Rate increases in August had a favorable impact of 3.2% on the total Allstate brand insurance premium.

Such moves related to rate improvements seem to be time opportune on Allstate’s part given the ongoing inflationary pressures on auto insurance severities. Per the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) for August 2022 increased 8.3% year over year. CPI remains one of the most popular measures to gauge inflation. Earlier in June this year, inflation in the United States attained its highest level in the past four decades.

As more vehicles are plying on the roads, thanks to the relaxation of COVID-19 restrictions, claims are expected to reach pre-COVID levels. However, inflation can escalate the prices of auto parts and components, and used vehicles. This might elevate claim costs for auto insurers. Continued incidence of labor scarcity in the United States puts further pressure on auto insurers as labor costs shoot up even for vehicle repair.

To address the inflation-related headwinds, Allstate has been swift enough to implement rate increases since the beginning of 2022. ALL enforced 72 rate raises that averaged around 10.3% at 51 locations from the onset of this year.

Frequent rate hikes bode well for auto insurers as the same is expected to boost an insurer’s premiums. Premiums usually account for a significant chunk of an insurer’s revenues. Written premiums of U.S. personal auto insurers witnessed decent growth of 4.5% year over year in the first half of 2022, per Fitch Ratings.

With the same source forecasting more solid growth in premiums written in the second half of the year, it seems that continuous rate improvements are gradually bearing fruits for the auto insurers.

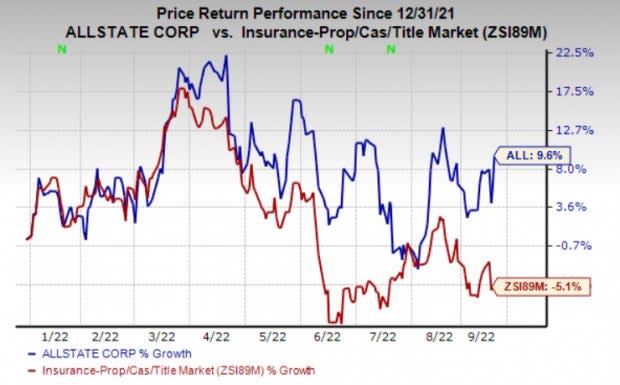

Shares of Allstate have rallied 9.6% year to date against the industry’s decline of 5.1%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ALL currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the P&C insurance space are W. R. Berkley Corporation WRB, Chubb Limited CB and AXIS Capital Holdings Limited AXS. While W.R. Berkley sports a Zacks Rank #1 (Strong Buy), Chubb and AXIS Capital carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

W.R. Berkley’s earnings surpassed estimates in each of the last four quarters, the average being 29.95%. The Zacks Consensus Estimate for WRB’s 2022 earnings suggests an improvement of 20.6%, while the same for revenues suggests growth of 16.7% from the respective year-ago reported figures. The consensus mark for WRB’s 2022 earnings has moved 8.8% north in the past 60 days.

The bottom line of Chubb outpaced estimates in each of the trailing four quarters, the average being 12.12%. The Zacks Consensus Estimate for CB’s 2022 earnings suggests an improvement of 25.4%, while the same for revenues suggests growth of 3.8% from the corresponding year-ago reported numbers. The consensus mark for CB’s 2022 earnings has moved 6.1% north in the past 60 days.

AXIS Capital’s earnings surpassed estimates in each of the trailing four quarters, the average being 48.08%. The Zacks Consensus Estimate for AXS’ 2022 earnings indicates a rise of 25.2%, while the same for revenues suggests an improvement of 2% from the comparable prior-year actuals. The consensus mark for AXS’ 2022 earnings has moved 6.5% up in the past 60 days.

The W.R. Berkley stock has gained 21.4% year to date. Meanwhile, shares of Chubb and AXIS Capital have declined 2.1% and 2.6%, respectively, in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance